What We Learned about Disney Last Week

The Walt Disney Company just held its quarterly earnings report call.

As usual, CEO Bob Chapek and his team answered questions about Disney’s present and future.

Photo: Disney

Here’s what we learned about Disney last week.

About the Parks

We learned a great deal about Disney’s theme park empire during the call.

Photo: Disney

Chapek confirmed that Disneyland and Disneyland Paris won’t return this quarter.

Neither of these announcements qualifies as a shocker. The soonest that the Paris park will return is early April.

As for Disney’s first park, it remains stagnant. Disneyland Resort cannot reopen unless California’s governor relaxes current rules.

During the downtime, Chapek emphasized that Disneyland has assisted with nearly 100,000 doses of COVID-19 vaccines.

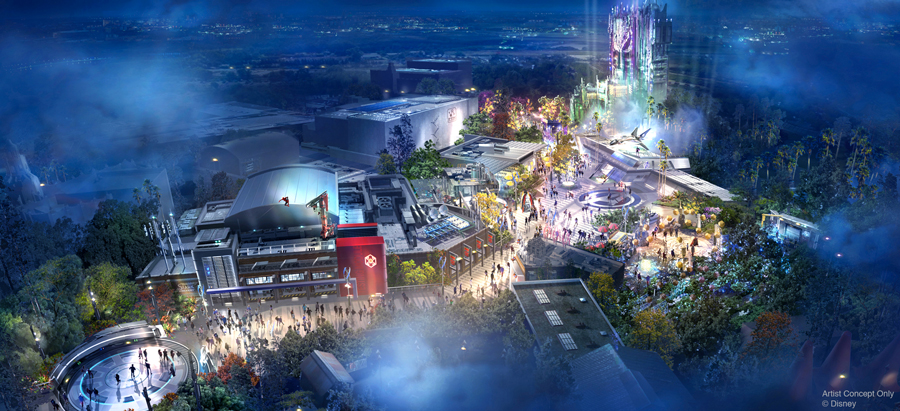

Also, Imagineers remain hard at work on two upcoming projects, Avengers Campus and Mickey & Minnie’s Runaway Railway.

The CEO suggested that Avengers Campus will open in 2021, which should give all of us hope for the second half of the year.

Image Credit: Disney

Remarkably, that’s not the only upbeat park news. Shanghai Disneyland cast members are working hard on an entire Zootopia themed land!

Don’t let the pandemic get you down, everyone! Disney’s ensuring that the parks will dazzle you once they’re fully open again.

Of course, Coronavirus has taken a bite out of Disney’s bottom line. For the most recent quarter, Disney estimates COVID-related losses at $2.6 billion.

That’s not even the worst part. For the past 11 months, Coronavirus has cost the Disney theme park empire $9.5 billion and counting.

During the most recent quarter, only two Disney theme parks operated daily. Those were Shanghai Disneyland and Walt Disney World.

Everything else either closed partially or entirely during the final months of 2020. Similarly, Disney’s cruise business remains offline.

More about the Parks

Chapek revealed some exciting information about Walt Disney World. During the holiday season, attendance increased substantially from the prior quarter.

Disney survey data suggests significant untapped demand for theme park visits.

That’s a businessperson’s way of saying that guests cannot wait to go back to Disney. Many consumers are waiting for the pandemic to end before going.

Photo: CNBC

However, for Chapek, the most exciting news stemmed from the profitability of the parks. He bragged:

“At the same time, our operations team found innovative ways to responsibly increase capacity, while still maintaining rigorous COVID protocols. Per caps were also up double-digits year-over-year.”

What’s he saying here? Disney has unearthed new methods to maximize revenue while reducing expenses during the pandemic.

Photo: Disney

The CEO believes that this trend will continue after Coronavirus subsides. At this time, Disney parks will become more profitable than ever.

Another park tidbit involves Hong Kong Disneyland, which recently closed again after a previous reopening.

Chapek indicates that this park will return soon. In fact, some scuttlebutt suggests that Hong Kong Disneyland could return this month!

The only problematic piece of park news is understandable. Capital expenditures at the parks won’t prove as extensive as previously indicated.

Photo: Kin Cheung/AP/Shutterstock

In other words, Disney won’t invest as much at the parks this fiscal year. This turn of events has happened despite previous assertions by Chapek.

However, he has a justifiable defense here. When the CEO indicated plans for 2021 capital expenditures, he had no way of knowing the future.

Once Disneyland Paris and Hong Kong Disneyland reopened, everyone expected them to remain that way.

Similarly, Tokyo Disney Resort is running with a maximum park occupancy of 5,000 right now. Those two parks average 90,000 daily guests during normal times.

Disney will spend less since several parks aren’t open.

About Disney+

I remember writing about the impending arrival of Disney+ back in the fall of 2019.

