What Have We Learned About Disney on Its Worst Day in 2024

The Walt Disney Company closed Tuesday, May 7th, with its worst single-day drop in its stock price in more than a year.

On a seemingly unrelated note, Disney announced its quarterly earnings for the early portion of 2024.

Photo: Washington Post

To say that this report has been overly scrutinized would be an understatement.

Critics have come out of the woodwork to assail Disney for all perceived wrongdoings.

Photo: skillastics.com

Meanwhile, Disney has been unusually forthcoming about what it considers an excellent quarter.

Nobody’s right or wrong here per se, but if you own lots of Disney stock, it’s not the best day.

Conversely, if you don’t, now might be a time to consider buying, as Disney executives believe the company is doing great.

Here’s what we have learned about Disney during its worst day in 2024 (to date).

Streaming vs. Linear – The Chicken and the Egg

A few months ago, I noted that Disney was transparently announcing plans to perform a parlor trick.

Disney knew that Wall Street obsessed on the strength of the Direct-to-Consumer (DtC) business.

As a rule, many Disney releases are multi-platform by nature, by which I mean they air on the Disney Channel and then Disney+.

In a properly vertically integrated company, the business pays once and then earns exponents of revenue from the same product.

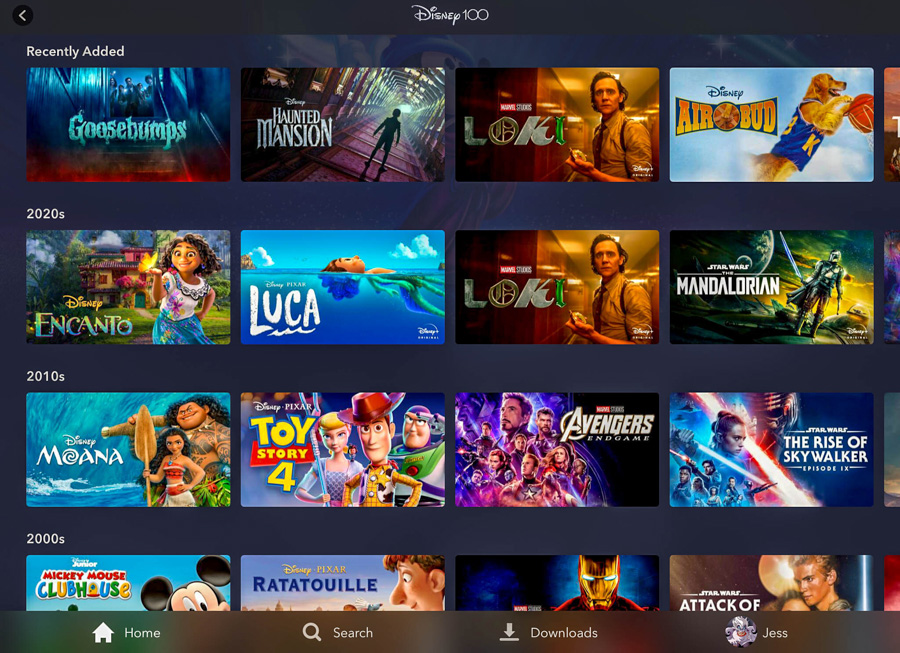

Photo: Disney+

For example, Descendants: The Rise of Red will debut on July 12th, and it will probably perform extraordinarily well.

So, Disney will benefit from the carriage fees and advertising revenue models on Disney Channel.

Photo: Hulu

Simultaneously, Disney+ will gain new subscriptions from people who want to watch the film.

That’s the kind of product that does drive first-time subscribers.

Photo: Disney

Disney’s accounting decision is where to slot the production costs. In short, who pays for the film, linear or streaming?

Disney pointedly stated that it’d assign such costs to linear, thereby reducing the expenses of streaming.

That plan allowed the entertainment portion of DtC to turn a profit for the quarter. But it came at a cost.

Disney suffered a modest financial shortfall with its Linear Networks.

