Five Problems for Disney to Resolve in 2024

The Walt Disney Company faces many challenges in 2024.

As theme park fans, we have thoughts on which ones matter most.

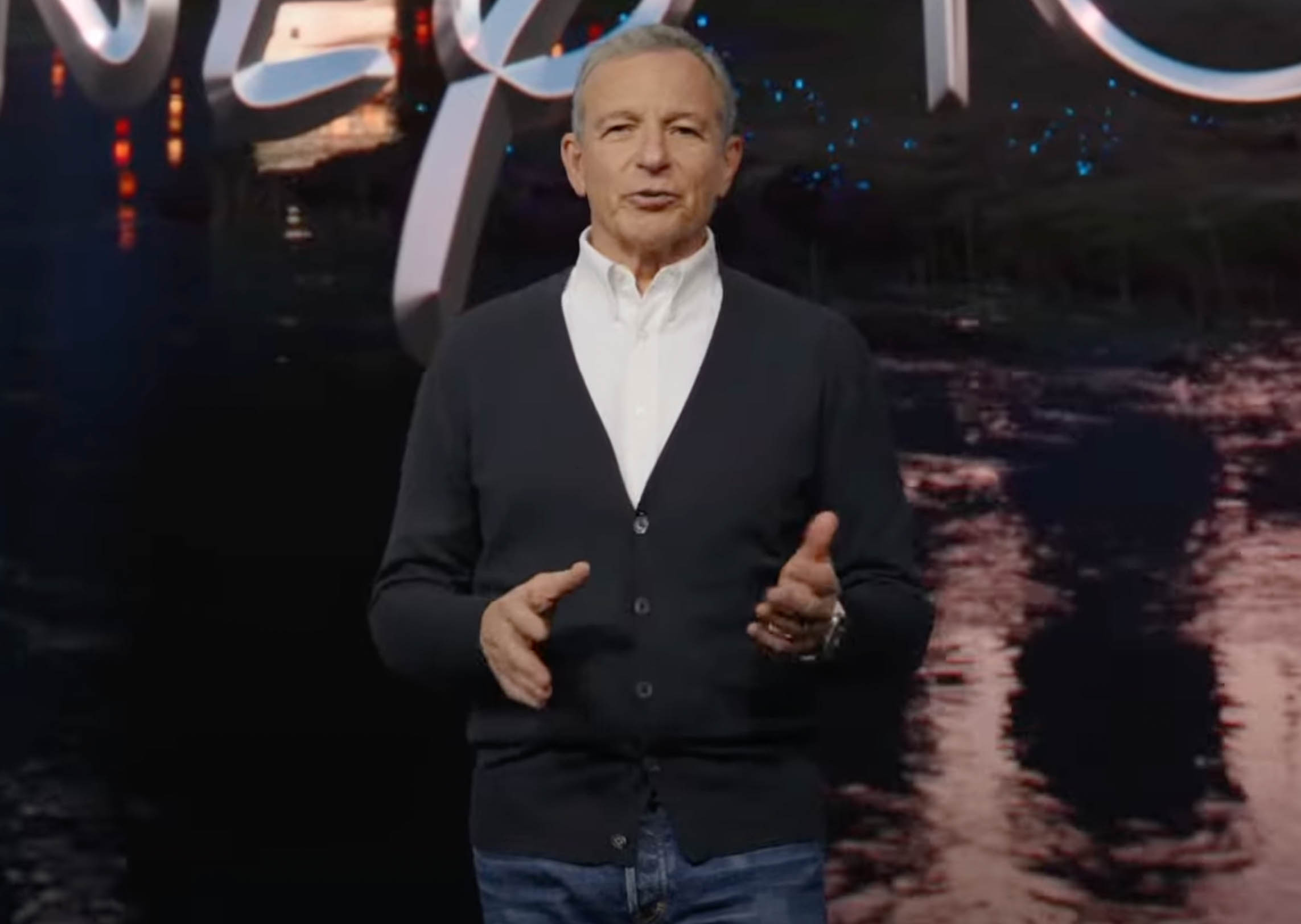

