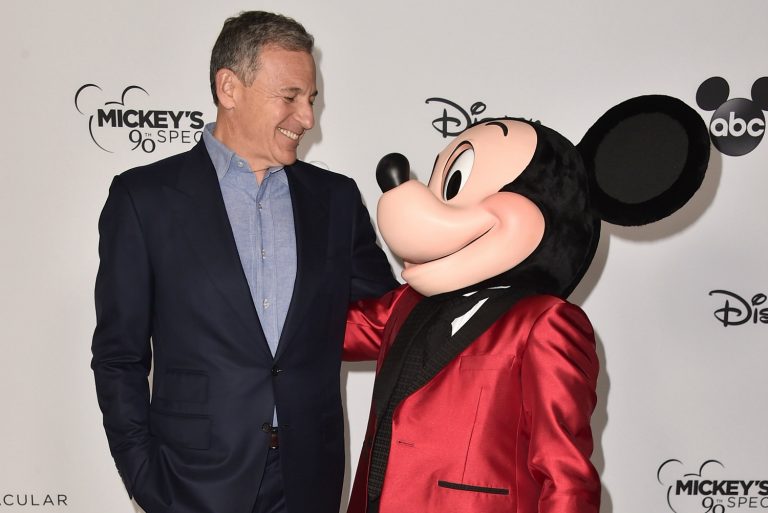

What Are Bob Iger’s Most Pressing Problems at Disney?

Okay, Bob Iger is back at The Walt Disney Company precisely 999 days after he announced his retirement.

As for the retirement itself, that lasted less than 11 months. Iger’s heart has always remained at Disney.

