What Disney’s Money Man Just Said

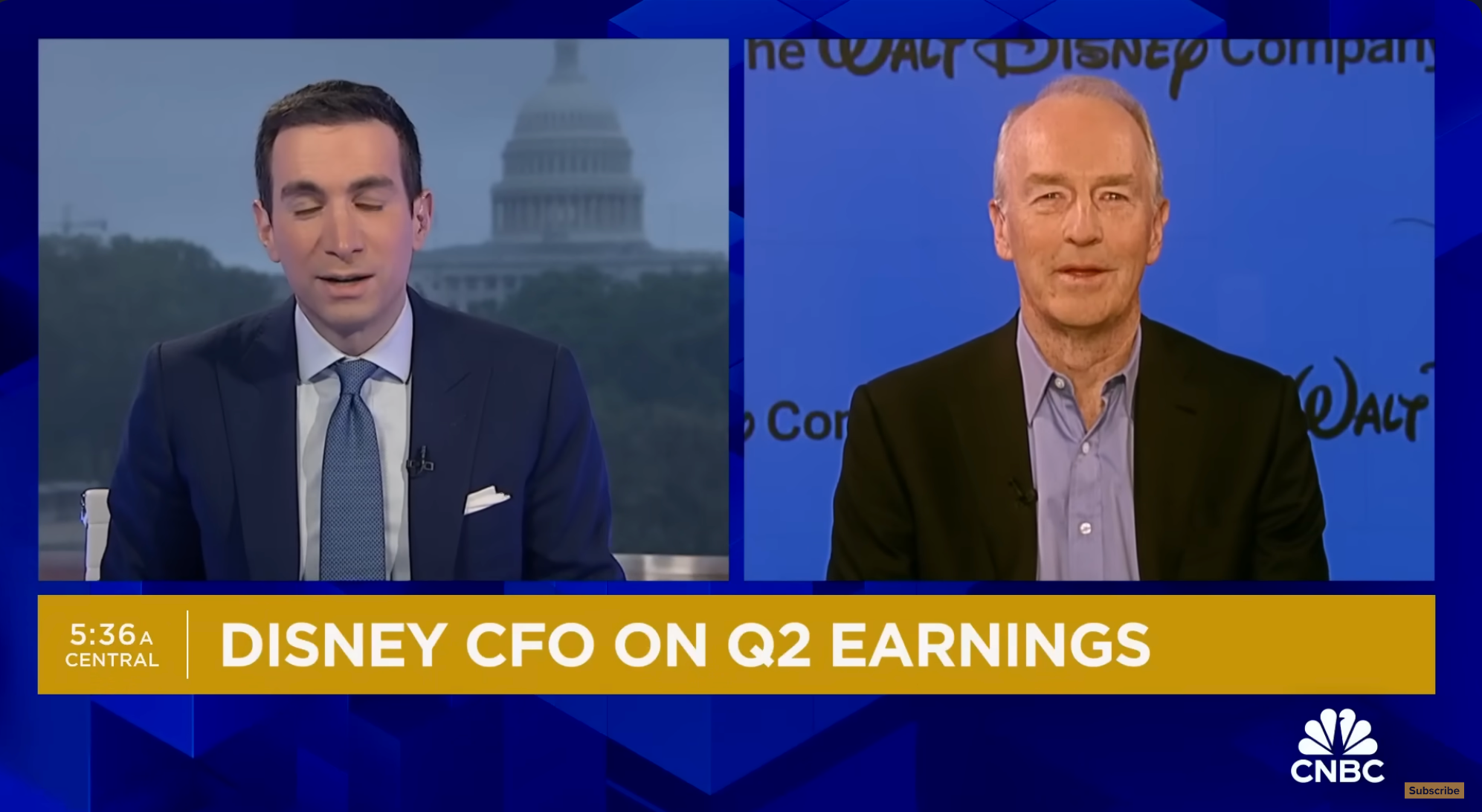

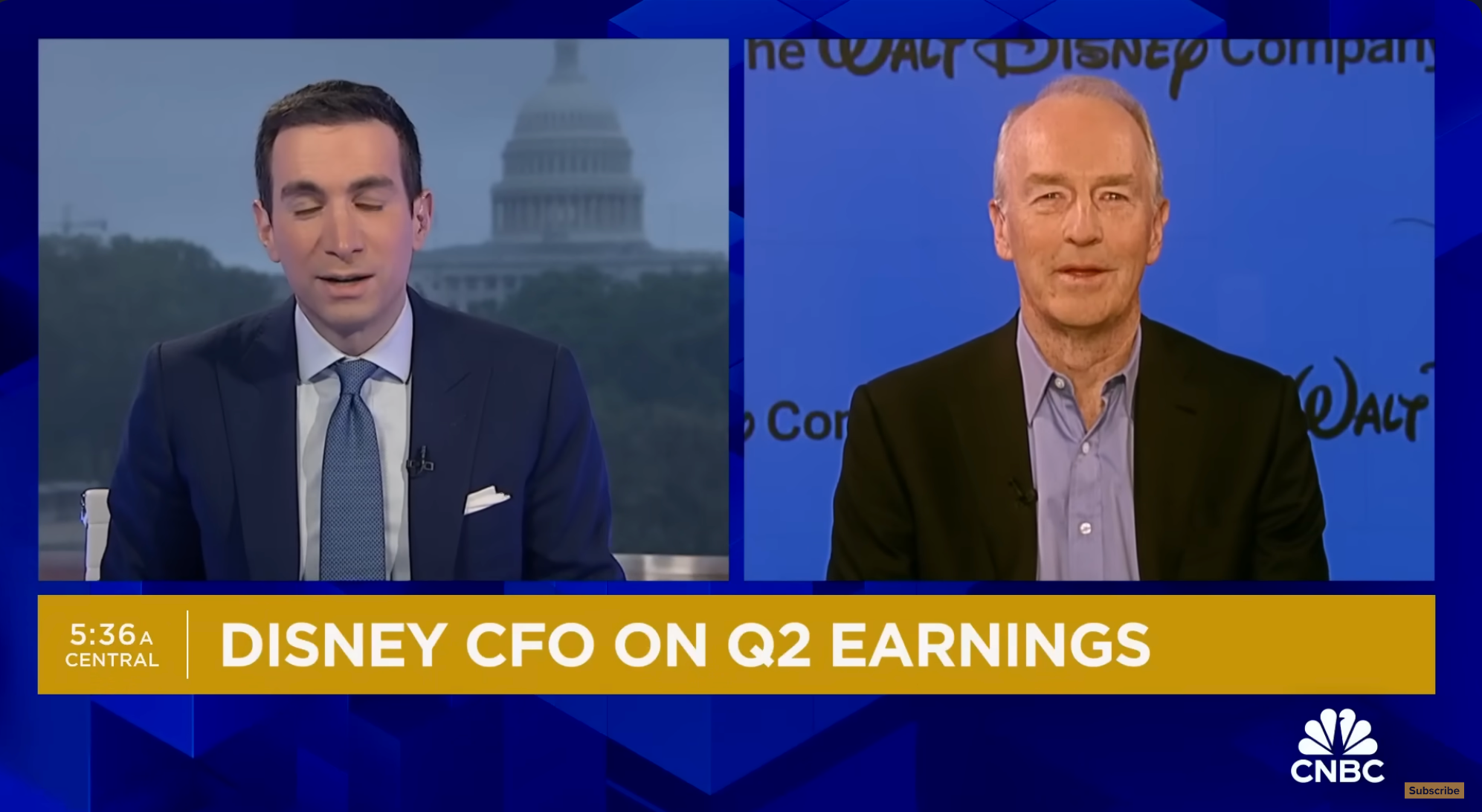

Disney CFO Hugh Johnston appeared on CNBC this morning, followed by speaking during the company’s quarterly earnings call.

Johnston is the new kid on the block at Disney, having joined the company in November.

Photo: PepsiCo

So, the CFO spoke on his first full quarter at Disney, and the interview…could have gone better.

The bottom fell out on Disney stock while Johnston presented what he thought was terrific news.

The Walt Disney Company

Here’s what Disney’s money man just said about your favorite company.

The Numbers Don’t Lie, Right?

A good public speaker knows to lead with the best facts about a subject.

Johnston started his CNBC interview by saying the following:

Photo: Disney

“It was really another strong quarter for Disney. We feel terrific about it. Operating income grew 17 percent.

“EPS grew 30 percent and, as you noted earlier, was 11 cents ahead of Wall Street.

Photo: Disney

“Maybe most heartening of all was the improvement in Direct-to-Consumer (DtC) streaming.

“Last year, that business lost about $600 million, and the Entertainment portion actually made $47 million.

(Photo Illustration by Mateusz Slodkowski/SOPA Images/LightRocket via Getty Images)

“That’s a couple of quarters ahead of what we said. We said we get’d there in Q4. We got there in Q2.

“Overall, streaming was up 12 percent, which led Entertainment to five percent revenue growth for the quarter.”

Photo: Disney

He concluded his opening remarks with, “Overall, good strength in the company…and we feel terrific about the momentum we have right now.”