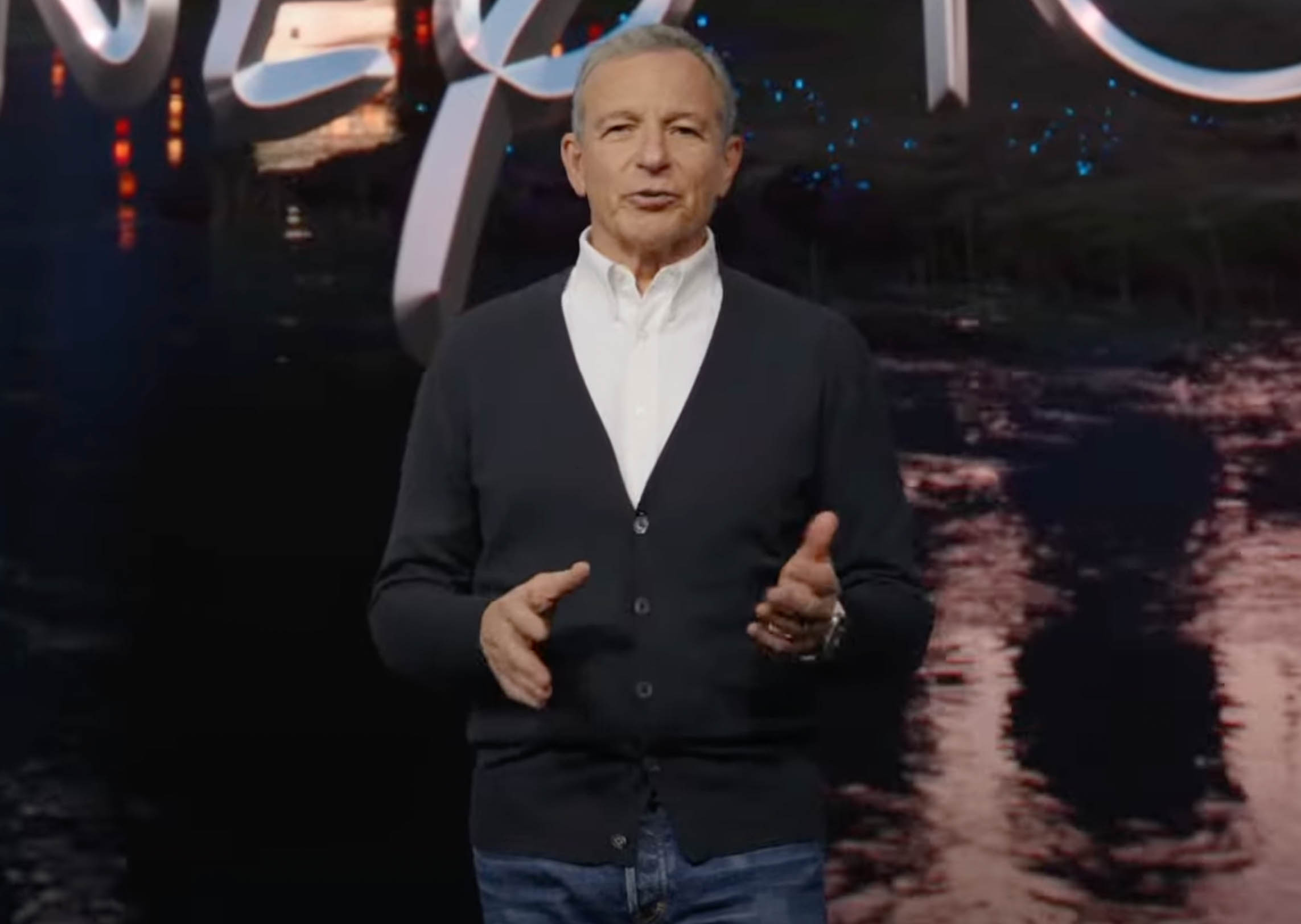

Photo: Disney CEO Bob Iger (Getty Images)

However, for Bob Iger, the company’s economic strength will determine how much Disney controls its own fate.

