Is Disney Making Enough (2024 Edition)

The Walt Disney Company finds itself at yet another crossroads, as investors once again ask: Is Disney making enough money?

I’m going to explore this topic from multiple angles in the coming weeks, but the short answer is yes. Very much yes.

Please allow me to explain.

The High Cost of Inflation

Photo: Wikimedia

Disney just reported its quarterly earnings, and if you’re a glutton for punishment like me, you can read the whole thing here.

I’ve done the legwork and can save you the headaches, though.

Since this earnings report is arguably the most critical one since 2004, I’ve spent plenty of time researching critical evaluations.

Photo: Bank rate

Something I’ve noticed is that the same critique arises whenever someone expresses displeasure with the stock.

The argument involves Disney revenue, which was flat year-over-year.

In layperson’s terms, Disney earned roughly the same amount of money in the first quarter of 2024 as in 2023.

Photo:Disneycoupon.jpg

Investors haaaaate that because it indicates a lack of growth, especially in an age of significant inflation.

Disney earned $23.549 billion in this quarter as opposed to $23.512 billion last year.

Does that matter? It’s definitely a fair evaluation.

Photo: vecteezy.com

According to the government’s inflation calculator, $23.512 billion a year ago is the same as $24.3 billion today.

So, one could objectively claim that Disney’s revenue is actually down year-over-year once we factor inflation into the mix.

Didn’t the Stock Soar in Value?

Photo: measureupgroup.com

Yes. Yes, it did.

When Disney’s stock closed before the earnings call, it sat at $99.27. The following day, the stock ended at $110.54.

That was Disney’s best closing price in more than a year.

Photo: Disney clip art

At one point, Disney stock nearly reached $112, which approaches a two-year high.

Disney stock has only soared to these heights one other time since the heady days of early 2022.

You’re probably wondering why the stock spiked if revenue was flat if not arguably down year-over-year.

Photo: Shutterstock

The short answer is that everything is trending the right way.

As I’ll discuss in a separate article, I was amused by how casually Iger threw in that every single Disney theme park was profitable.

Of course, we all expected Disney Experiences to do well. It always does.

Photo: Wikimedia

The concerns centered on Direct-to-Consumer, which lost nearly $6 billion in Fiscal 2022 and 2023.

That lodestone has dragged down Disney’s balance sheet, and there’s not enough lipstick in the world to slap on that pig.

To his credit, Iger appears to have stopped the bleeding, even though subscribers fell slightly.

Photo: Center Watch

Disney’s price increases led to 1.3 million in subscriber losses, which was always expected.

Companies refer to this behavior as churn, with the idea that getting the right kind of customers matters the most.

Netflix has mastered this art, and Disney is learning from their competitor’s successes.

Photo: Netflix

So, even though Disney lost customers, its average revenue per core subscriber increased by $1.07 compared to last year.

Also, Disney has a plan to gain new subscribers this quarter.

The company believes the Taylor Swift Factor will lead to at least 5.5 million more subscribers.

Photo: Taylor Swift

So, this $75 million purchase offsets any short-term subscriber losses.

Disney only needs to maintain the new subscribers for 70 days to turn a profit.

Is the Stock Boost Solely Because of Streaming?

Photo: Pexel.com

Absolutely not.

In truth, that’s one of the smaller factors at play here.

Investors care more about the big picture, and that’s much rosier for Disney.

Operating income (OI) improved dramatically this quarter.

OI was up 27 percent to $3.9 billion, with Disney Entertainment specifically increasing by more than $500 million year-over-year.

That’s a sign that Disney’s cost-cutting measures are working.

Photo: Getty Images

Moreover, Disney projects its free cash flow at $8 billion for fiscal 2024.

That’s important for something we’ll discuss in the next section, but let’s stick with the numbers for now.

Disney CEO Bob Iger appeared on CNBC to take a victory lap before the earnings call.

Photo: Chip Somodevilla/Getty Images

Before he said a word, a CNBC reporter announced a staggering Disney financial stat.

The company expects its earnings per share to increase by 20 percent by the end of fiscal 2024.

To avoid the Nelson Peltz fiasco for a third time, the company will buy back $3 billion in stock this year as well.