That sounds like good news, right? Well, CNBC conveniently showed the price of Disney stock in after-hours trading as the CFO spoke.

Photo: CNBC

At the time, Disney stock was valued at $115.50. As I type this five hours later, the stock is trading at $104.93.

For the day, Disney has lost $20 billion in market cap and $11.55 in stock value.

Photo: Disney

When Johnston spoke, I can’t help but wonder what all the investors heard.

He sure sounded like he was presenting excellent news, yet what Wall Street heard was “SELL! SELL! SELL!”

Photo: CNBC

I’m having fun with the whole thing, but it’s also why I frequently note that I cannot take Wall Street seriously.

There’s little logic behind the selloff, but here we are!

Disney’s Strong Performances

As a Disney fan, you don’t care about the other stuff as much as the theme parks. That’s why you’re here.

But you know that some of the other stuff helps to pay for Disney’s planned $60 billion expansion.

Magic Kingdom

So, the market cap and stock price matter some, whether we like it or not.

The hard numbers matter more, though. Disney’s CFO quickly points out how strong those are.

Cinderella Castle in Magic Kingdom

In Disney’s Experiences division, the one that includes theme parks, the company earned $8.39 billion.

That’s a growth of 10 percent year-over-year. Even better, the operating income increased by 12 percent.

Spring Break crowds

At one point, a reporter asked Johnston whether guests paid for fewer experiences, like meals and merchandise purchases.

The implication was that budget-conscious vacationers might skimp on things like “lunch” – an actual comment from the interviewer.

Emporium in Magic Kingdom

Johnston downplayed such concerns, indicating that Disney fans are generally less price-sensitive than they are for other businesses.

While every industry has a tipping point about pricing, Disney hasn’t reached its inflection yet.

All-Beef Hot Dog

In fact, Johnston didn’t seem the least bit concerned about people spending less at Disney.

The CFO said that even though CEO Bob Iger later indicated that Disney has finally tracked some signs of a post-COVID slowdown.

Monorail Blue

Also, expected Q3 operating income in the Experiences division will remain flat year-over-year due to some one-time expenses.

Generally, Johnston and Iger believe that Disney theme parks will remain a steadily growing core driver for the foreseeable future.

