Let’s Talk about Disney’s Early 2024 Cash Situation

We’ve somehow entered the most exciting timeline for Disney observers, especially rubberneckers.

During the first four months of 2024, The Walt Disney Company faces unprecedented challenges in navigating its future.

Disney just wrote an $8.6 billion check to Comcast a few months ago. Now, it finds itself in a battle with an activist investor.

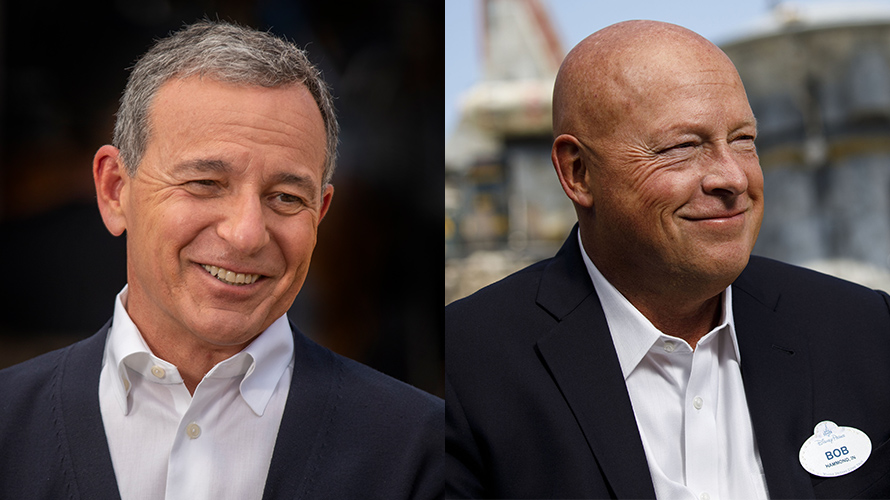

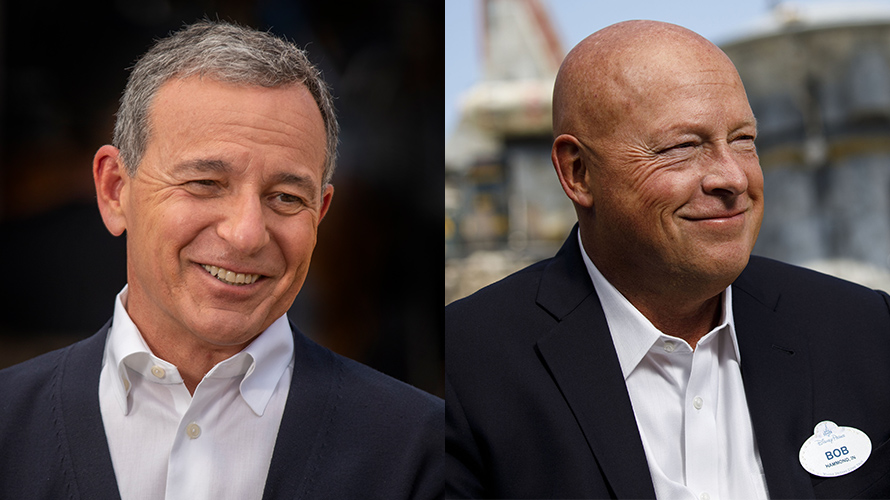

Photo: Washington Post

Simultaneously, Disney is fighting a multi-pronged legal battle with the state of Florida and its governor.

Oh, and Disney just revealed the equivalent of a Sports Hulu service in a joint endeavor alongside Warner Bros. Discovery and Fox.

That’s like several years of excitement that has occurred in barely three months.

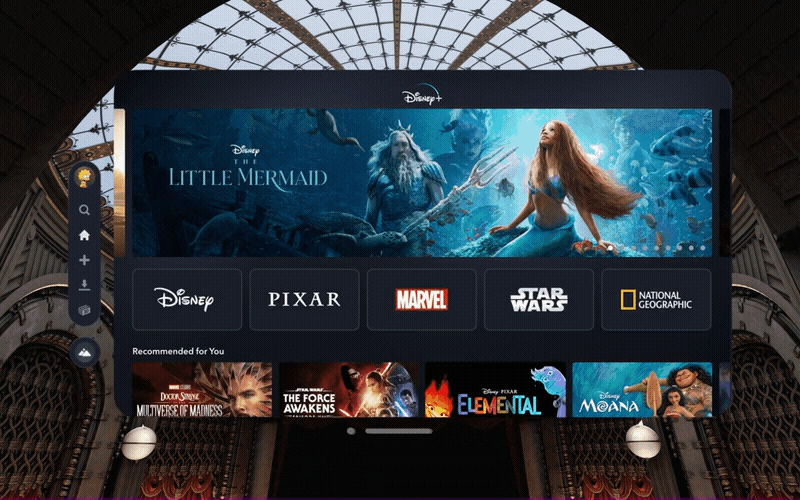

Photo: Disney+

Needless to say, Disney CEO Bob Iger faces plenty of questions as he reports the first quarterly Disney earnings report of 2024.

So, how did Disney fare? Let’s take a quick look at the details.

Disney by the Numbers

Photo: History.com

I presume most of you have read one of these before. By now, you should know the drill.

Wall Street creates its own projections and then expects corporations to match/surpass those estimates.