At the time, I performed exhaustive research to learn about reasonable expectations for subscriber numbers.

Photo: Shuttershock

Some analysts believe the product would struggle to achieve 10 million subscribers during its first year. Ha!

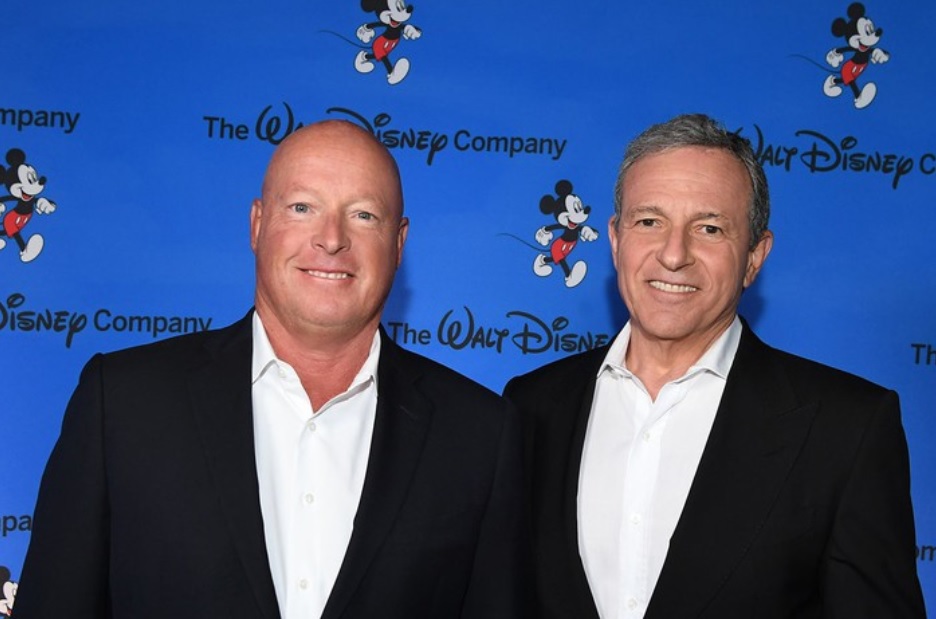

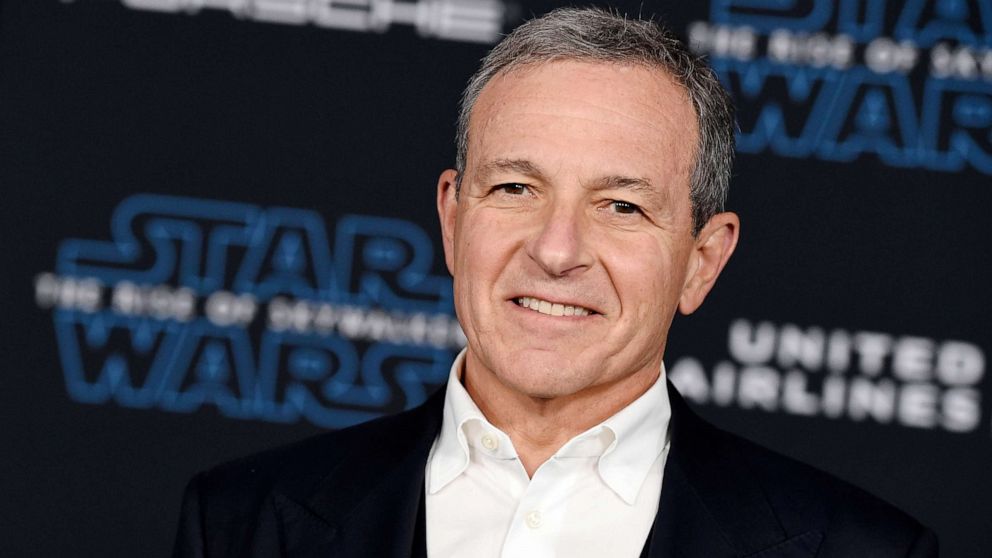

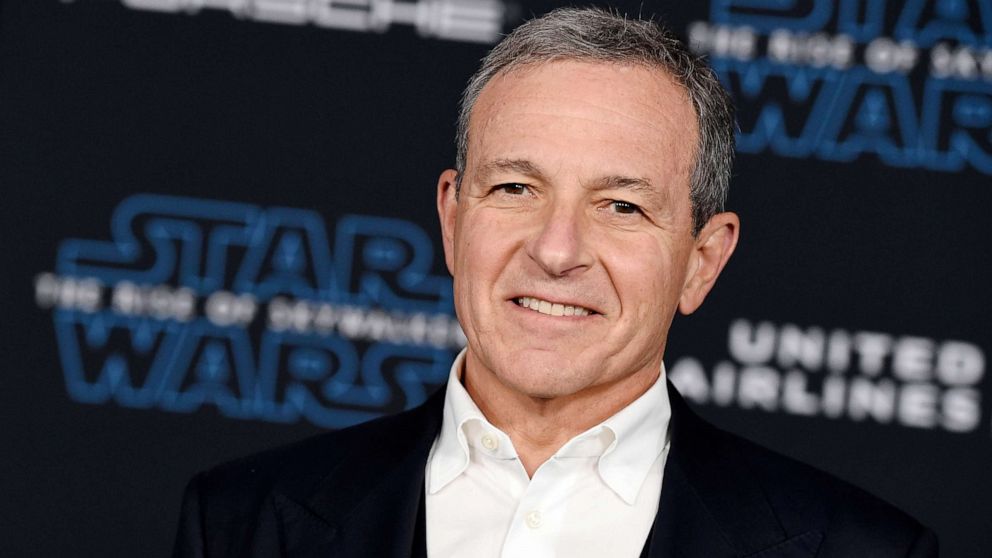

Others scoffed at then-CEO Bob Iger for his projection that Disney+ would reach 60 million subscribers by 2024.

Photo Credit: ABCNews.go.com

Iger even suggested that 90 million wasn’t outside the range of possibilities. I think only he believed in that potential for the service.

Well, the most recent fiscal quarter ended during the 14th month of Disney+ service. Amazingly, 94.9 million people already subscribe.

Disney hasn’t provided data on how many Americans use the service, but I suspect the number is somewhere in the 50 million range.

For perspective, Netflix recently listed just under 74 million subscribers in the US for its 13-year-old service.

Objects in the rearview mirror are closer than they appear.

About Disney’s Other Streaming Services

The news wasn’t entirely glowing, though. Many of Disney’s subscribers come from India for reasons I’ll explain in a bit.

Disney sells packages there at loss leader rates to build the brand in a highly populated region.

So, ARPU dropped precipitously during the quarter. As a reminder, ARPU is effectively what Disney earns per subscriber.

In the past, the number has hovered around $5.30. For the most recent quarter, ARPU dropped to $4.03.

Disney quickly added that the ARPU in America remains at $5.37. However, that’s Disney trying to have its cake and eat it, too.

If Disney wants to brag about subscriber numbers, it must take the good with the bad…and an ARPU of $4.03 is really bad.

For comparison, Netflix hovers at or near $11 these days. And that company just announced a price increase at the end of 2020 to maximize profit.

Disney+ will increase by a dollar in March, which means even $5 APRU seems challenging right now.

What’s the difference between $4 and $11 in ARPU? At the current subscriber numbers, it’s about $8 billion per quarter!

That’s an entirely new theme park a quarter Disney could finance with better ARPU for its primary streaming service.

