What Does Trian Want with Disney?

The Walt Disney Company recently announced a succession plan…but not the one you’d expect.

Mark Parker will take over as Chairman of the Board, presuming he wins a shareholder vote in early March.

CREDIT: REX SHUTTERSTOCK

Meanwhile, an outside hedge fund has tried to push its way onto Disney’s Board of Directors.

So, who is Trian, and what does it want with Disney? The answer is messier than you might expect.

Photo: Playbuzz.com

What Is Disney?

I won’t say that Disney faces an existential crisis right now because it’s patently untrue.

However, many people who don’t hold any sort of stake in Disney possess differing views about what it is and what it should be.

Photo: The Walt Disney Company

Even if you and I sat down for dinner and discussed Disney, we’d likely share wildly variant opinions about the basis of Disney.

Should we think of Disney as a business or an ideology? More importantly, what do you want Disney to become over the next quarter-century?

Photo: Disney

This conversation proves essential for Disney, which turns 100 this year. Like the Vatican, Disney thinks in terms of decades, not years.

To some, that’s a problem. They want to choose what Disney thinks, which brings us to all the recent turmoil happening with the company.

Photo: measureupgroup.com

Outsiders, some of whom have deep pockets, perceive Disney differently than its own internal evaluators.

The ones who purchase hundreds of millions of dollars of Disney stock believe they should gain a seat at the table, too. In Disney’s case, that’s the Board of Directors.

Photo: CNBC.com/Getty

Last year, activist investor Dan Loeb of Third Point successfully pushed his way onto Disney’s Board by taking this approach.

Loeb persuaded then-CEO Bob Chapek and current Chairman of the Board Susan Arnold to add former Meta executive Carolyn Everson to Disney’s Board.

Photo: CNBC

This strategy worked, as Disney got what it wanted out of the deal. Loeb agreed to drop many of his demands in exchange for having a body at Disney’s Board meetings.

Everson works as Loeb’s eyes and ears on the inside. Since this has occurred, Loeb has dropped his request for Disney to sell ESPN.

Photo: CNBC

The problem with cutting a deal like this is that people notice. Now, another party has adopted the same approach.

Who Is Trian Partners?

A few weeks ago, Disney stock plunged to multi-year lows, and what happened next proved predictable.

Photo Credit: AP Photo/Richard Drew, File

A hedge fund overflowing with capital recognized a rare buying opportunity and acquired roughly $800 million in Disney stock.

That total is fractional relative to how many Disney shares are available, but it’s enough to make waves.

Photo: Trian Logo

Since then, the investors, Trian Partners, have duplicated Loeb and Third Point’s tactics. They have demanded a seat on Disney’s Board.

This ploy has played out quite differently in two ways. First, the leader of Trian, Nelson Peltz, has personally demanded a seat on the Board.

Photo: restorethemagic.com

Loeb selected a trusted intermediary since he didn’t want to attend the meetings himself.

Second, Disney has firmly rejected the notion of Peltz joining the Board. Ultimately, Disney’s shareholders will decide at the shareholder meeting on March 9th.

(Photo by Lisa Kyle/Bloomberg via Getty Images)

Generally, the shareholder votes border on formalities. However, Disney advised against one activist investor vote last year that shareholders approved anyway.

In other words, Trian may force its way onto Disney’s Board against CEO Bog Iger’s wishes.

Photo: Chip Somodevilla/Getty Images

That’s significant in that one of Trian’s stated issues involves Iger’s return. The company (correctly) believes that Disney botched its succession plan.

Trian understands that it must work with Disney to achieve its goals, though. For this reason, Peltz has conceded that Iger should stay for two years.

Photo: CNBC

The question becomes why Peltz believes he has any right as an outsider to make that determination.

Trian’s the Villain Here, Folks

Well, that’s Peltz’s standard operating procedure. He shows up, buys massive share volume of corporations, forces changes, and then sells for a profit.

Photo: skillastics.com

In fact, the investor just did the same thing with Wendy’s. He’s a corporate raider who tries to shake things up in the short term and then profits.

Peltz bought a large investment, ginned up support for a sale, and then chose not to buy the company himself.

Photo:Wendy’s

Yes, that proclamation just occurred on Friday, and it likely happened due to Peltz’s growing infatuation with Disney.

With this company, he recognizes another opportunity to buy low and sell high. If that happens to destroy Disney in the short term, he doesn’t care.

Photo: LinkedIn

In fact, the Wendy’s debacle plays out like a kind of “Ghost of Christmas Future” for Disney if Trian earns a spot on the Board.

Peltz is the non-executive chair for the Wendy’s Board and just tacitly acknowledged that he won’t buy the company with his own money.

Photo: Center Watch

That’s not how corporate raiders profit. They make their cash by driving up stock prices using artificial means. They don’t worry about the future beyond a later date when they sell for profit.

Instead, investment teams like Trian force multiple reorganizations and leadership changes to attain these goals.

(Photo by Lisa Kyle/Bloomberg via Getty Images)

Not coincidentally, Wendy’s just confirmed its second reorg since June 2022 and fired the company’s U.S. President and also its Chief Financial Officer.

CNBC added the chilling note that “the lack of a deal frees up time for Peltz.” Yes, that’s a reference to Peltz having more time to mess with Disney. Yikes!

Photographer: Tasneem Alsultan/Bloomberg via Getty Images

What Does Trian Want?

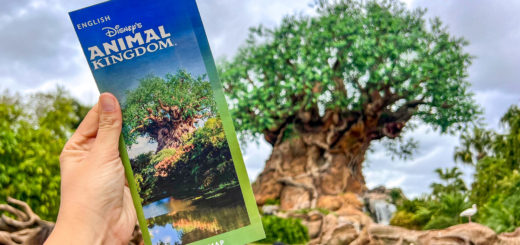

For its part, Trian published a new website this week called Restore the Magic.

Peltz sells his message on this site, and it’s basically, “Everything you hate about Disney is bad. Vote for me, and I’ll fix it.”

Image: The Wall Street Journal

Specifically, Trian takes issue with Disney’s streaming expenditures, excessive executive compensation, and the failed Iger/Chapek succession.

Also, Trian slags Disney’s mergers and acquisitions attempts with Sky and Fox, the latter of which Disney won.

Comcast

Disney held less interest in Sky than it indicated. That move was largely retribution by Iger for Comcast bidding up the price of Fox by $19 billion.

That’s beside the point, though. Iger is familiar with not just Peltz and Trian but also their kind.

Corporate raiders reached their nadir in the 1980s, but they’re still around. Most want the same thing.

Photo: Getty

They seek to capitalize on struggling, undervalued companies. Whether they make the business better is irrelevant.

That thought should terrify Disney fans. No matter what your vision of Disney is, I can assure you that it’s not anything Trian cares about.

Photo: RestoretheMagic.com

No, this move can only be described as a power play against a presumably weakened foe.

You can read the official Restore the Magic site for more information, but I can save you the aggravation.

Mainly, what Peltz will try to do is get Disney to sell assets like Hulu and ESPN+ in order to fix its balance sheet.

Photo: Walt Disney Company

In the process, Wall Street will increase the value of the stock independent of whether Disney’s status improves in the short term. That’s irrelevant to them.

Trian merely wants to buy low and sell high. If it destroys Disney in the process, Peltz won’t care.

Mike Pont//Getty Images

I don’t expect this attempt to work since Iger and Parker are seasoned veterans, but it’s a scary turn of events.

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below and one of the agents from MickeyTravels, a Diamond level Authorized Disney Vacation Planner, will be in touch soon!

Photo: Patrick T. Fallon/Bloomberg via Getty Images