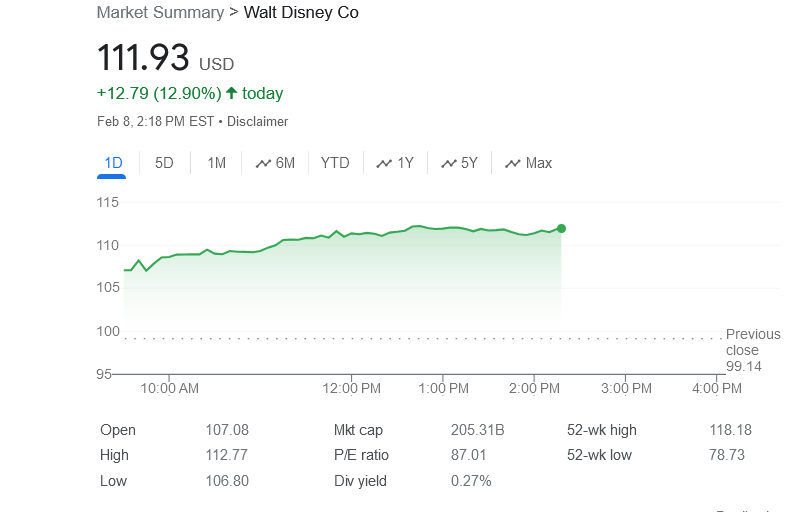

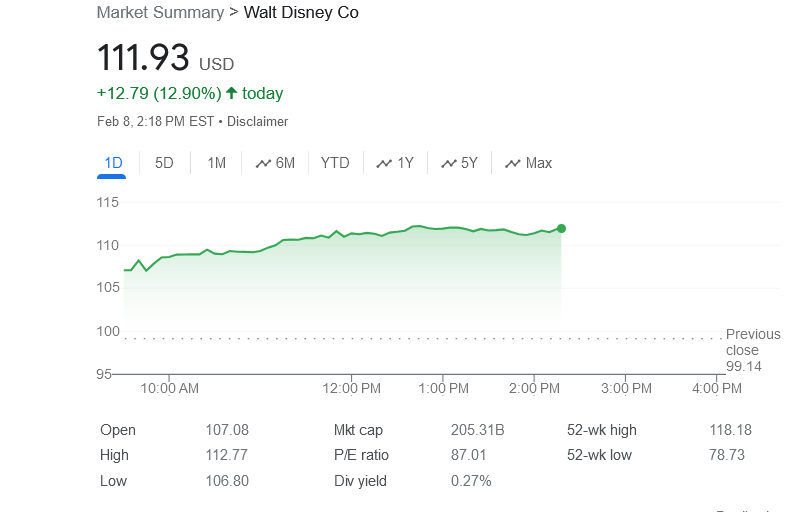

Disney’s Stock Sees Its Biggest Jump Since 2020 Following 1st Quarter Earnings Report

Following yesterday’s quarter-one earnings call that saw Disney post strong results alongside a slew of announcements for the future, Disney’s stock jumped 11% today.

The increase was the biggest gain for Disney’s stock since December 2022. In addition to new films, theme park expansions, and a direct-to-consumer ESPN, Disney also promised boosted capital returns and a bigger dividend.

Credit: Disney

Following yesterday’s earnings, Wall Street was bullish on Disney’s future.

Goldman Sachs and Morgan Stanly Praise Disney

Goldman Sachs maintained a Buy rating, noting that the company has made progress on its lengthy to-do list.

Photo: Google

“The most notable area of traction, in our view, is against DIS’s cost savings initiatives,” analyst Brett Feldman wrote. “For example, DIS increased its target for run-rate annual cost savings from $5.5B to $7.5B. Management expects the positive impact of these efforts to be reflected in its F2024 [free cash flow]. Which it estimates at ~$8B. This would represent a material increase vs. $4.9B in F2023 and nearly match pre-COVID cash generation.”

Meanwhile, Morgan Stanley reiterated its Overweight rating for the company.

“The F1Q results saw the continued strength in Parks combine with a faster ramp in profitability at streaming and a more substantive benefit from last year’s efficiency initiatives,” analyst Benjamin Swinburne said. “The result is over 20% adjusted EPS growth, which we think can compound into F25 and beyond.”