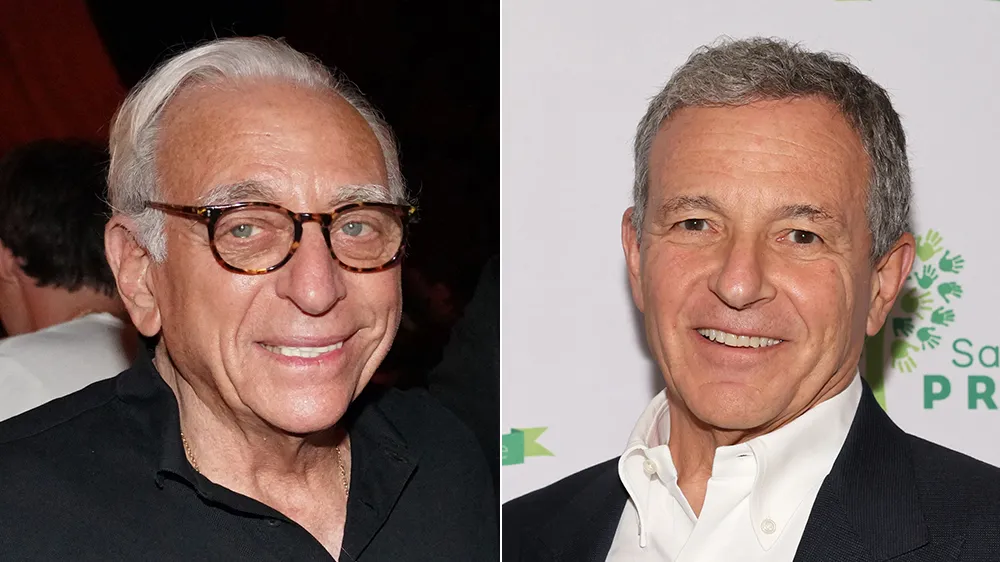

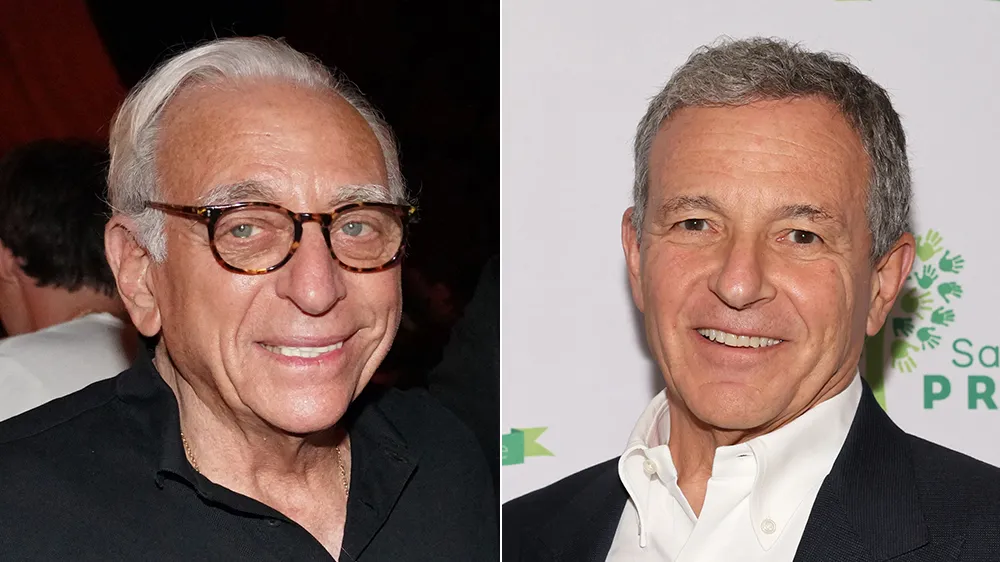

Romain Maurice/Getty Images for Carbone Beach | Dia Dipasupil/Getty Images

Iger and Disney’s Board have deduced that there are too many outstanding shares, which makes them too vulnerable to Peltz’s ilk.

This buyback suggests that Disney definitely isn’t worried about money/liquidity anytime soon. It’s an act of confidence.

Not coincidentally, analysts this week have indicated that they have little expectation of Peltz winning his battle for Board seats.