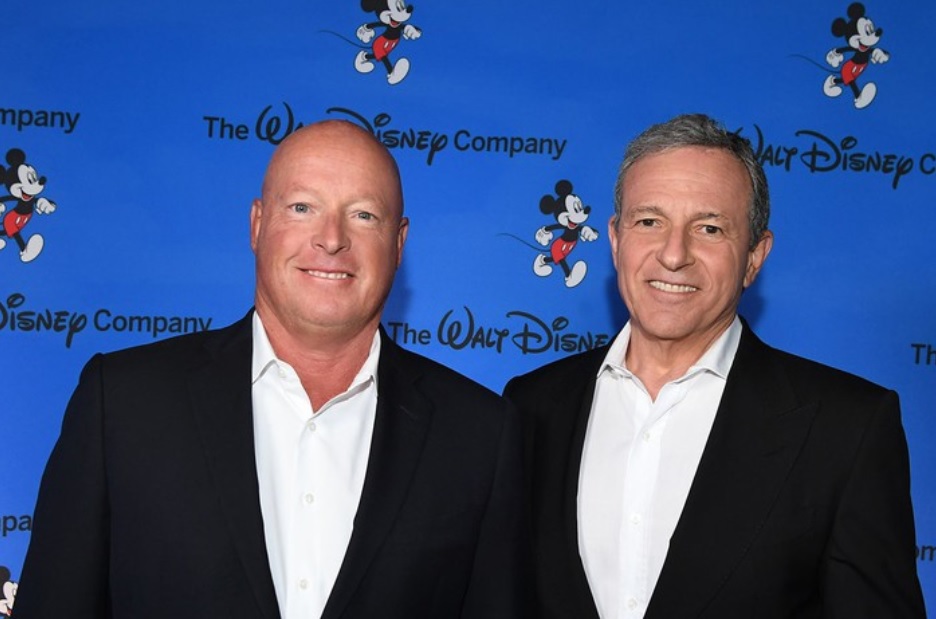

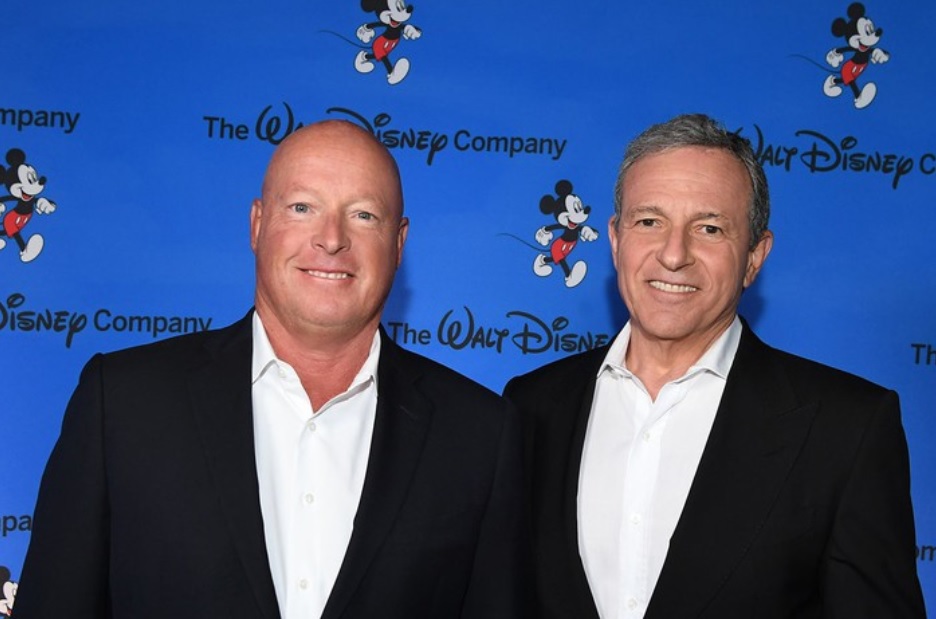

Photo: Alberto E. Rodriguez / Getty Images

Now that he’s back again, what should we expect from Disney’s once and future CEO? Here are the five most pressing problems Iger faces during his return.

Customer Loyalty

Raise your hand if you’re happy with Disney right now.

Okay, this is a virtual exercise, and I can’t see you. Still, we all know that nobody’s hand is raised.

Let the record show that during Chapek’s last week on the job, he reopened annual pass sales at Disneyland Resort and then promptly closed them again after 36 hours.

Meanwhile, he also increased prices to record-setting levels at Walt Disney World. In my favorite summary of his entire tenure, Disney Genie+ pricing broke its previous high by 36 percent on his final day on the job.

Bob Chapek spent the body of three years robbing a vault with our money in it.

That’s on top of his other mistakes, which I chronicled yesterday.

Customers are only as loyal as businesses deserve. If you don’t believe me, ask anyone you know whether they like Comcast.

For my entire life, Disney has stood as the best company with the most exceptional customer service.

If we took a vote on this right now, I’m unsure whether Disney would make most people’s top ten list.

Photo: Disney

Iger faces the onus of restoring faith in the Disney brand.

It’s a multi-faceted endeavor filled with nuances.

We’ve got political, professional, financial, and creative criticisms regarding Disney as we enter the post-Chapek era.

Photo: Charles Krupa/AP

I don’t think any of us realistically expects Iger to solve them all overnight.

However, he only has two years to fix most of them AND find a successor who can solve the rest.

Photo by Chip Somodevilla/Getty Images

How to Approach Movie Releases

Disney lost nearly $1.5 billion on streaming content during its most recent fiscal quarter.

Perhaps you’ve heard. After all, that’s the reason Bob Chapek no longer has a job.

Photo: skillastics.com

He thought Wall Street was cool with these long-predicted losses when they obviously weren’t.

Now, Iger finds himself facing the same dilemma that many streaming media CEOs do.

He must decide how to course correct now that Wall Street has moved the goalposts on streaming criteria.

Photo: History.com

When Chapek set his plan into motion, Wall Street preferred huge streaming subscriber numbers.

With a potential recession looming, the money people want smaller streaming content losses.

Image: Disney Plus

That’s a problem since Disney has already signed multi-year contracts for expensive sports content and upcoming Disney+ projects.

Simultaneously, exhibitors bristle at how Disney has employed day-and-date theatrical releases in some instances, followed by shorter theatrical windows in others.

In short, Chapek got everyone mad at Disney, and Iger is now the person responsible for cleaning up this mess.