When companies achieve those milestones, everyone pops champagne and breaks out the Grey Poupon.

When the stock suffers a miss, it plummets mightily in a matter of minutes.

So, Wall Street is holding Disney accountable for an expected earnings per share (EPS) of $0.99.

Meanwhile, forecasts called for relatively flat revenue growth at $23.64 billion.

Image: The Wall Street Journal

Now that the stock market has closed, Disney has reported its numbers, and it’s a hit.

Specifically, Disney listed gross revenue of $23.55 billion and an EPS of $1.22.

Is that enough to persuade voters to deny Nelson Peltz’s bid to join Disney’s Board? We’ll have to wait until April to find out.

The Business That Matters

Photo: Disney

You and I care the most about Disney’s theme parks division, which the company recently renamed as Disney Experiences.

However, Disney finds itself in a precarious position at the moment.

Wall Street cares the most about Disney’s digital future, starting with the Direct-to-Consumer (DtC) division’s profit margins.

Photo: AdWeek

To date, there aren’t any. Remember that the final straw for former CEO Bob Chapek was a DtC loss of more than $1.4 billion.

Specifically, Disney lost $1.474 billion during the fiscal fourth quarter of 2022.

When Iger returned, he faced an investor mandate to shrink costs and uncover a path to profitability.

(Photo Illustration by Mateusz Slodkowski/SOPA Images/LightRocket via Getty Images)

To Iger’s credit, he largely stopped the bleeding. Twelve months later, Disney’s 4Q DtC losses had slowed to $387 million.

Yes, that’s still pacing as a loss of $1.4 billion annually, but that’s four times as good as losing $1.4 billion quarterly.

Image rights: CNBC and Illustration by Elham Ataeiazar

Still, Iger really needed DtC to perform well this cycle. Did it?

Well, Disney’s DtC reported a loss (fact check) of $138 million, which is a staggering improvement.

Disney has expressed confidence that it’ll turn a profit in DtC by the fourth quarter of 2024.

How Is Disney’s DtC Doing?

Photo: Disney+

The other two drivers to track are subscriber totals, especially in North America, and average revenue per user (ARPU).

Dan Rayburn at StreamingMediaBlog thoughtfully tracks ARPU across all streaming services.

Photo: English Jargon

Here is his current data heading into Disney’s earnings report:

- “Disney+: Global ARPU, $3.91, Subscription plus advertising (Q3 2022)

- Disney+: Domestic ARPU, $6.10, Subscription plus advertising (Q3 2022)

- Disney+: International ARPU, $5.83, Excluding Disney+ Hotstar, Subscription plus advertising, (Q3 2022)

- Disney+ Hotstar: ARPU, $0.58, Subscription plus advertising, (Q3 2022)

- ESPN+: ARPU, $4.84, Subscription plus advertising, (Q3 2022)

- Hulu: SVOD Only ARPU, $12.23, Subscription plus advertising, (Q3 2022)

- Hulu: Live TV+ SVOD ARPU, $86.77, Subscription plus advertising, (Q3 2022)”

In simplest terms, ARPU is how much Disney earns per customer.

So, an ARPU of $3.91 means that Disney earns $391 million monthly for 100 million subscribers.

Wall Street wants, expects, and demands that this number be much higher because, as you’re about to see, it’s well behind the competition.

In glancing at the data, you can identify how much of a drag Hotstar has been to Disney’s bottom line.

Photo: Disney

The company used it as a loss leader, that tactic failed, and Disney is in the process of merging it with a South Asian corporation.

In North America, Disney has fared much better, at least until you contrast it to Max (domestic ARPU of $10.66) or Netflix ($15.74).

I’ll update this data as Disney reports it, which will happen gradually over the next day or so.

For the time being, we know that Disney+ lost a modest 1.3 million subscribers and now claims a total of 111.3 million subscribers.

So, this is acceptable, but Disney’s DtC still has a long way to go to reach its lofty expectations.

Iger provided guidance suggesting growth of at least 5.5 million subscribers during the current quarter, though.

About the Parks

Photo: PRNewsFoto/The Walt Disney Co.

During the fourth quarter of 2023, the parks division, Disney Experiences, grossed $8.16 billion.

In the first quarter of 2023, the comparison for today’s data, Experiences earned $8.736 billion.

That brings us to a vital point. This division’s revenue should improve from the prior quarter since it’s the holiday timeframe.

We knew from the comically large crowds at Walt Disney World that business was gooood.

Now, we have the data to reinforce that. During the October-December timeframe, Disney Experiences earned $9.132 billion.

Disney’s explosive growth in this division is more astounding when we circle back two years.

(Matt Stroshane, photographer)

In fiscal 2022, what we now call Disney Experiences grossed $7.234 billion. That’s how far Disney has come in just two years.

Finally, while it’s not theme park-related, Disney has recently emphasized another metric.

Free cash flow (FCF) has become a priority on Wall Street during/after the Hollywood strikes.

Image Credit: Disney

After last quarter, Disney listed FCF of $4.897 billion, a huge improvement from $1.509 billion the prior year.

For this most recent Disney quarterly earnings report, Disney’s FCF should please investors, as it’s $7.247 billion.

At the moment, Iger definitely appears to have kept the wolves at bay.

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!