Photo: restorethemagic.com

That’s how strong Disney’s performance was this quarter.

Disney has dramatically improved its operating income and free cash flow while still earning the same amount of money.

There’s a term for that: smart business.

How Disney Makes Its Money

Photos: istock

I’ll explore this in shocking detail at a later date, but this earnings report underscored how diverse Disney is.

During the fiscal first quarter, $10 billion of Disney’s $23.5 billion – 42 percent – came from the Entertainment division.

Sports earned $4.8 billion or 20 percent, while Experiences grossed $9.1 billion or 38 percent.

So, 80 percent of Disney’s money comes from parks and entertainment, while sports claims the other 20 percent.

That’s a much deeper, more involved conversation than we need to have today, but it’s a quick insight into how Disney makes its money.

Everything feeds off the Entertainment division, which explains why Disney needs films and television series to excel.

Crowds

That’s the hidden part of this earnings report people have barely considered.

Disney performed this well in the aftermath of a nightmarish quarter for its theatrical releases.

The Marvels and Wish experienced virtually their entire theatrical runs during this quarter…and they were both financial failures.

Had the two films performed as Marvel and Disney Animation titles ordinarily do, revenue would have increased by at least $1.5 billion.

For this reason, Disney’s Moana 2 announcement matters greatly to the bottom line.

Disney just revealed what will probably be one of the top five theatrical releases of 2024, and we didn’t even know it existed last week.

Photo: Disney

In the process, Bob Iger secured the fortress for the fiscal first quarter of 2025!

That’s the kind of long-term planning a CEO must possess when running a business like Disney.

Speaking of which…

Future-Proofing the Bottom Line

Photo Credit: Getty Images

I strongly suspect that Bob Iger knows less about video games than anyone in North America.

Still, Iger just pulled off a masterstroke with the Epic Games deal.

I’ve written a full article about this that you can read soon.

Notably, more details have come out since I completed my work.

Remember that $1.5 billion Disney was missing this quarter?

Numbers like that matter to investors because of the opportunity cost they represent.

Photo: EPIC Games

In Disney’s cast, $1.5 billion is how much the company has spent to buy a stake in Epic Games, the makers of Fortnite.

Disney had previously built a relationship with Epic Games CEO Tim Sweeney via Disney Accelerator.

That relationship has paid massive dividends, as Disney just purchased nine percent of Epic Games at that $1.5 billion cost.

Photo: EPIC Games

The Information reports that Disney has given Epic Games a valuation of $22.5 billion.

This total reflects a downgrade from a previous funding round that valued Epic at $31.5 billion.

In the short term, Disney introduces an entirely new monetization stream at a modest cost.

Buying Or Licensing?

Photo: Epic Games

Overall, Disney just put a stake in the ground that it could purchase controlling interest in Epic if so inclined.

While valuations are always tricky – see: Star India – Disney could probably buy all of Epic Games for about $25 billion.

Photo: x @starindia

That’s if we split the difference between its current and previous valuations and allow for the fact that Disney already owns nine percent.

In reality, I think the investment would be slightly under $20 billion or a bit more than double what Disney just paid for one-third of Hulu.

For that price, Disney purchases a gaming empire that conveniently includes the Unreal Engine.

Mandalorian

If you didn’t know, Disney has used the Unreal Engine on several of its films such as The Lion King (2019) and series like The Mandalorian.

So, there are hidden cost savings in this sort of acquisition.

Conversely, Disney has already claimed nine different video game franchises with $1+ billion in revenue.

Photo: Washington Post

In a way, Disney history is repeating itself to a degree.

The debate of major intellectual property owners centers on maximizing profit.

Will a company perform better by licensing its content to others, or should it vertically integrate?

Source: comicbook.com

Disney faced this same conundrum with Netflix, and its opinion has evolved (some would say flip-flopped) over the years.

For now, Iger has simply stated the obvious.

“This marks Disney’s biggest entry ever into the world of games and offers significant opportunities for growth and expansion.”

Photo: skillastics.com

So, Bob Iger isn’t merely concerned about whether Disney is making enough money right now.

Disney’s CEO is future-proofing the company to ensure improved revenue streams in future years.

MickeyBlog Logo

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!

Feature Photo: Disney