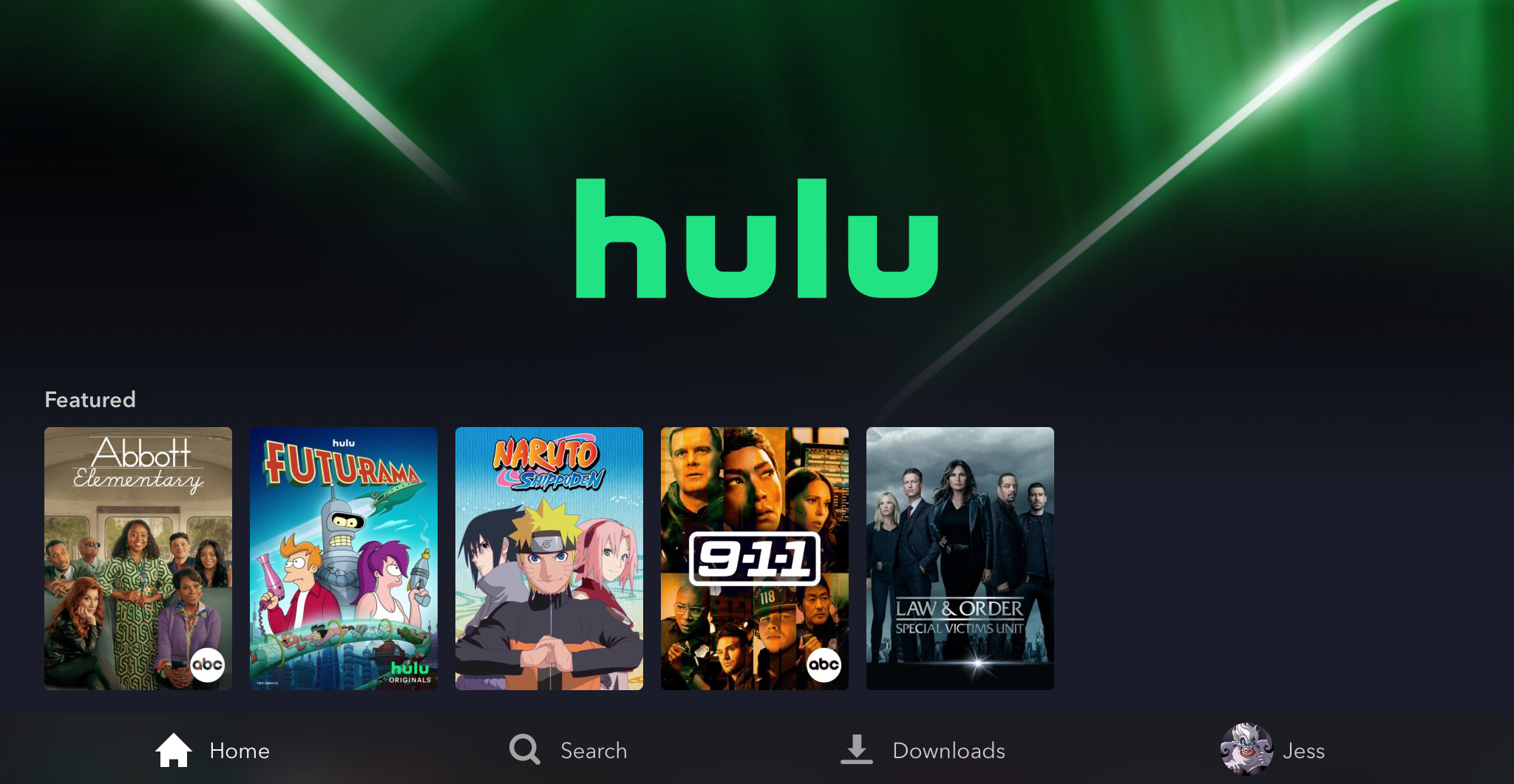

The Nuance of Disney Streaming

As long as investors fixate on the topic, streaming will remain top-of-mind for all involved.

CNBC reporters asked Johnston about streaming, and he confirmed that Disney will turn a profit soon.

Photo: Disney+

The number I mentioned above didn’t include sports content.

Overall, Direct-to-Consumer (DtC) lost $18 million for the quarter.

Photo: ESPN

As Johnston mentioned, the Entertainment section was profitable, though.

That piece earned $47 million, while the sports part lost $65 million, leading to a slight shortfall of $18 million.

Photo: Disney+

Johnston provided a bit of nuance about what’ll happen next. According to him, next quarter will be worse.

That’s nothing to be alarmed about, as it’s due to *sigh* cricket rights. Here’s the applicable quote:

Photo: Disney

“We’ll go down a little bit in Q3 based on some ICC cricket rights out of India.

“Then, in Q4, we will be back to profitability. And we’ll build on that in 2025.”

Photo: x @starindia

Investors may have downgraded Disney a bit, knowing that the company will suffer upcoming bad DtC news in three months.

Some Wall Street players bake that sort of thing into their investing strategies.

Photo: Marvel

From Disney’s perspective, though, it’s fully on pace to start making money from streaming in six months.

I’d call that the primary headline of everything that came out about Disney today.

The Streaming and Sports Debates

That one boomer on CNBC – if you’ve ever watched, you know the guy – asked his usual “all is doom” question.

That talking head is like if a Smashing Pumpkins song became a person.

Photo: CNBC

Anyway, he wanted to know whether Disney had traded “digital nickels for analog dollars.”

Yes, the old man wants to go back to the days of yore when everything was great and the kids stayed off his lawn.

Credit: Disney

I really don’t like that guy. But I digress.

The unflappable Johnston responded politely, going so far as to lie and call it a “great question.” It wasn’t.

The Walt Disney Company

The CFO’s remarks were insightful, though. Johnston explained that entertainment/streaming is “a fundamentally healthy business.”

“You basically see eyeballs moving from one channel to another, in effect, going from cable to digital.

The Walt Disney Company

“Obviously, there’s margin implications initially, but as we scale over time, I think we ought to be able to equalize those margins out.”

Later, Johnston punctuates his comments by concluding, “The margins are gonna be there for us.”

Photo Credit: AP Photo/Richard Drew, File

That’s an exceptional evaluation of how to surf the disruptive wave of streaming consumption takeover from linear networks.

No, Grandpa Simpson won’t like it, but it’s the reality we live in.

Photo: Disney

Johnston also adds the fascinating data point that the average streaming consumer is 20 years younger than a linear viewer.

For the moment, Disney can target both via a multi-platform approach, and that appears to be part of the plan in place.

Hulu banners in Disney’s Hollywood Studios

Overall, this was my first experience with Johnston as an executive.

I came away deeply impressed with his core competence and his civility.

Photo: PepsiCo

Johnston didn’t make me cringe in fear, unlike another recent Disney CFO who shall remain nameless.

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!