CEO Bob Iger Just Made Some Promises. Can He Keep Them?

Bob Iger just added an impassioned plea to the VoteDisney site.

The CEO of The Walt Disney Company assured investors that Disney is trending in the right direction.

During his three-minute speech, Iger made some promises. Now, the question becomes whether he can keep them.

Photo: Disney CEO Bob Iger (Getty Images)

Let’s examine how realistic these six promises are.

One of the Most Admired Companies in the World

(Charley Gallay / Getty Images for Disney)

Early in his persuasive speech, Iger explicitly stated that Disney should be “one of the most admired companies in the world.”

The Disney CEO added that this goal is “one of our biggest priorities.” Frankly, it needs to be.

I say this because a historic 20-year reign recently ended.

Forbes had ranked Disney as the most admired media/entertainment company for 20 straight years….until now.

In the latest Fortune/Korn Ferry survey, Disney slid from sixth to 12th place overall on the Most Admired Companies list.

In the media/entertainment rankings, Netflix usurped Disney.

Photo: Netflix

Overall, the Disney brand absorbed a beating in the past few years as Mickey Mouse found himself dragged into the culture wars.

Disney’s very public squabble with former Presidential hopeful Ron DeSantis objectively took a toll.

For Disney to rank outside the top ten on this list is quite surprising in a vacuum.

The unwelcome result is understandable in the wake of recent events, though.

Iger just clearly communicated that Disney will prioritize improved rankings, which is another way of saying he gets it.

Disney will do its best to calm the seas from now on, although that’s not entirely up to them.

