Disney Headlines for May 7th, 2024

The Walt Disney Company has made what appears to be a winning bid to maintain its NBA broadcasting/rights for another decade.

Disney hasn’t finalized the transaction yet, as the NBA is still deciding between two suitors for another slice of the pie.

NBA

Still, all signs point to the NBA remaining on ABC and Disney for the foreseeable future.

In this week’s Disney Headlines, we’ll evaluate what’s happening, whether Disney is doing the right thing, and other potential fallout.

What’s Happening with the NBA?

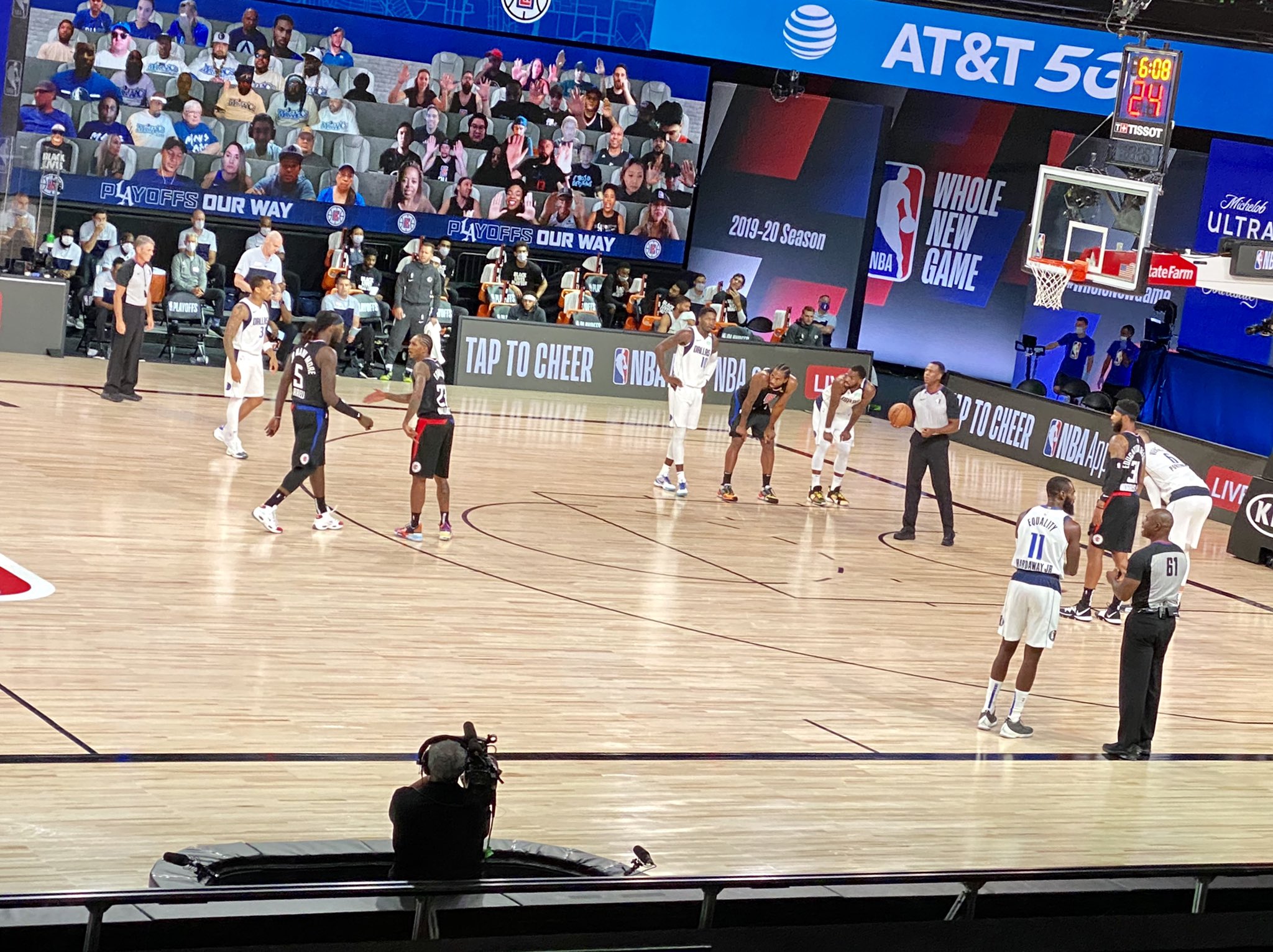

Photo: Disney

In 2014, when I was writing for a media site, I covered this story. A decade ago, Disney signed its current NBA rights deal.