A Bright Future

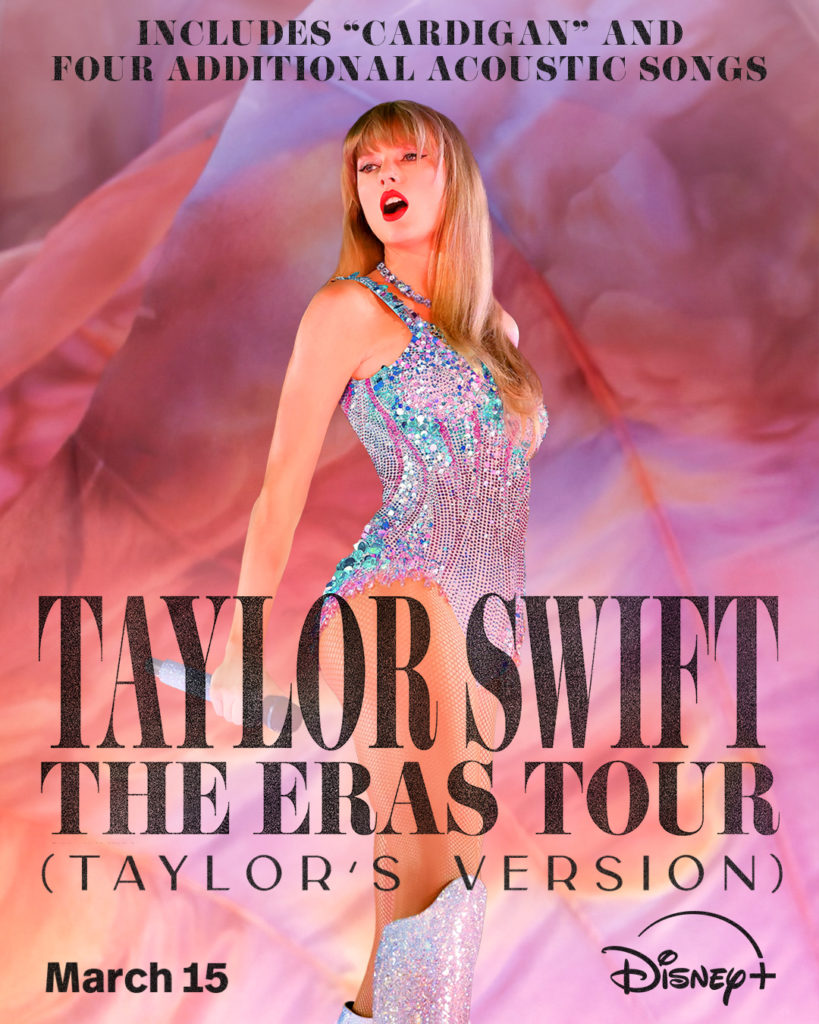

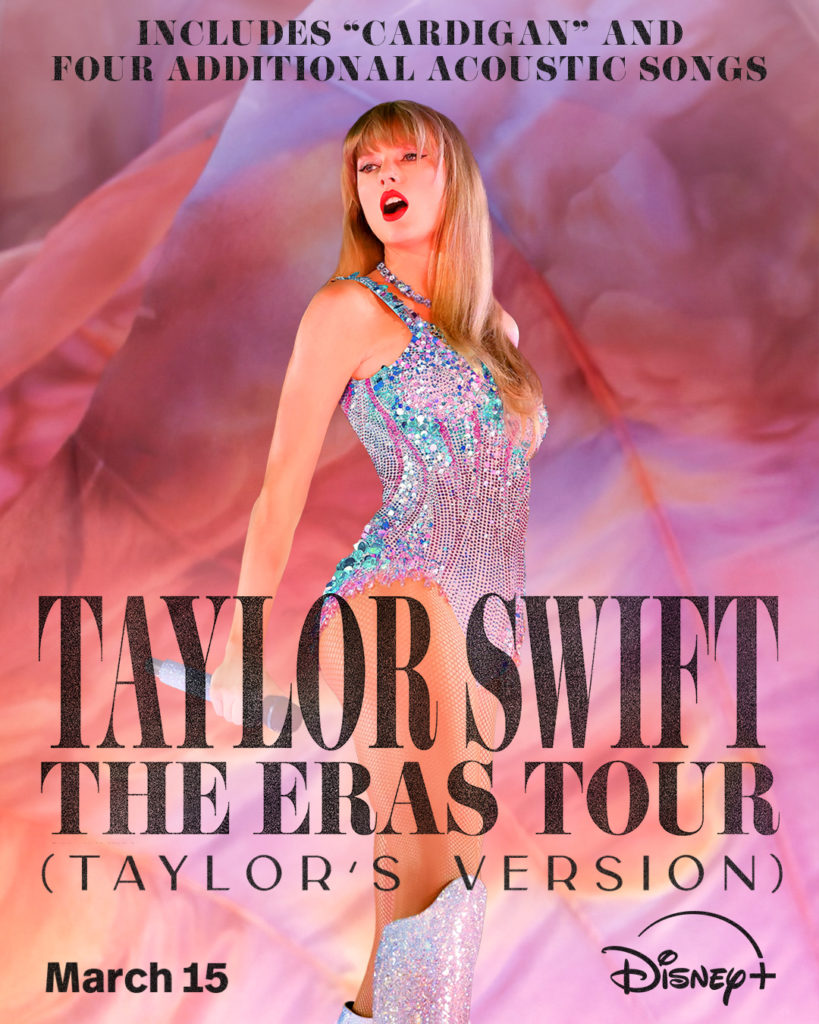

Outside of its strong earnings, the big news coming out of yesterday’s earnings call included the release of Moana 2 this year, the fact that Disney+ will be the exclusive home of Taylor Swift, and Disney will be creating an expansive gaming universe.

Photo: Disney+

With a proxy battle against Nelson Peltz and Blackwells looming, it looks like Bob Iger and the Disney board are back in full control.