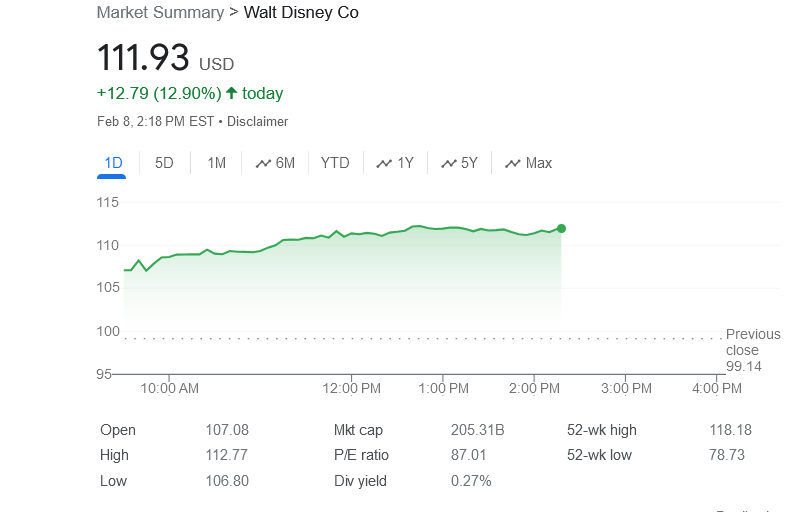

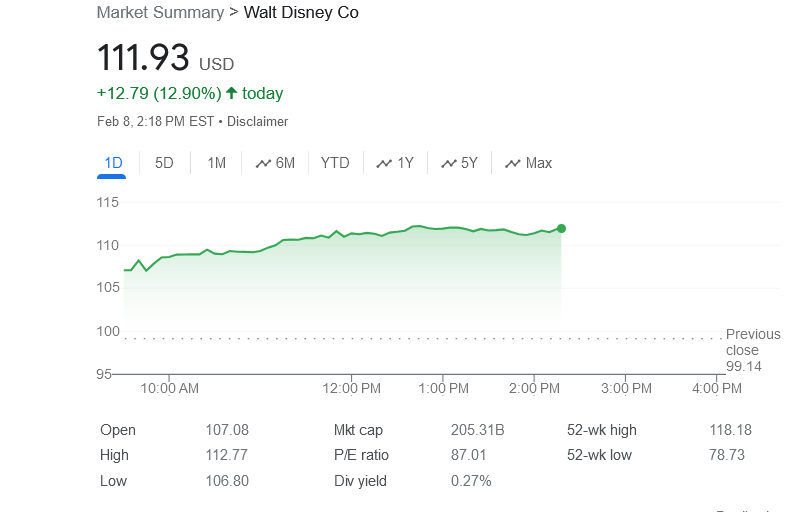

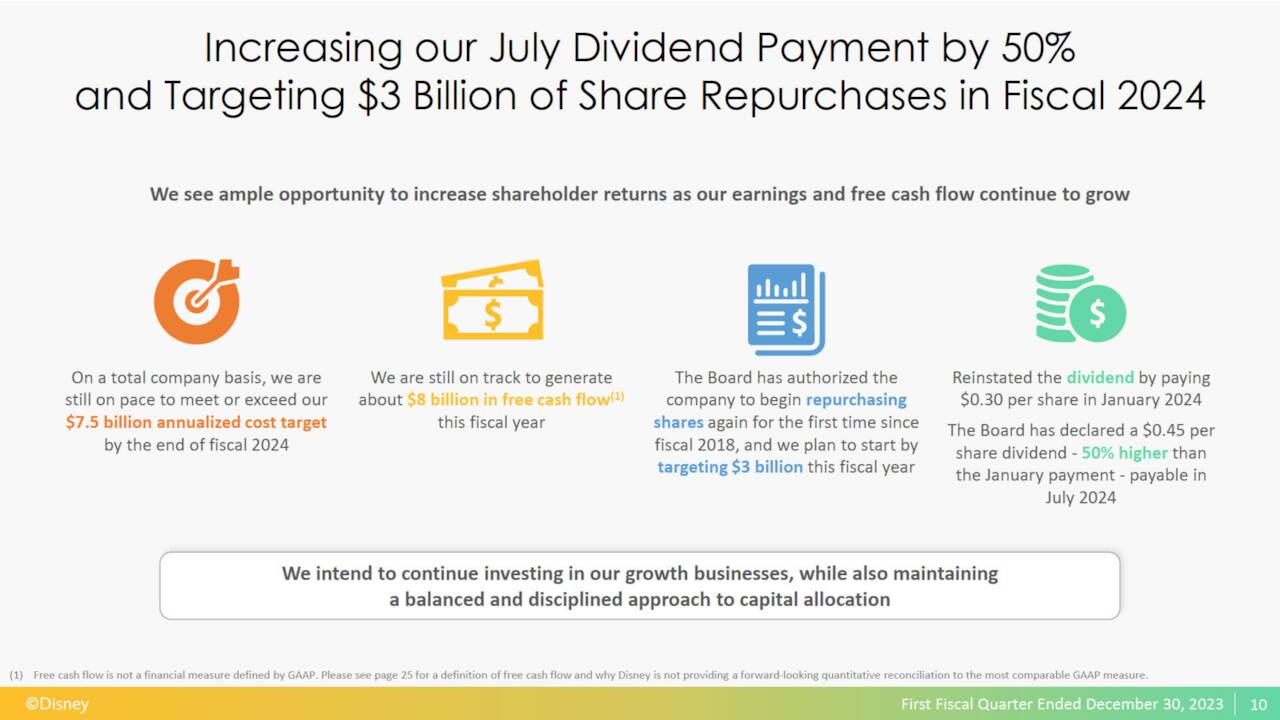

Consistently Deliver Shareholder Value

Photo: Google

Iger thoughtfully did my homework for me on this one.

Rather than leaving the discussion up to speculation regarding intent, the CEO clarified his meaning.

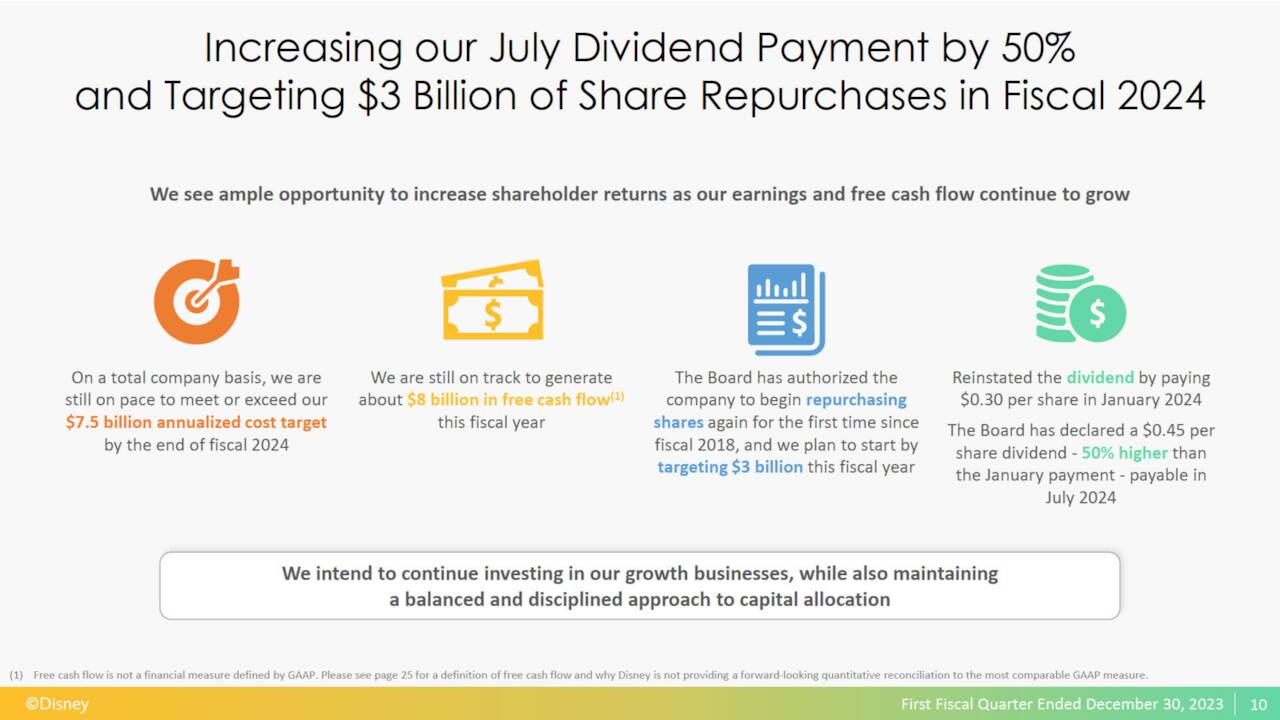

Iger maintains that Disney has already started this process by announcing a higher stock dividend.

Image: Disney

Disney will pay shareholders $0.45 per share in July. Also, the company provided future investor guidance.

Executives expect earnings per share in fiscal 2024 to reach $4.60, which is really good if it happens.

In addition, Iger and his team have recognized that they have too many shares of stock available for purchase.

This lingering issue is a vital part of the reason Iger must plead with investors to vote with him.

So, Disney will perform a $3 billion stock buyback this year, thereby reducing its float.

Improved Film Quality

Photo: The Walt Disney Company

We all know the deal here. Disney experienced an up-and-down 2023, with several films failing.

While the financial outcome wasn’t anywhere near as troubling as some may think, it’s still a sticking point.

Much of Disney’s operation relies on the strength of its entertainment division.