Highly regarded Bank of America analyst Jessica Reif Ehrlich had projected $800 million in revenue for Linear Networks.

Instead, the division’s earnings came in a bit short at $752 million.

That $48 million gap isn’t much in the world of high finance.

However, it alarmed investors who worry that Disney’s Linear Networks are in steep decline.

Freeform

As Disney solved one problem, it exacerbated another. Whoops.

A Stagnant Third Quarter?

Photo: CNBC

Sometimes, there’s such a thing as too much honesty.

Your partner doesn’t need to know that your server is too flirty, right? You’ll get yelled at for something you didn’t even do.

Photo: CNBC

The same thought process applies to big business. You can be too honest while providing guidance on upcoming results.

Disney CEO Bob Iger and CFO Hugh Johnston were so upbeat about the company’s financial situation that they said too much.

Photo: CNBC

Specifically, Disney warned investors that an upcoming *sigh* cricket rights deal negatively impact streaming next quarter.

The executives warned investors that the numbers wouldn’t be as good in three months.

Photo: Yahoo News

Similarly, operating income in Disney Experiences, the parks division, will remain flat from the third quarter of 2023.

Iger and others also warned that theme park demand is starting to “normalize,” a polite way of saying that we’ve reached the end of Revenge Travel.

Image: Disney

Due to those comments, Disney has told investors two of its cores won’t gain much during the current quarter.

So, investors sold a stock they believed had run out of short-term growth potential. And I mean, boy howdy! Did they ever sell!

Photo: Disney

In a matter of six hours, the stock gave away all its gains from February 8th forward.

Next time, say less, Disney.

Disney Streaming Isn’t Afraid of Consolidation

Photo: Disney

Are you familiar with the concept of consolidation among streaming services?

Several of the smaller fish in the sea are struggling to survive. Other presumably larger fish are also starving.

Photo: Getty Images/Ringer illustration

Warner Bros. Discovery apparently cannot afford NBA rights, while Paramount finds itself in a legitimate quagmire.

That’s Max and Paramount+ to streaming fans, and it’s not like Comcast’s Peacock service is doing well, either.

Photo:cnet.com

The groupthink in play on Wall Street right now is that two or more of these services will combine into a single product.

An idea being bandied about at Paramount right now is a joint venture with Peacock. Think ParaPeacock+.

Image: The Wall Street Journal

Okay, the name needs workshopping, but you get the idea. Struggling services would consolidate into one streaming app.

During one of today’s Disney discussions, someone asked CFO Hugh Johnston whether consolidation would hurt its streaming services.

Photo: Disney Careers

The CFO provided a shocking insight here. According to Disney’s data, the company fares well in this scenario.

When more budget-conscious consumers downgrade and consolidate subscriptions, Disney’s streaming services are keepers.

Photo: English Jargon

Simply stated, if a person can only choose two or three subscriptions, they generally prefer Netflix, Hulu, and Disney+.

A Sense of Déjà vu

Image rights: CNBC and Illustration by Elham Ataeiazar

I won’t bore you with Wall Street jargon that crypto bros have co-opted, but there’s a lingering concern here.

You can read the specifics about “support zones,” terminology I honestly wish I didn’t know.

Photo: LA Times

The gist is that Disney stock dropped at one point today more than anyone would have thought possible.

In the process, many of us felt a lingering sense of déjà vu, as we remember this happening…and not that long ago.

Photo: CBR.com

On a memorable November day in 2022, an equally miscalculating Bob Chapek presented a Disney earnings report.

Within 24 hours, the stock had dropped 13.2 percent, with Jim Cramer calling for Chapek’s head.

Photo: Variety

In a surprising twist, Cramer got his wish. Less than two weeks later, Chapek was out of a job.

Bob Iger returned as the conquering hero, a turn of events that has led us to today, when…history has repeated itself.

Photo: TheWrap.com

While the stock is 30 percent higher, and everyone’s job appears safe, it’s still bizarre that Disney has had this happen twice in 18 months.

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!