Here are five problems for Disney to resolve in 2024.

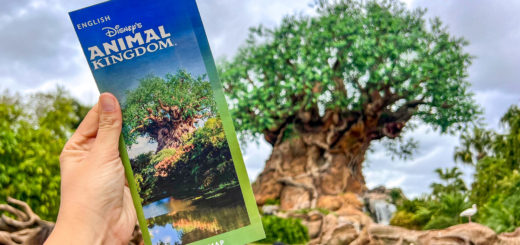

The High Cost of Hulu

Photo: Wikimedia

As an FYI, I didn’t choose these topics. Instead, they’re the work of respected Bank of America Securities analyst Jessica Reif Ehrlich.

When Ehrlich posts a stock evaluation, the entirety of Wall Street takes note. So, her topics become Iger’s biggest problems by default.

The first one the analyst lists is the continued integration of Hulu into the Disney ecosystem.

Photo: Wikimedia

As a brief reminder – Hey, we were all on holiday break, so you probably forgot! – even Disney doesn’t know how much it has paid for Hulu.

I’m not being glib or facetious here. Those were the terms of the deal.

Disney just purchased Comcast’s one-third ownership stake in Hulu.

Photo: Disney+

In exchange, Disney has promised to pay at least $8.1 billion for this piece.

Comcast and Disney have hired arbitrators to determine each company’s valuation for Hulu.

When those two advisors inevitably fail to reach a compromise, an independent arbitrator will make the final call.

Disney/Comcast/Hulu

Disney may yet pay several billion more for Hulu, which concerns Ehrlich and other analysts.

Then, we have the second part of the conversation. Disney+ recently added a Hulu tile.

The company did this with little warning but hoped to cushion the blow when Hulu becomes permanent during the first half of 2024.

Photo: THIERRY CHESNOT/GETTY IMAGES

Technically, Hulu is in beta on Disney+ as parents determine the best child-friendly settings for the app.

Will everyone go along with this addition, or will it lead to a backlash about decidedly adult content available on Disney+?

Nobody can say for sure yet, but the success (or failure?) of Hulu in 2024 will go a long way in defining Disney’s fate in the streaming wars.

Finding an Investor for ESPN

Justin Hermes posted an article last week about ESPN extending an NCAA contract for eight years.

ESPN gains the rights to 40 different NCAA championships in this agreement, which pairs well with Bob Iger’s philosophy that live sports drives business.

Image Credit: NCAA

Still, Ehrlich correctly points out that Disney cannot maintain this sports rights arms race.

Consider that the NCAA Women’s Basketball tournament rights tripled in value from the last contract.

Disney faces such pricing escalation throughout sports, a financial challenge for “Worldwide Leader.”

Photo: DIsney+

Thus, Iger has publicly stated that he aspires for ESPN to gain two financial partners.

In a perfect world, Disney desires two partners. One of them is a trillion-dollar digital company like Apple or Amazon.

The explanation here is straightforward. Disney wants someone to help pay the bills for sports licensing fees.

Photo: skillastics.com

Amazon and Apple have entered the digital video race by throwing money at the problem, making television series and movies as loss leaders.

If one of those companies purchased an ownership interest in ESPN of say, 10-15 percent, they’d be incentivized to help with the costs to run the service.

Photo: T-Mobile

Then, Disney desires distribution. Everyone owns a phone and happily live streams sports.

So, a company like T-Mobile could provide ESPN with a built-in audience of nearly 118 million customers.

ATT and Verizon would offer even larger customer bases, but I’ve chosen T-Mobile for a specific example.