Disney paid a staggering $12.6 billion to broadcast NBA games from the 2015-2016 season until 2024-2025.

Photo: skillastics.com

In total, the NBA boosted its revenue to $24 billion at a rate of $2.6 billion annually.

Here’s a breakdown of what each broadcast partner paid. You’ll note that Disney paid slightly more than Turner Sports.

Photo: NBA

Disney wanted to broadcast the NBA Finals and paid more for the rights.

Since then, streaming has fundamentally altered the way that people consume live sports.

NBA

The NBA aspired to increase its annual licensing revenue by introducing a third partner.

Apparently, the league succeeded in this endeavor, as the prevailing belief is that Amazon will stream games.

Photo: Disney

That move would represent a hallmark change in the industry, as linear television would cede some games to a streaming service.

Disney and Warner Bros. Discovery (WBD), the owner of Turner Sports, accepted this inevitable change during the bidding process.

Photo: Warner Bros. Discovery

Both companies allowed their exclusive renewal windows to expire with the NBA as a business tactic.

The corporations gave the NBA a chance to evaluate interest from other parties, a decision that may have backfired for WBD.

Apparently, the NBA is sizing up competing bids from Peacock/NBCUniversal and WBD.

Peacock has bid $2.5 billion, a total WBD may be unwilling to match.

Photo: Washington Post

If so, Turner Sports will end a 40-year relationship with the NBA.

A lot is riding on this game of musical chairs, and Disney is fortunate to have a seat after this is over.

Is Disney Doing the Right Thing?

NBC News

Recently, Disney has rolled the dice on a couple of sports licensing deals.

CEO Bob Iger has emphatically stated that he considers live sports a way to bridge the generational gap in media consumption.

(Charley Gallay / Getty Images for Disney)

For this reason, Disney has locked up streaming rights for many college sports championships, often extending the deals into the 2030s.

Similarly, Disney passed on the streaming rights to cricket in India, accepting that it was a low-margin business at best.

At worst, Disney’s Hotstar service would have lost money with its cricket rights, which is almost assuredly what happened.

Disney eventually merged its operations in India with a competitor to avoid such bidding wars.

Credit: Disney

Disney also passed on the opportunity to purchase NFL Sunday Ticket rights, ceding that deal to Google.

Overall, Disney has acted conservatively with most sports licensing rights, primarily securing the ones with the highest upside.