Photo: The Walt Disney Company

You probably didn’t buy merchandise for Wish, The Creator, or The Marvels, and you’re a loyal Disney fan.

More casual Disney fans definitely didn’t give this stuff a chance.

In the process, there was less demand for the titles on streaming, and they didn’t earn as much in future movie licensing deals.

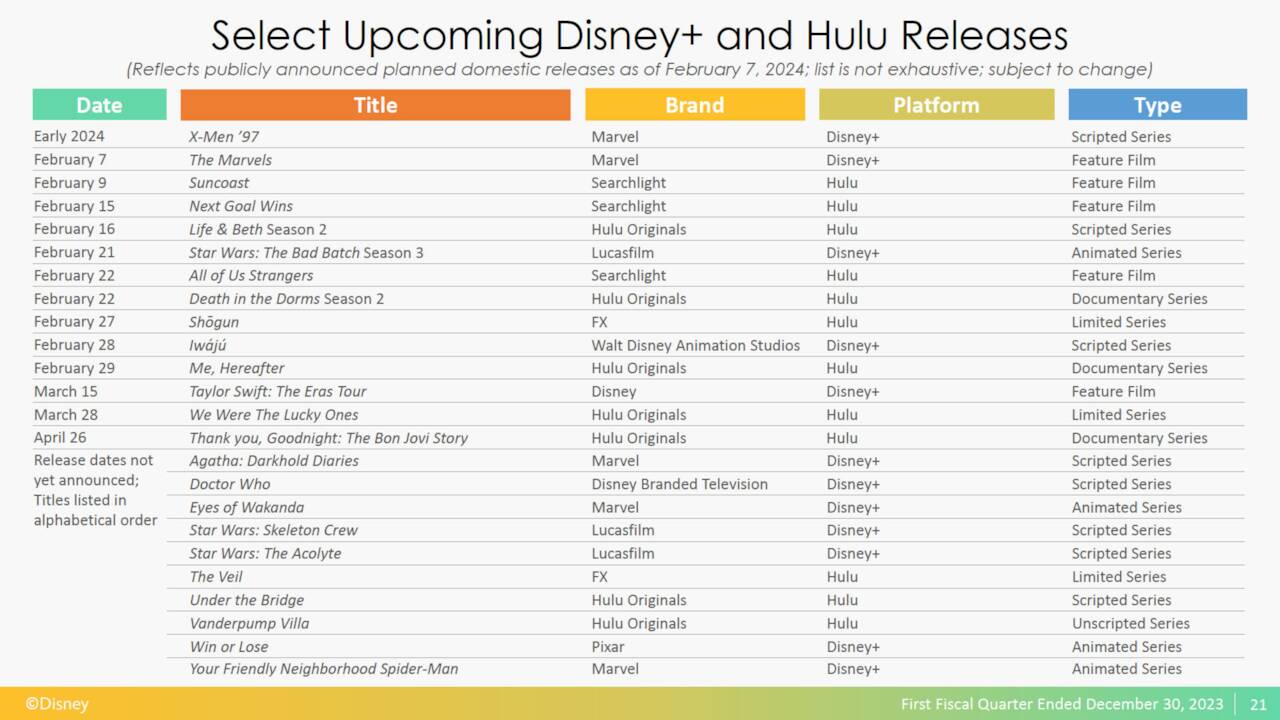

Disney must address that, and it’s off to a good start. During the Super Bowl this past Sunday, the company released hot new trailers.

Here are the clips for Deadpool & Wolverine:

And Kingdom of the Planet of the Apes:

While nobody ever knows for sure until reviews and social media comments come out, both titles look great.

Also, Iger recently revealed an ace in the hole with Moana 2, a surefire blockbuster.

Photo: Disney

Still, while all these signs appear positive, 2023 looked great on paper, too.

We can’t say for sure whether Iger has lived up to his word until we start recapping 2024.