Will Disney recommit to longer theatrical release windows? Will it reduce expenditures on streaming service-exclusive projects?

This question is the multi-billion dollar one for Disney to answer right now.

Planning the Next Big Move – Mergers and Acquisitions

Why does Wall Street revere Iger so much?

The answer is simple. As the head of Disney, Iger somehow cornered the market on intellectual properties.

Disney acquired Star Wars, Marvel, Pixar, and virtually all significant Fox assets during his tenure.

Photo: The Wrap

I’ve said this before, and I’ll keep saying it: I sincerely doubt Iger would have returned to Disney unless he recognized a viable acquisition target in the marketplace.

I’m not talking about something like Warner Bros. Discovery or Peacock. However, I’ve already seen speculation linking Disney to Netflix. Does that pass the laugh test, though?

Photo: Netflix

I’ve also pointed out the connection to Candle Media, the current owners of the CoCoMelon brand. I think that acquisition is a distinct possibility.

Still, we should keep in mind what Iger is: a visionary.

He started setting the table for Disney+ several years before its debut.

Since Iger left Disney, he’s primarily been linked with Web3.0 projects.

For this reason, I wouldn’t be surprised if Disney takes a run at some holding company that owns several video game intellectual properties.

Photo: mentalfloss.com

I view those as more undervalued in the marketplace right now, while most television and film licenses are oversaturated.

Regaining Wall Street’s Trust

Honestly, this one probably isn’t particularly challenging for Iger, at least in the short term.

Photo: USA Today

Simply by returning, Iger has already thrilled analysts who were frankly sick and tired of Bob Chapek.

Then again, Walt Disney may have won the press conference. Iger’s return comes at an uncertain time.

As mentioned, Disney has already committed many of its 2023 resources to content creation.

Photo: Chesnot/Getty Images

Now, Iger must find a way to manipulate Disney’s balance sheet such that it can make significant acquisitions.

Simultaneously, Iger must decide how to approach the hiring freeze and layoffs Chapek had previously announced.

Photo: Disney

According to the most recent financial documents, Disney owes roughly $48 billion, which is a reasonable amount for a company likely to earn $90 billion in revenue in fiscal 2023.

Remember that Disney just paid $71 billion for Fox in 2019 and then experienced the financial ramifications of the pandemic.

Photo: Twentieth Century Fox

I’ve previously described Chapek as a wartime consigliere tasked with fixing Disney’s balance sheet.

No matter what you think of the man as a leader, he achieved his primary goal.

Photo: Matt Stroshane/Courtesy Disney Parks

Iger temporarily benefits from that work, but he’ll lose some of his momentum if he immediately lays off the staff he just reassured with his first message.

Conversely, Wall Street probably wants to see those layoffs and other improvements that increase Disney’s 2023 earning potential.

That’s a tightrope he’ll have to walk, and I wonder how he’ll pull it off.

Will He Really Leave in Two Years?

This one’s the elephant in the living room. Sure, we can all point to the pandemic as the reason why Iger initially retired.

Photo: Disney

Even so, Disney’s current CEO turns 72 in February…and he’s said his goodbyes once already.

I’ve mentioned a few times that media CEOs don’t always think the same way other Wall Street leaders do.

Photo: John Blanding | Boston Globe | Getty Images

Some media CEOs never want to go. In an extreme example, Sumner Redstone ran ViacomCBS until he was 92…and only gave up the gig then due to a court order.

Iger is unmistakably a vibrant 71. He showed no signs of losing his fastball before he exited Disney.

