Will Disney Play Follow the Leader With Its Content?

A Bloomberg article on Friday hints that The Walt Disney Company is exploring new ways to monetize.

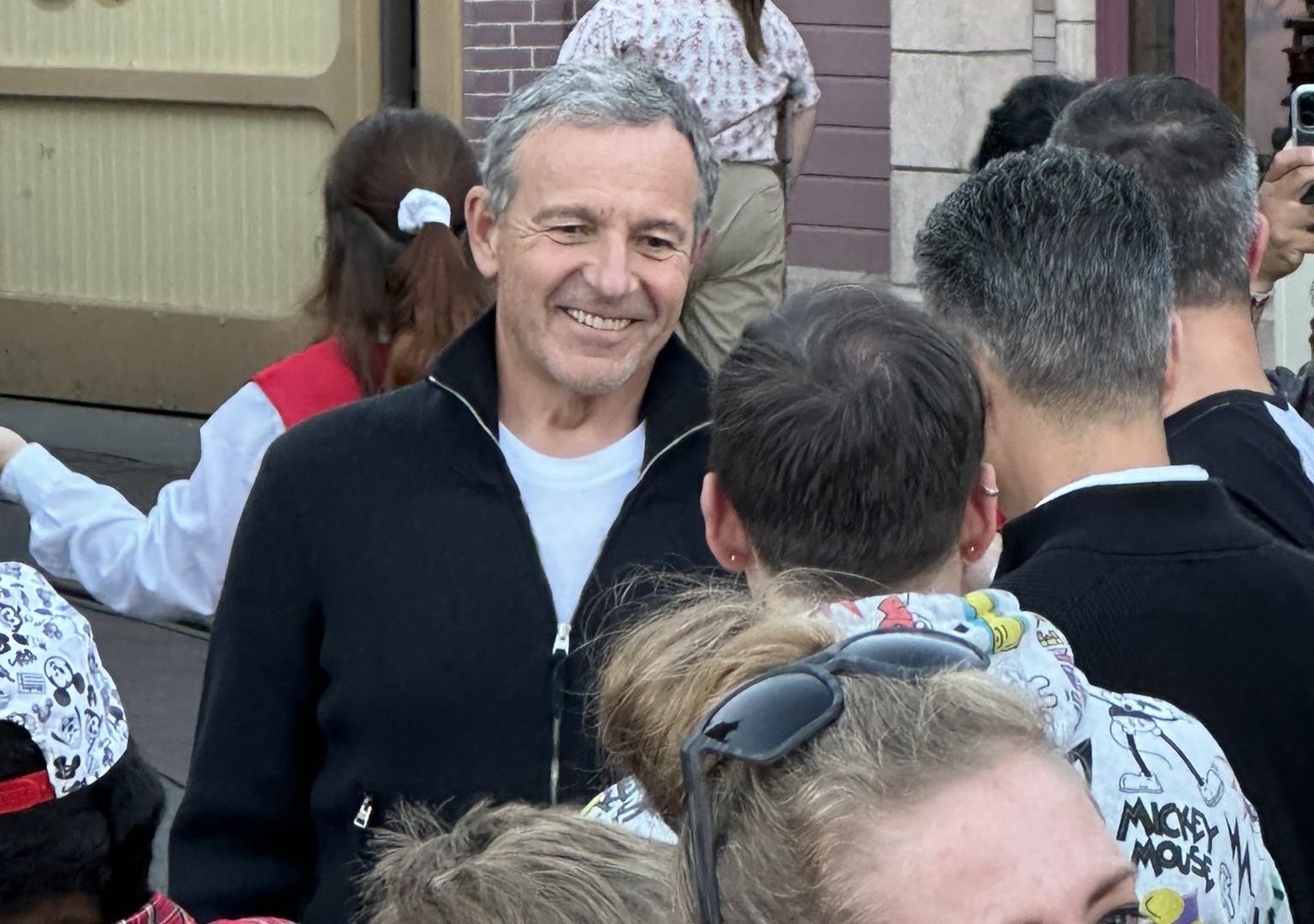

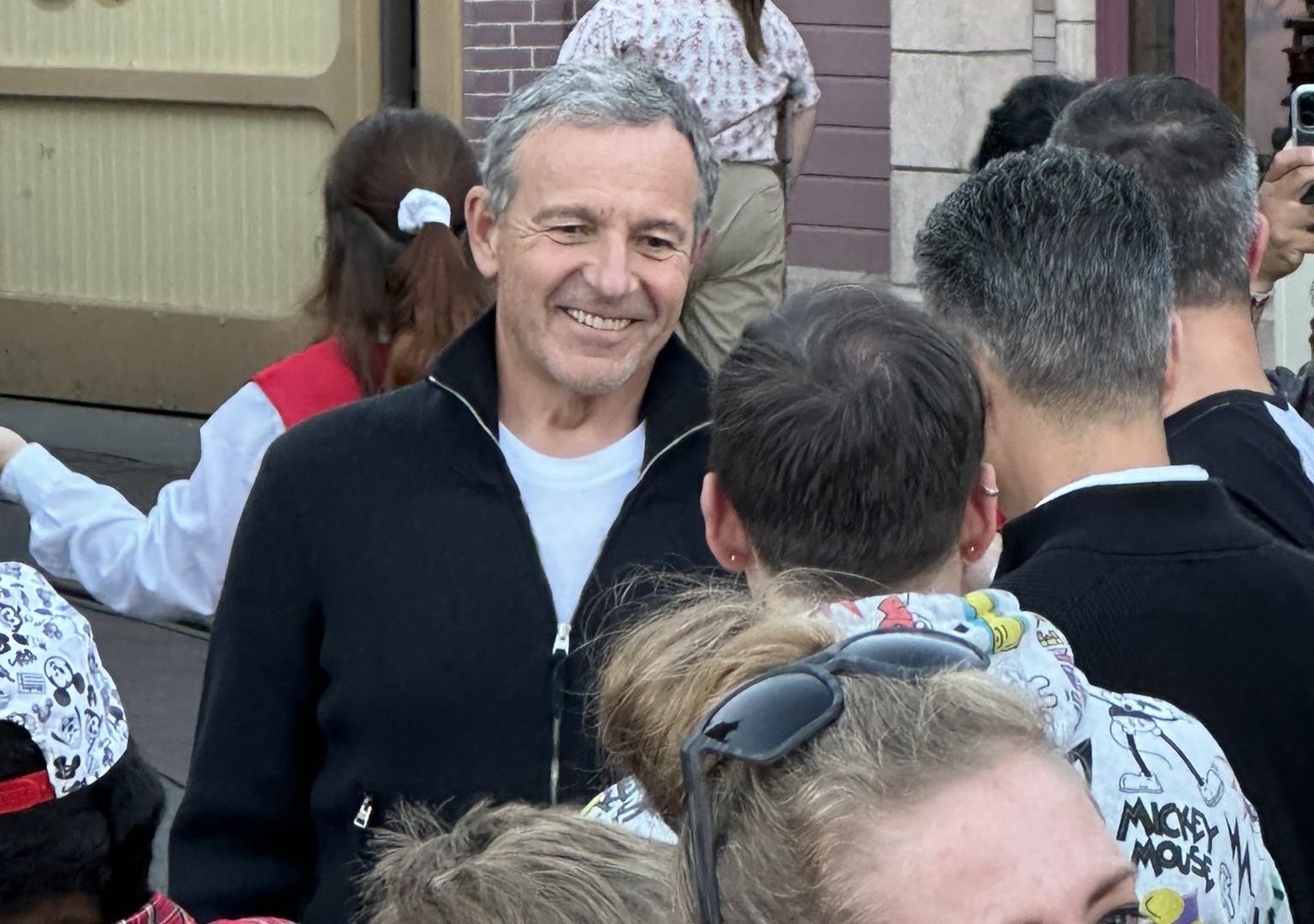

With the company facing a proxy fight with a billionaire investor, CEO Bob Iger needs to whittle down Disney’s debt.

Photo: skillastics.com

Reportedly, Iger is contemplating a new but also tried-and-true method of revenue generation. It’s one that comes with overhead, though.

Will Disney play follow the leader with its content? Here’s what we know.

Disney’s Streaming Media Struggles

Photo: Chesnot/Getty Images

I should preface this news by stating that Disney announces its fiscal first quarter 2023 earnings next Wednesday, February 8th.

Everyone expects a rough report in the wake of the most recent one, which got Bob Chapek fired.

Photo: Patrick T. Fallon/Bloomberg

Disney faces a slew of losses with its streaming content, which was always predicted. Wall Street suddenly decided it cared more in 2022, though.