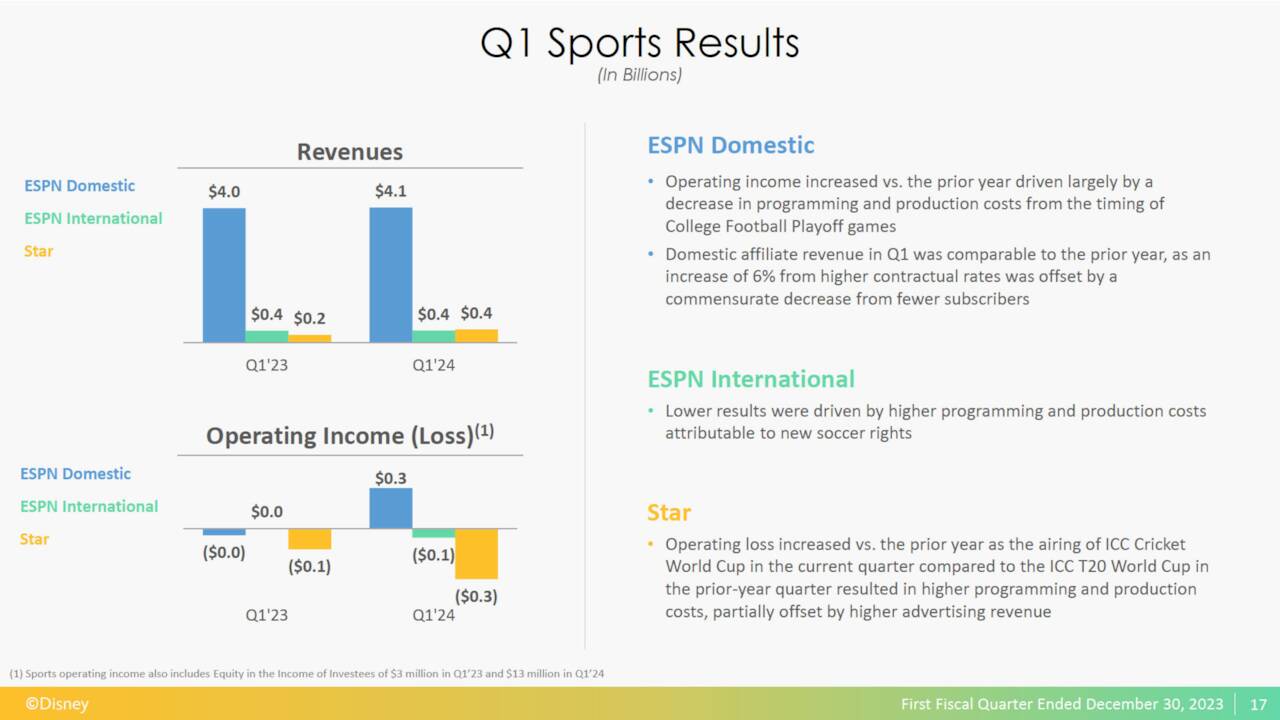

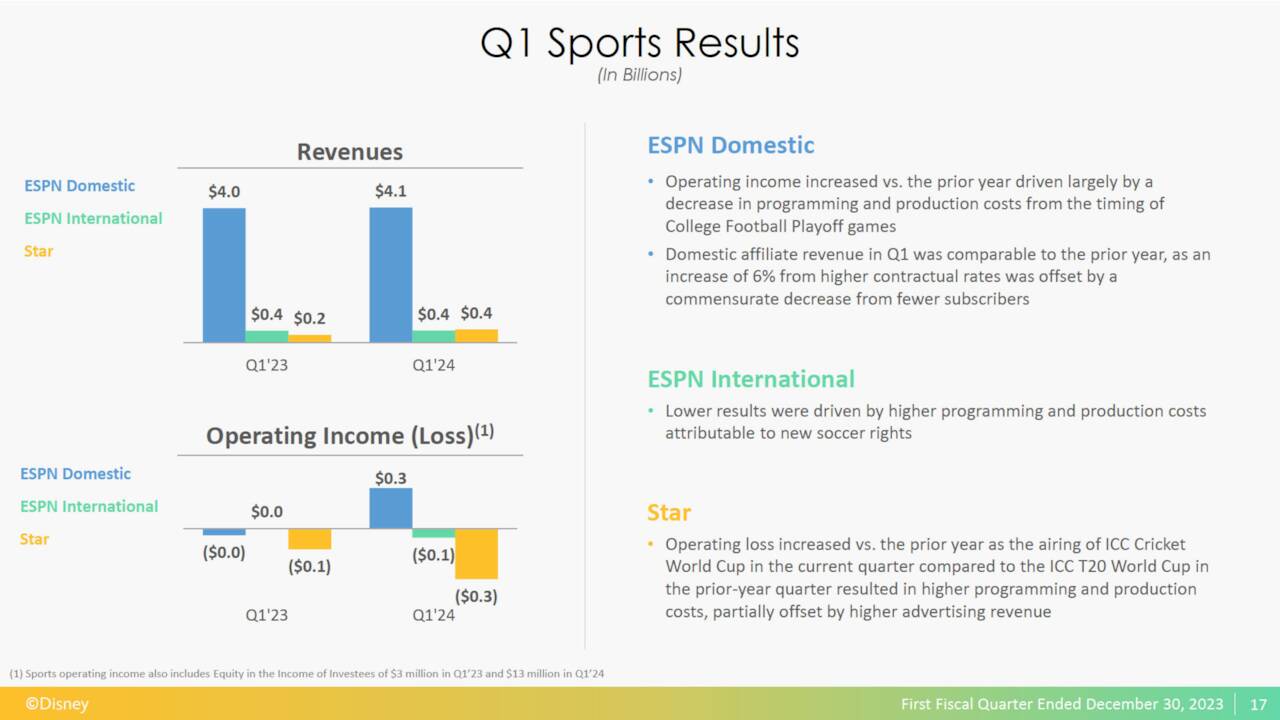

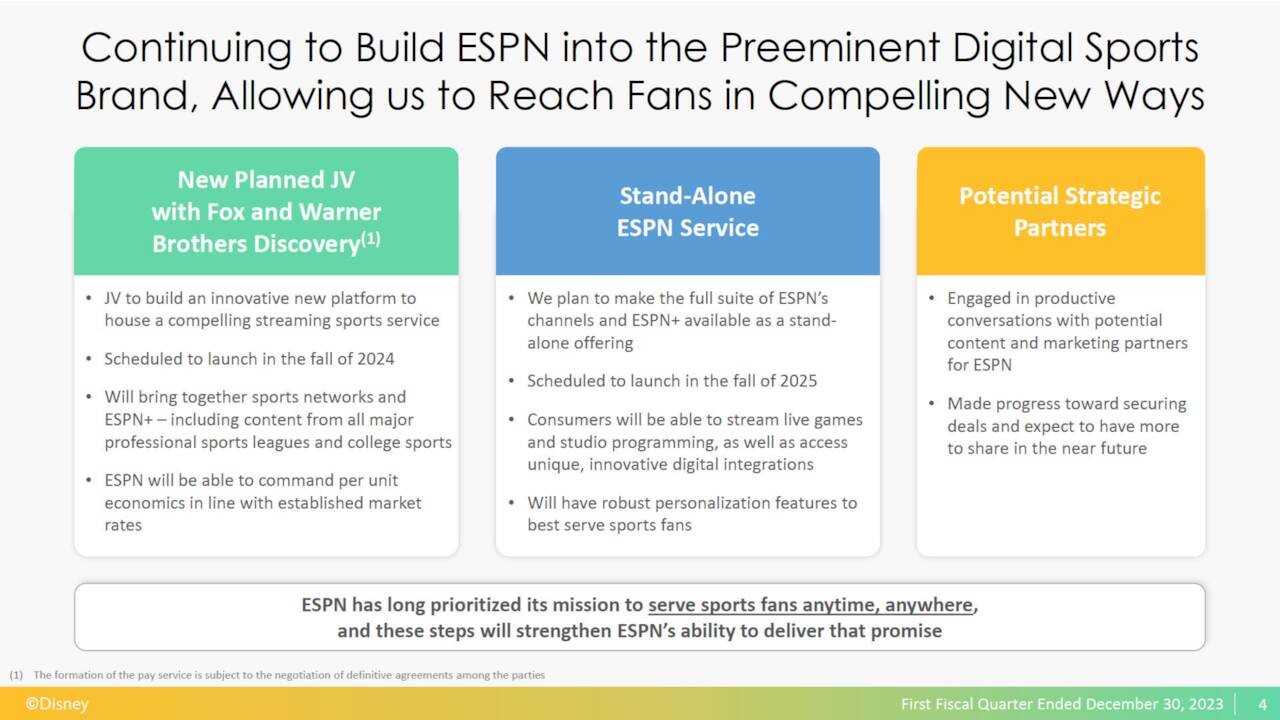

Transition ESPN into a Digital Sports Platform

Image: Disney

This one’s messier than a Bravolebrity.

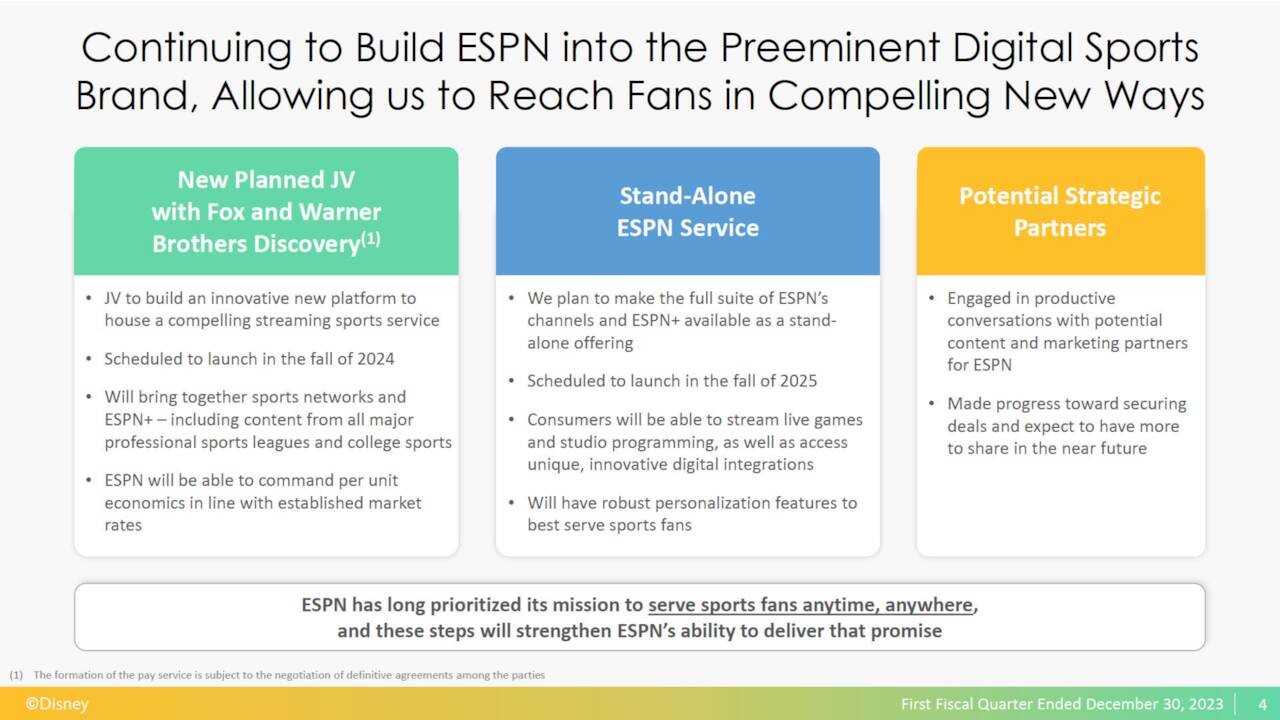

Disney has planned to convert its flagship sports network, ESPN, into a primarily digital service.

In fact, Iger recently confirmed a contingency plan, a Sports Hulu service run jointly with Fox and Warner Bros. Discovery.

Photo: Disney

Estimates suggest that this skinny bundle akin to Sling TV or YouTube TV would include 52-55 percent of all major sports.

However, that’s only Disney’s side plan, which I’ll discuss in detail in a different article this week.

Iger references a more specific plan for ESPN to abandon conventional Linear Networks broadcasting.

ESPN

Instead, ESPN will join Hulu and Disney+ as primarily streaming services.

You’re probably thinking, “Isn’t that just ESPN?” Surprisingly, the answer is no.

ESPN currently protects its top sports licensed assets like the NFL and many NBA games.

Photo: NBA

You’ll only find them via ESPN on cable or one of those aforementioned skinny bundles.

In fact, Peacock recently experienced a firestorm of criticism for “paywalling” an NFL playoff game.

ESPN did that many years ago when it broadcast its first playoff game on cable television.

Image: Disney

For whatever reason, consumers don’t perceive the matter that way.