Photo: ESPN

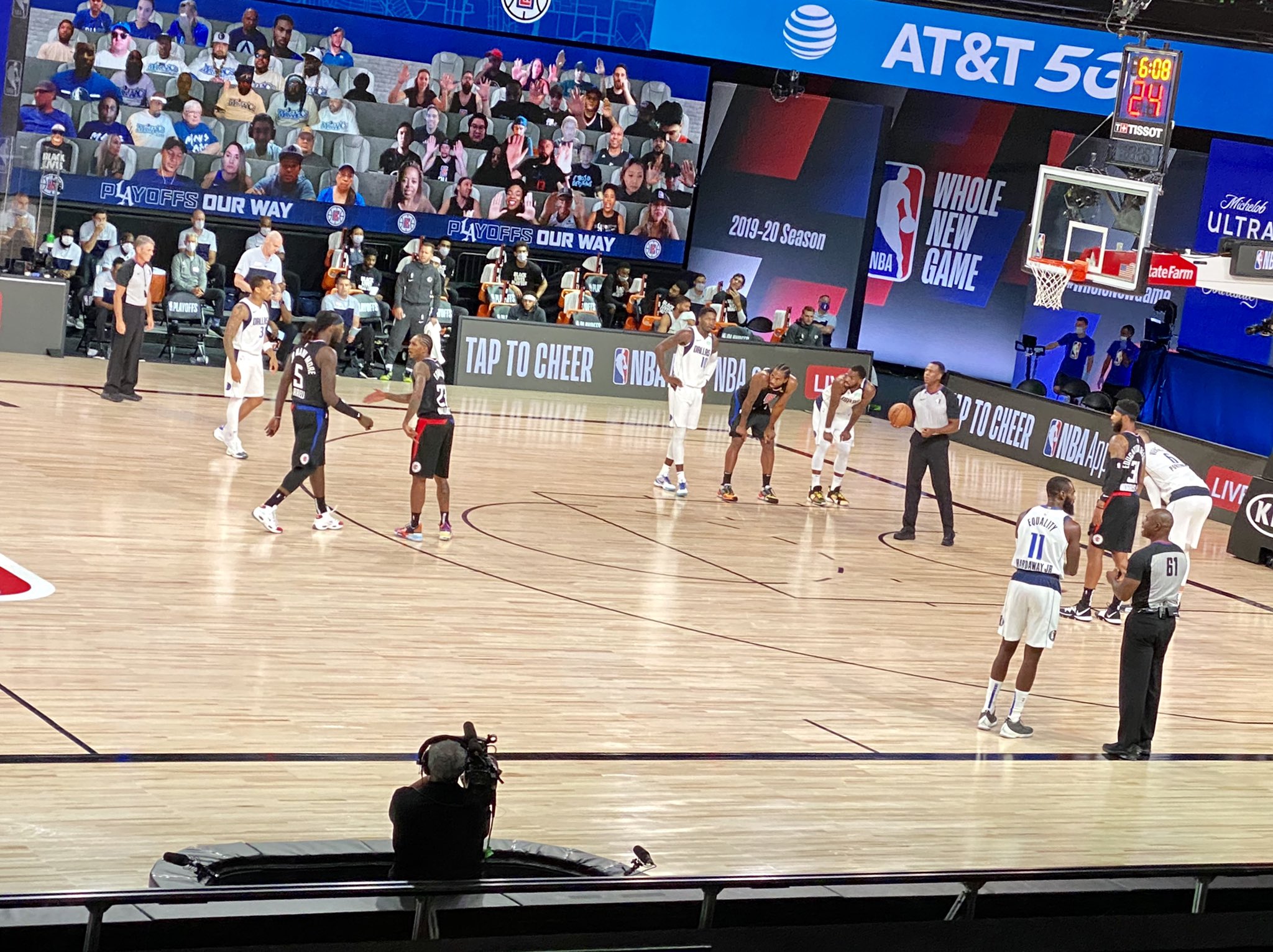

That’s why the NBA deal, as reported, is so intriguing. The NBA will apparently triple (!) its revenue to $7.8 billion annually.

According to Bloomberg, Disney will pay $2.6 billion to keep the rights it already has.

Photo: English Jargon

That’s nearly double the former rate of $1.4 billion annually, yet the rights will largely stay the same.

Disney will gain the right to stream its content, which hasn’t been the case.

Photo: ESPN

For example, if you want to watch the NBA Finals in a few weeks, you must do so via ABC/ESPN rather than ESPN+.

That sort of licensing deal is already archaic just a decade later, and Disney has worked with the NBA to modify it.

Disney

To a larger point, Disney needs this deal to extend the lifespan of its current Linear Networks revenue model.

If Disney lost the NBA, its cable carriage fees would be overpriced.

The Potential Fallout from the NBA Deal

Photo: Chip Somodevilla/Getty Images

Speaking of carriage fees, there’s additional fallout from this negotiation, and two angles impact Disney.