So, Disney must show that it has viable solutions to cut its substantial losses.

Photo: LA Times

During the most recent quarter, Disney’s streaming content suffered a financial shortfall of $1.5 billion. With a B. That’s a lot.

According to Bloomberg, Disney has watched the competition and debated adopting some of their tactics.

Photo: Bloomberg via Getty Images

Specifically, David Zaslav’s Discovery somehow forced a takeover of Warner Bros., which was akin to a guppy swallowing a shark.

Since then, the new Warner Bros. Discovery has cut costs at an alarming rate. Seriously, I cover this on my media podcast, Streaming into the Void.

Photo: Variety.com

We jokingly refer to the whole affair as the WBD Deathwatch because the news coming out of that organization is always so grim.

That doesn’t mean all the ideas are bad, though. Zaslav, for all his many faults, is akin to Chapek in that he’s a bean counter extraordinaire.

Source: Variety.com

In recent months, Zaslav has done the unthinkable and frankly counterintuitive.

After the company spent years reacquiring the streaming rights to all its valuable intellectual property (IP), Zaslav started removing some of its own content from HBO Max.

Source: Marvel/ Hollywood Reporter

What was the CEO thinking? He planned to license this content elsewhere so that he’d receive payment for it.

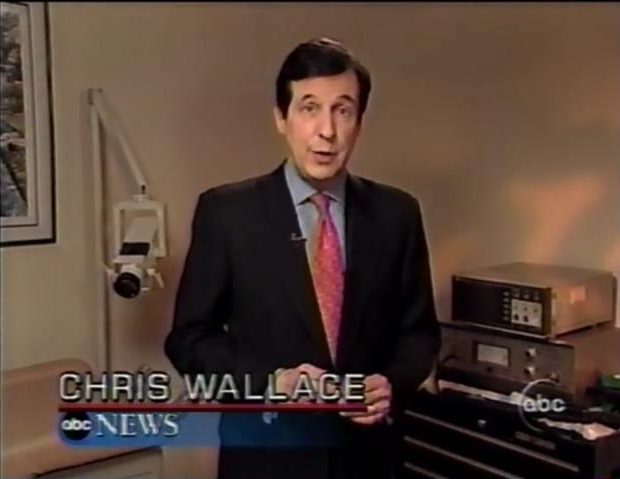

Shows like Westworld disappeared from HBO Max and will now appear on Roku’s streaming service. In exchange, Roku pays WBD for the content.

You can see where this is going.

Disney Plots the Unthinkable

Source: comicbook.com

Many years ago, Bob Iger identified Netflix’s new streaming model as an existential threat to Disney’s core businesses.

Since Disney acquired ABC, ESPN, and what became ABC Family/Freeform in 1995, the company earned massive revenue from its television channels.

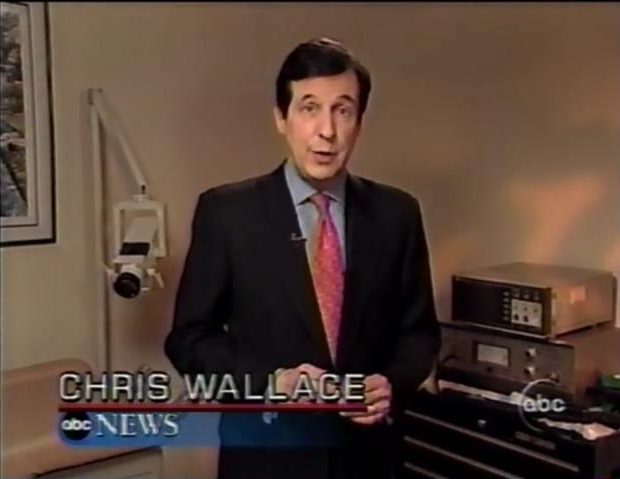

Photo: ABC

Streaming reset the status quo, something television executives failed to recognize quickly enough.

Even Disney licensed Netflix the rights to several Marvel characters, The Defenders.

Photo: Comicbook.com

Later, Iger would famously describe this decision as “like selling nukes to the enemy.” A quote like that stays with you, and he was absolutely correct.

Around 2016, Iger settled on a new strategy for Disney. It would lay the course for its own streaming services, which eventually became ESPN+ and Disney+.

Photo: ESPN+

To do that, Iger stopped licensing Disney characters to other streaming services. Moreover, he allowed existing licensing agreements to expire.