Now, Disney must find a path to persuade people to ditch cable television forever in favor of a high-priced ESPN streaming app.

Will that work? Probably. Disney has hedged its bets with this Sports Hulu service, though.

Turn Streaming Profitable

Photo: Disney+

We don’t need to relitigate this one.

Disney’s entire future hinges on the success of Disney+, Hulu, and the unnamed ESPN product.

The future is digital. A dear friend of mine wrote an article of that name in 2002, and his comments proved prescient.

Photo: Disney+

Everything about digital delivery is superior to prior standards.

Realistically, consumers should have converted to digital long ago.

The reason why they didn’t was because corporations had incentive to protect the old ways as long as possible.

Image: Disney

That financial aspect is no longer as finite today, and it’s flipping more each quarter.

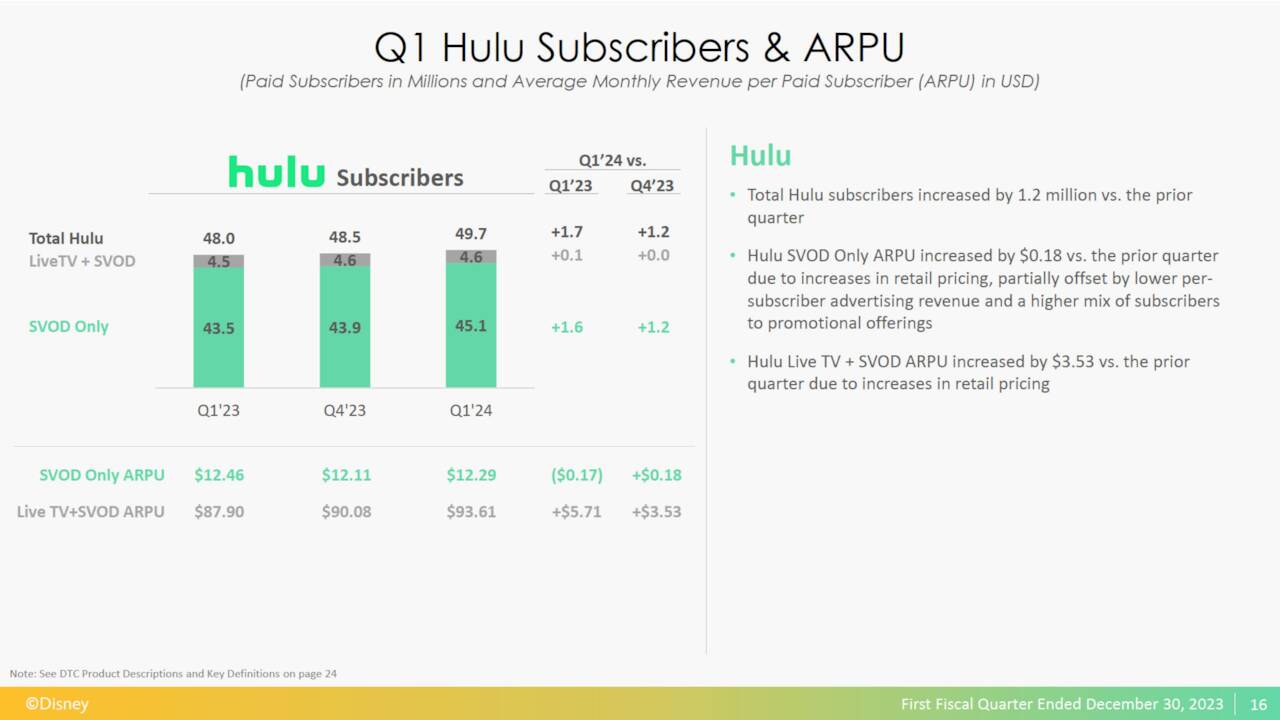

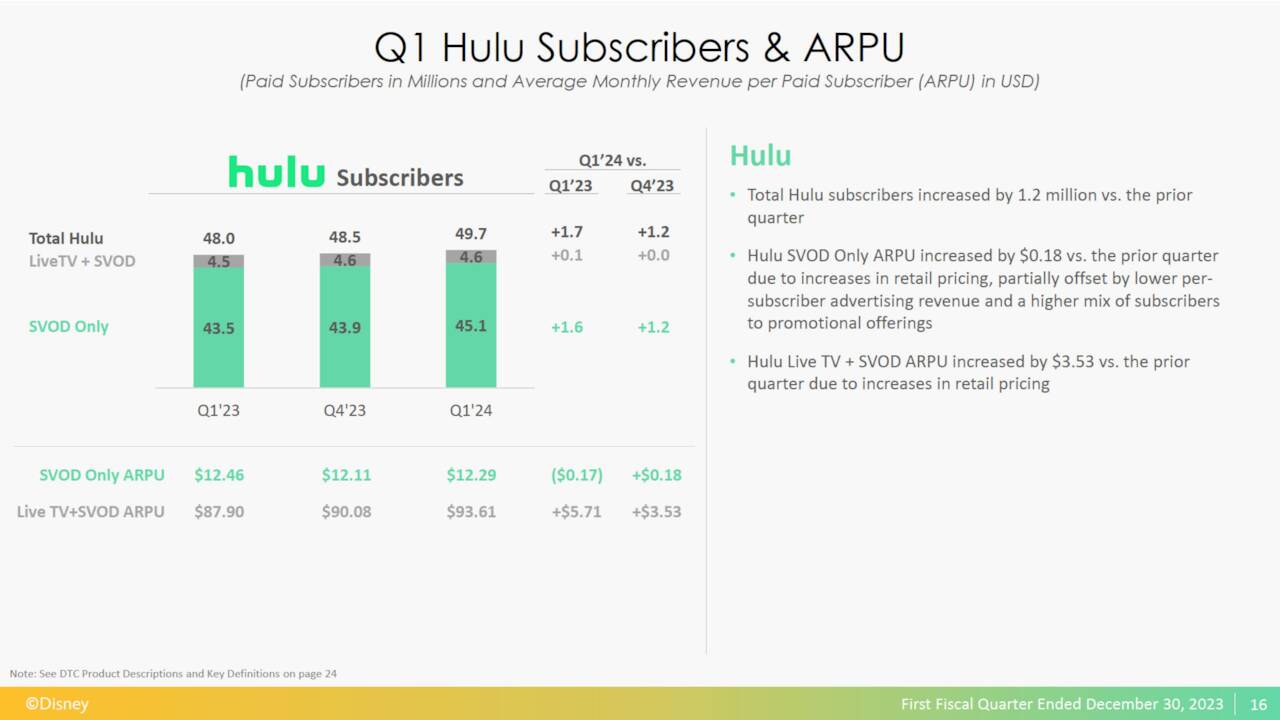

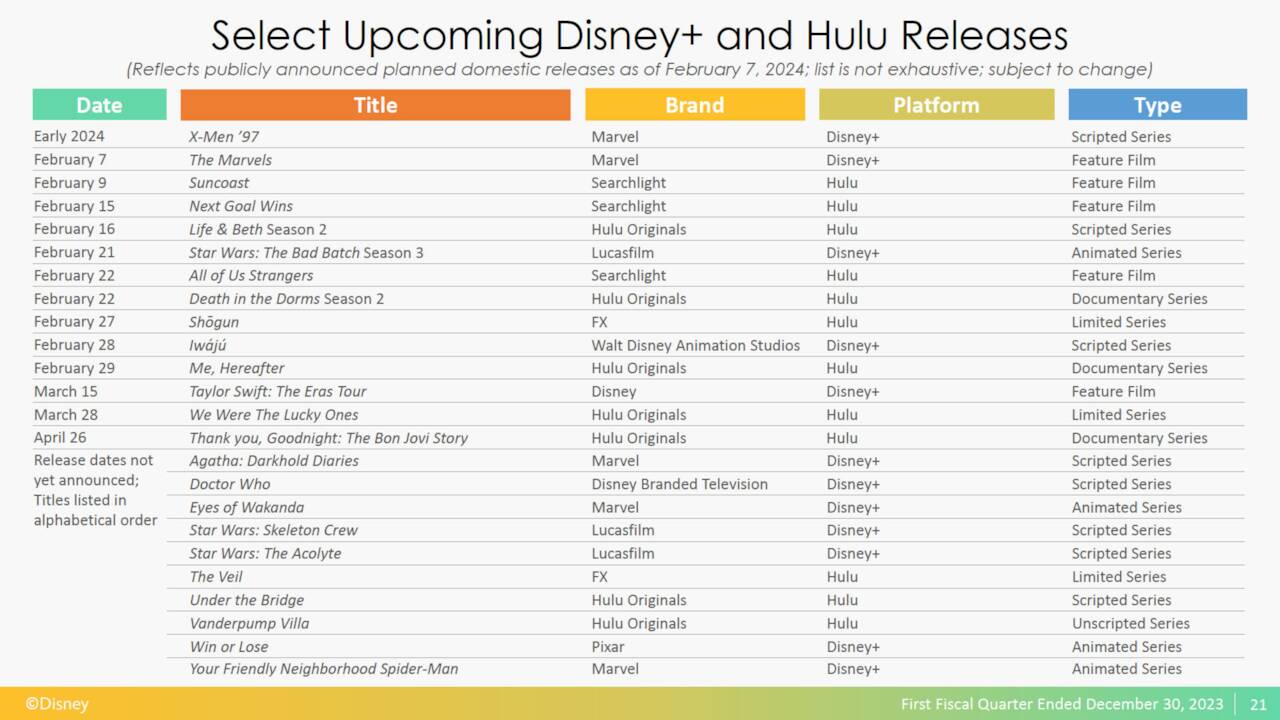

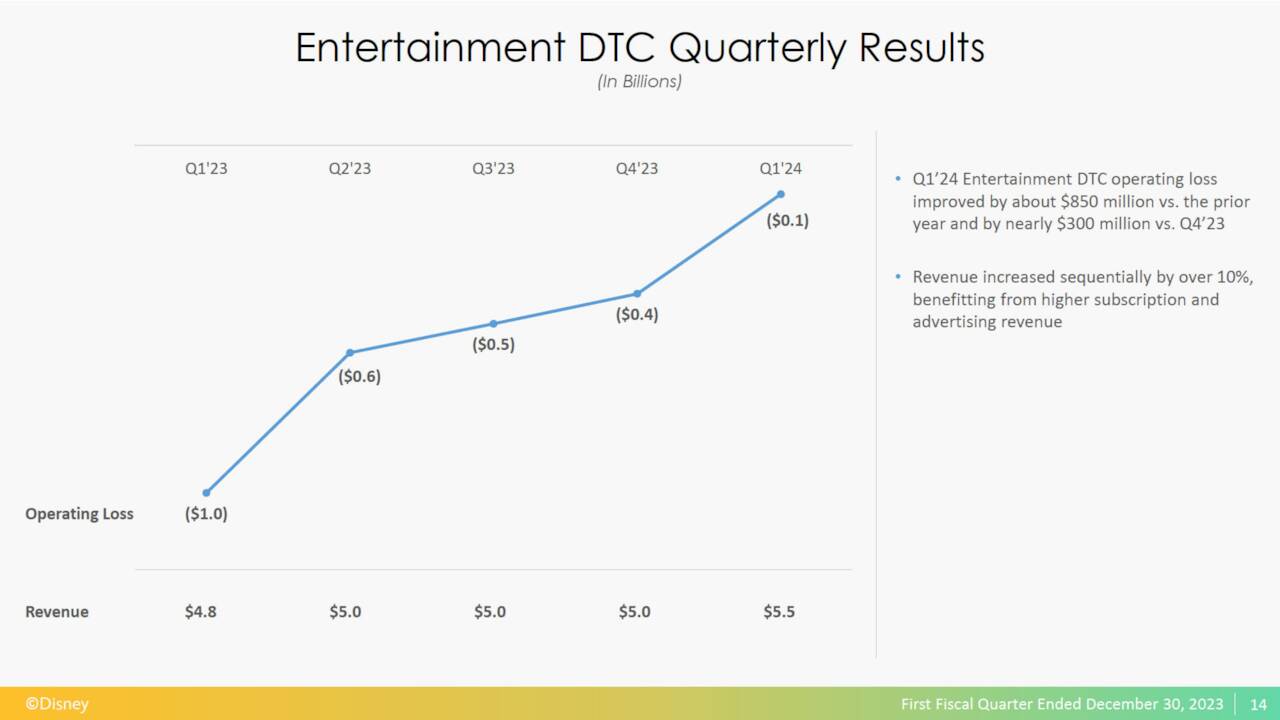

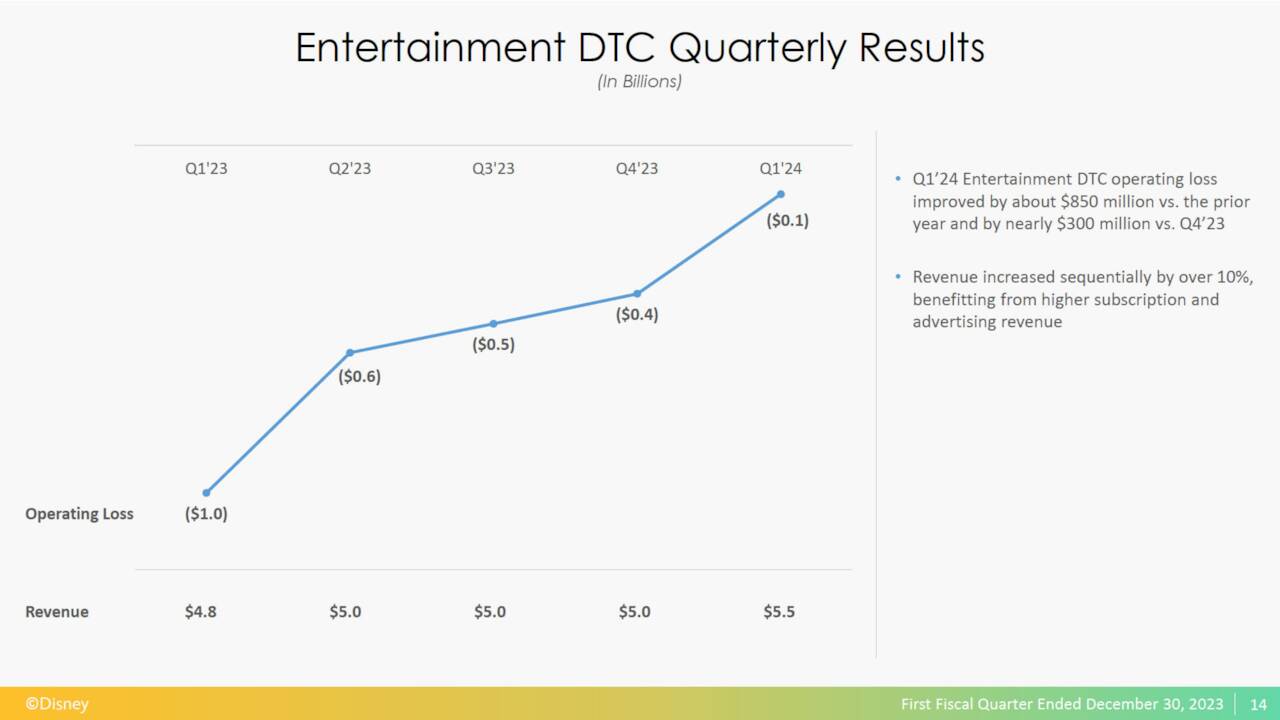

We can identify this reality from Disney’s earnings reports, which have tracked steady improvement in Direct-to-Consumer.

The most recent results show the highest revenue and lowest losses to date.

Image: Disney

Now, Disney appears to have cracked the math on this, and Iger knows it.

The CEO recently confirmed that DtC should turn a profit by the end of fiscal 2024.

Image: Disney

As a reminder, we’re already in the second quarter of 2024. So, that’s less than nine months from now.

Turbocharged Growth in Experiences Business

Photo: Disney

Here’s the one where you and I want him to keep his promise.

Iger refers to Disney’s plans to $60 billion on theme park expansion, which will include additions everywhere.

The hidden secret of this claim is that Disney isn’t promising to spend significantly more in capital expenditures than we’d expect.

Photo: Disney

Instead, Disney is listing a big number for a decade, which breaks down to $6 billion a year.

Historically, Disney spends billions of dollars a year in its Experiences division anyway.

So, we’re only discussing $2-$2.5 billion more, but $60 billion sounds better.

As a master promoter, Iger understands that. Among the promises listed here, this is the easiest one to keep.

To a larger point, Iger indicates that Disney has “made meaningful progress with each” of these promises.

After a bit of reflection and analysis, I think he’s right. Still, it’s early to game to say all these promises will definitely happen.

MickeyBlog Logo

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!