Image Credit: Disney

However, Hulu+ and ESPN+ make up for the differences. As I mentioned in MickeyBlog News, the two services claim 51.5 million subscribers.

Yes, Disney’s streaming services have already surpassed 146 million in less than two years!

Image Credit: ESPN

For now, ESPN and especially Hulu are the breadwinners over Disney+, though.

This quirk should continue for at least another 18 months. While some analysts project 2026 as a target date for Disney to overtake Netflix, their math is off.

Disney’s three-headed streaming monster can and likely will pass Netflix in 2021, 2022 at the latest.

Meanwhile, Disney+ alone should pass Netflix in American subscribers by 2023. Chapek and his team have somehow microwaved the timeline.

About Other Disney Businesses

I won’t bore you with the details, but the pandemic has wreaked havoc with ESPN programming.

Seasons have started and ended at seemingly random times, with many high-profile games canceled on short notice.

As such, ESPN’s advertising revenue faced unprecedented constraints. CFO Christine McCarthy commented on the quirks that worked against ESPN.

Several games didn’t fall into the fiscal quarter this year, while previously negotiated licensing rights issues did. So, that hurt the company a bit.

Image Credit: ESPN

As mentioned, ESPN+ has evolved into such a success story that these oddities are easier to tolerate, though.

Perhaps the most impactful sport isn’t one on ESPN…and probably not even one whose rules you understand.

The IPL, India’s professional cricket league, will increase Hotstar revenue in 2021 due to having two seasons in a calendar year.

Hotstar accounts for 28.5 million out of the current 94.9 million Disney+ subscribers. Disney blurs them together for arcane reasons.

Photo: TechRadar

One IPL season recently ended, causing analysts to worry about a drop in Disney+ subscriptions. However, another one will start in the spring.

Disney also points out that many Hotstar subscribers choose the annual package, which isn’t substantially more than the monthly rate.

(AP Photo/Richard Drew, File)

Yes, cricket affects Disney’s bottom line enough that it’s a hot-button topic during earnings calls!

Feature Image Rights: (AP Photo/Richard Drew, File)