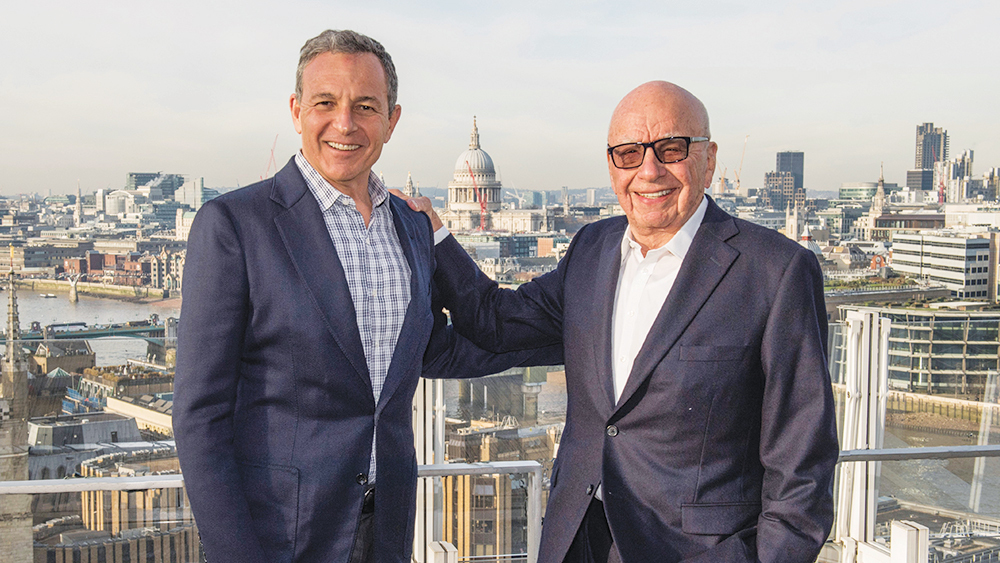

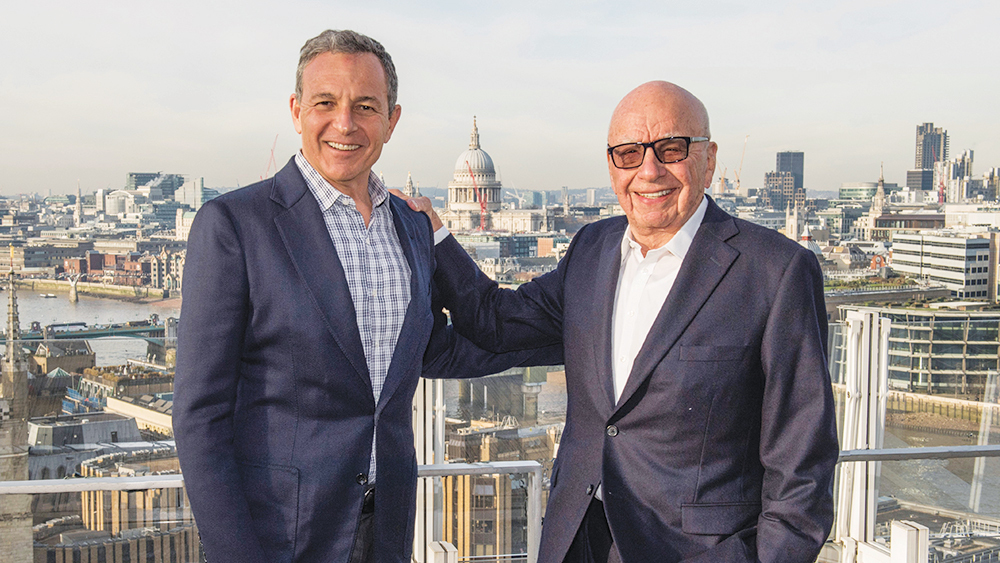

In fact, Iger closed the Fox acquisition when he was 69 years old, and Rupert Murdoch’s condition was that the CEO must stay with Disney.

Murdoch didn’t want his life’s work ruined by a less competent executive than Iger.

Robert Iger and Rupert Murdoch

credit: Disney

For his part, Iger wanted to run for President of the United States. But, unfortunately, he missed that window in 2020 because of the Fox deal. Now, he’s ceding it again to save Disney.

With such a high cost to return, should we genuinely expect Iger to leave in two years? That’s a shorter time than you may realize.

Chapek’s run as CEO seemed to last forever, but it was only 33 months. So should we honestly expect Iger to be gone by the start of 2025?

Feature Image: Getty

So happy he’s back. We love Disney. Even more now!!!!