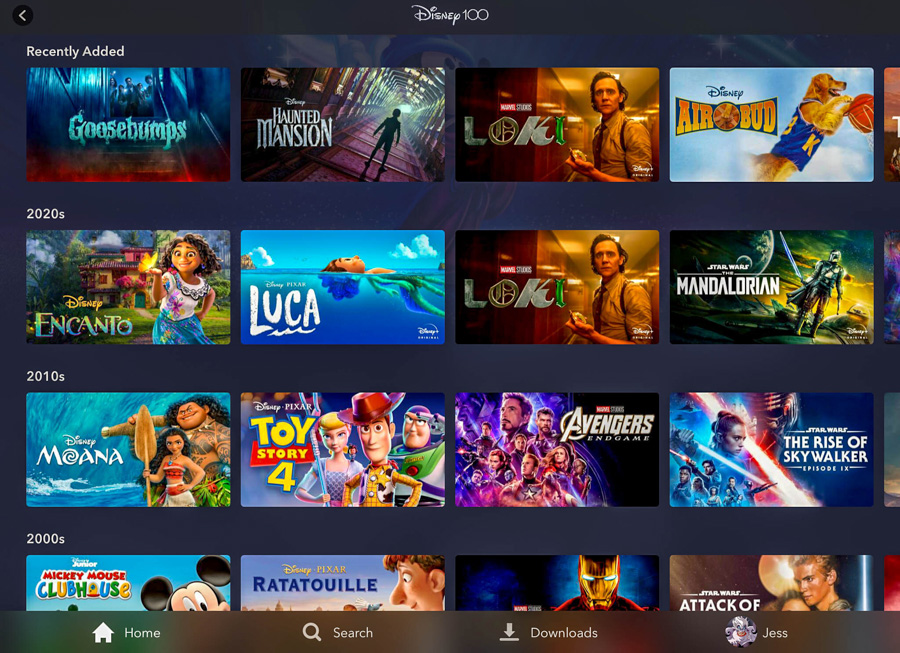

The first is that Fox, WBD, and Disney are currently building a Sports Hulu service together.

Photo: Getty Images/Ringer illustration

I expect we’ll hear more about the sports streaming entity this very week, but WBD’s presence has grown tenuous.

I don’t know how Disney and Fox could cut WBD from the deal. However, without the NBA, WBD isn’t offering much.

Photo: Dunkest

The company would primarily offer some golf, college basketball, and NHL coverage, plus MLB and AEW.

That’s…not a lot. Much of that coverage is seasonal, skewing hard toward March Madness and the playoffs, too.

Photo: People

In short, if WBD loses NBA rights, Turner Sports drops in value, making it less desirable as a part of this Sports Hulu joint venture.

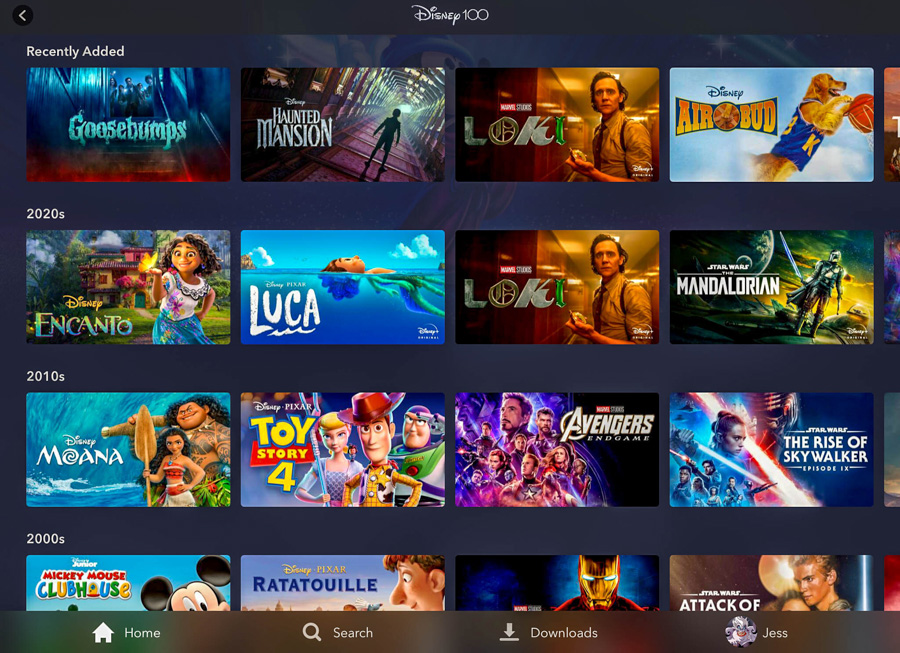

That’s not the only fallout, either. The NBA on TNT broadcast is the gold standard in sports coverage.

Photo: Christian Pestana Rodriguez; Getty Images

Turner Sports has compiled a group of Ernie Johnson Jr., Charles Barkley, Shaquille O’Neal, and Kenny Smith.

Johnson will reportedly stay at Turner Sports no matter what.

Disney will likely have interest in Barkley, who could earn $20 million annually on the open market.

Photo: USA Today

A bidding war would likely ensue with Amazon over Sir Charles and possibly others, while Shaq has hinted he’ll take a break.

Disney recently spent a fortune on Jason Kelce, and Barkley is objectively a bigger star.

So, we’ve got a lot in play here as the NBA rights negotiations wind down.

Disney

Ultimately, as long as nothing changes, Disney has accomplished its primary goal. It has kept the NBA and modernized its streaming rights.

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!