Photo:GETTY IMAGES FOR ESPN

The company just announced last week that some of its subscribers will get Hulu for free soon.

A more permanent version of that offer is what Iger envisions for ESPN.

Photo: ESPN

It would ensure heavy usage of ESPN after linear television reaches the end.

That day is coming soon, and the thought explains why Disney wants to act fast on other methods of distribution.

Renewing NBA Rights

Photo: People

This problem ties back to what I just discussed.

Part of what feeds the Disney machine is its reliance on the eyeballs of live sports viewers.

NBA Top Shot

Disney markets many of its products to these potential customers, and there are a lot of them who watch the NBA.

In fact, the new in-season tournament just claimed staggering ratings for otherwise meaningless NBA games.

We’re talking about 4.6 million people watching NBA games during the early part of the season.

(Photo by Kevin C. Cox/Getty Images)

The catch here is that the popularity of this new event has increased the value of the NBA even higher.

Warner Bros. Discovery and ESPN currently own broadcasting rights for the NBA, but that deal expires after next year.

The previous contract for $2.6 billion annually is looking VERY light. Everyone expects the price to increase significantly.

Photo: NBA Central

In fact, the companies I just mentioned, Apple and Amazon, might get involved with the bidding.

Disney cannot compete with companies of that scale in bidding wars, something it learned the hard way with IPL cricket.

Disney is currently merging assets with Reliance Industries, the business that took the cricket rights from the Mouse.

Photo: The New York Post

That deal embodied the concept of, “If you can’t beat ‘em, join ‘em.”

To avoid the same fate in North America, Disney hopes to entice Apple or Amazon to join ESPN rather than competing with it.

Photo: simplemost.com

The outcome of these negotiations will go a long way in determining whether ESPN keeps its NBA rights beyond next year.

This story is MUCH bigger than anybody realizes yet. Some scary dominos could fall if Disney doesn’t win this one.

Reinvigorating the Creative Engines

Photo: Pixar

That’s a polite, undeniably corporate way of saying something obvious.

Disney needs to tell better stories. Many recent movies and even some high-profile television series haven’t been up to Disney’s standards.

To be fair, those are impossibly high standards, but even if we lower them, the answer stands.

Photo: CNBC

Several of Disney’s 2023 releases disappointed critics and filmgoers alike. In fact, many of those filmgoers decided to stay home.

We live in a constantly online, interconnected society brimming with entertainment options.

If something isn’t good enough, word spreads immediately, hurting not just the box office but the brand’s overall perception.

Getty

Disney relies on the content machine to generate revenue across divisions.

When you like the programs, you buy the merchandise, check out the parks’ experiences, and subscribe to Disney+/Hulu.

Photo: kindpng.com

If you don’t like the programs, well, a lot goes wrong on Disney’s balance sheet.

So, this subject is one where Wall Street and casual Disney fans align. Disney needs to make better movies and television shows.

CEO Succession

Photo: Disney

We’ve talked this one to death, although it’s just about time for me to do another CEO power rankings debate.

We all know the deal here. Bob Iger is staying through the end of 2026.

Presumably, he’ll leave then, but we never really know with Iger.

Image: Disney

If Iger is serious about leaving – and he does sound kinda burnt out lately – he needs to name and train a successor.

Preferably, that announcement would occur around mid-2025, maybe even sooner.

After all, Iger turns 73 in February and while he’s had no (reported) health scares of note, nobody ever really knows.

Photo: Natacha Rafalski on Instagram

I mean, I don’t want to get dark here, but the average American male lives to be 77.3. Iger will be 75 in the year he plans to retire.

Disney should have a plan in place to avoid what we all fearfully describe as The Chapek Scenario wherein someone unworthy gets the job.

Photo: Variety

Every Disney observer in the world is waiting to see what’s next, but I disagree with Ehrlich on this one.

I’m dubious that Disney resolves this in 2024 unless unexpected events force the issue.

MickeyBlog Logo

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!