Within a year of the debut of Disney+, virtually all Disney content was either available on the service or could be if Iger desired it.

Image Credit: Disney

Titles once buried in the Disney Vault suddenly became readily available to watch on Disney+.

Just as importantly, almost all Star Wars, Marvel, and Pixar-related content came free with the Disney+ package.

Disney traded the revenue it gained from content licensing for a superlative streaming media product.

For Disney fans, Disney+ is legitimately a lifelong dream come true.

While Iger was gone, Chapek recognized the trap of increasing subscriber numbers, though. It’s an expensive process.

Disney’s losses accelerated at an alarming rate. So, now, Iger is back in charge and contemplating something unthinkable. He may reverse course on his own decision.

Photo: Hollywood Reporter

According to Bloomberg, Disney may begin licensing some of its content to competitors once again. In terms of c-suite decisions, that one would be pretty shocking.

Bob Iger’s Dilemma

Photo Credit: @jaytasmic/Twitter

Here’s the key takeaway from Bloomberg’s article:

“Wall Street cheered (Disney’s choosing not to license content) at the time because it meant the company was entirely focused on building out the streaming business.

(Photo by Kimberly White/Getty Images for Vanity Fair)

The shift was costly, however, as Disney surrendered billions of dollars from home video sales and licensing deals with other networks.”

Yes, again, that’s billions in lost revenue. With a B. You can appreciate Iger’s dilemma here.

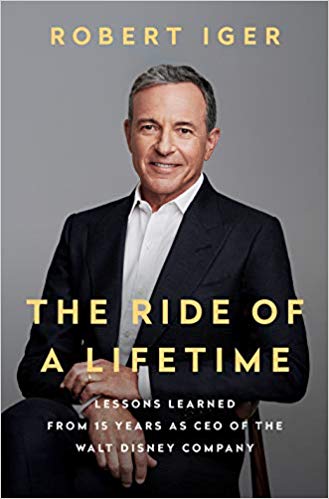

If you’ve read his memoir, The Ride of a Lifetime, you know how much he bragged about the painful but correct decision to take back control of all Disney content.

Now, Wall Street has changed its opinion on the tactic. Investors like the idea of companies monetizing their IPs by licensing them to third parties.

Yes, the action Iger described as arming the enemy is now back in vogue once again. And Disney has apparently decided to go along with the crowd.

Photo: Patrick T. Fallon/Bloomberg

Bloomberg reports Iger’s choice as a fait accompli. Apparently, Disney is already shopping some of its titles to other streaming services.

For reasons too arcane to discuss, Hulu is one of them. Please understand that in-house businesses operate under their own budgets.

Photo: Hulu

For this reason, the report may prove overblown. If Disney licenses its own content to Hulu, that’s pretty much the point of Hulu anyway. That’s not a story.

If Disney licenses its content to a third party like Roku, Tubi, or *gulp* Netflix, THAT is a big deal.

Photo Credit: Netflix.com

Such a decision shows that Iger has gone back on his thinking from just a few years ago.

Also, a third-party licensing deal indicates that Iger is at least worried enough about a proxy fight that he wants to show investors that the company is paying down its debt.

Disney’s Apology Tour?

Photo: Empire

Iger’s team announced some other noteworthy stuff on Thursday. Most notably, Disney scheduled three full years of upcoming theatrical releases.

You should view that as what it is: a conciliatory message to theater owners.

Photo Credit:screenrant.com

Even though Disney has remained the top studio in terms of box office revenue for seven straight years, exhibitors still threw a tantrum during the pandemic.

Chapek (correctly) chose to release films on Disney+ rather than exhibit them in theaters during the pandemic.

(Photo by Jesse Grant/Getty Images for Disney)

Not coincidentally, Disney+ is arguably the fastest-growing streaming service of all time. But it has come at a massive cost.

Iger has basically apologized to theater owners with this three-year release schedule. It’s his way of confirming Disney’s commitment to the theatrical movie-going experience.

Photo: DIsney+

You should expect to hear more about both of these decisions during Disney’s earnings call next Wednesday.

Today’s announcements represent Iger’s getting ahead of the news cycle and already snagging some wins before the proxy fight on March 10th.

Iger’s a brilliant and calculated CEO. However, if he does license Disney content, he’s following the lead of David Zaslav, and that’s…questionable.

Photo: MickeyBlog