I Thought Bob Iger Had Lost His Fastball, But Then He Did This…

Bob Iger returned as CEO of The Walt Disney Company ten months ago.

While we all hailed him as the conquering hero, his second tenure as Disney’s leader…hasn’t gone smoothly.

Honestly, I thought Bob Iger had lost his fastball, but then he turned around pulled off a masterstroke.

Let’s talk about the triumph that restored my confidence in Bob Iger.

The Problem

Photo:Source: Ivan Marc / Shutterstock.com

I’m gonna summarize several stories at once here, some of which MickeyBlog has covered for six years now.

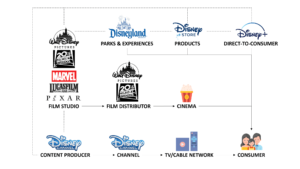

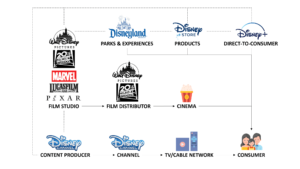

The most pressing one involves Disney’s linear networks. When I say linear networks, what I mean is ABC, ESPN, and a bunch of cable channels.

Photo: fifth person.com

When Disney purchased ABC nearly 30 years ago, it gained ESPN as part of the package. And the word package proves vital here.

Over the quarter-century that followed, Disney developed grudging but positive relationships with companies like Charter Communications and Comcast.

Disney provided content for these cable companies in exchange for carriage fees.

Charter and Comcast agreed to the arrangement because most Disney content, especially the live sports on ESPN, attracted more subscribers.

Photo: Deadline

You can think of the cable carriers as the ice cream truck and Disney as the ice cream suppliers. One needs the other.

Everyone got along swimmingly due to the sheer volume of revenue involved.

Photo: measureupgroup.com

In 2010, Charter stock sold for about $32-$35. During 2021, that stock had risen to $811.

That’s an extreme example of how lucrative the cable company business was for the largest companies, which are the two I’ve mentioned.

Photo: Bank rate

Fast forward to 2023, and you can quickly identify the problem. Charter stock has fallen to $450 and once dropped under $300 for a time.

Charter’s problem mirrors Disney’s problem in that both companies have declined for the same reason.

Photo: Wikimedia

People started cutting the cord more than a decade ago. At first, the decline was gradual.

Since mid-2021, this behavior has accelerated to the point that more people watched streaming than linear networks two months ago.

Photo: English Jargon

That had never happened before the summer of 2023. And that’s a troubling trend for companies that earn a lot of revenue from linear television.

Why Is This Time Different?

Photo:nbjobs.ca

I’m avoiding the hard math here as much as possible, but here’s one telling statistic.

In 2013, Disney’s Linear Networks earned $4.9 billion. Five years later, that total had surged to $6.0 billion.

Photo: Getty

At the end of fiscal 2022, Disney was still grossing $6.3 billion from its Linear Networks…but that number had dropped five percent from fiscal 2021.

We’ve reached the downward slope on this behavior, a trend that hasn’t impacted Disney significantly yet.

Photo: kindpng.com

Charter and Comcast, on the other hand, have watched their customers cancel at alarming rates, particularly over the past year.

Six years ago, 17.3 million Americans subscribed to Charter. In the first quarter of 2022, that number fell under 15 million. It’s at 14.1 million now.

(Pavlo Gonchar/SOPA Images/LightRocket via Getty Images)

Charter hasn’t lost a devastating amount of revenue yet because many of those same customers also subscribe to Charter’s broadband internet service.

Still, when Charter loses hundreds of thousands of customers, it employs a business tactic to make up for the revenue gap. The company raises prices.

Photo: Wikimedia

When Charter (or Comcast) raises prices, more people cancel. It’s a vicious cycle.

Meanwhile, Disney does the same, but its “customers” are Charter and Comcast, each of whom pays Disney set fees for programming.

ESPN famously charges the highest “carriage fee,” which was $9.42 per subscriber earlier this year.

Comcast and Charter currently claim about 30 million cable subscribers.

Photo: skillastics.com

So, ESPN alone nets literally billions of dollars through a sort of passive income.

Disney does nothing but program ESPN. Then, the money flows in. But that presumes something.

Photo: ESPN

Every few years, the companies renegotiate the price of carriage fees.

Disney asked for more money for ESPN. And Comcast said no.

Photo: Yahoo Sports

Remember when you were a child who wanted ice cream, and an adult told you no? It was like that for Disney.

The Solution

Photo: The Walt Disney Company

Ultimately, Charter and Disney came up with an agreement that shocked plenty of observers.

I say this because a staggering percentage of well-respected investment analysts took note of what Charter did.

Photo: the wrap

The cable company threatened to drop all Disney channels from its service entirely.

Charter bluffed that it would give up its most popular linear networks to save money. And the analysts believed them.

Bob Iger didn’t.

Mandatory Credit: Photo by JUSTIN LANE/EPA-EFE/Shutterstock

Ever the consummate dealmaker, Disney’s CEO recognized an opportunity. He also immediately identified a transparent bluff.

So, Iger worked to smooth over the situation with Charter, offering a deal while quietly picking their pocket.

Charter Spectrum

Charter ultimately did the one thing it swore it wouldn’t. It paid Disney a higher carriage fee for ESPN.

Charter believed it had made its point by dropping eight Disney channels from its service.

Photo: Wikimedia

Also, Disney agreed to allow Charter to add Disney+ to one of its cable packages.

Later, when ESPN switches to a streaming service product currently nicknamed Flagship, Charter can offer that as well.

Getty Images/Ringer illustration

In exchange for these concessions, Charter agreed to sign a multi-year agreement with Disney.

You can think of this contract as both parties acknowledging that linear television is dying.

![]()

![]()

However, they’ll both make several billion dollars more before they pivot to the next thing.

From Charter’s perspective, it had drawn a line in the sand and forced Disney to give Charter Spectrum customers a better value.

The Benefits

Photo: DIsney+

I would imagine Bob Iger giggled for the next three days after Disney brokered this deal.

Why do I feel this way? Here’s what happened from Disney’s perspective.

Charter’s bluff would have cost Disney $2.2 billion in revenue.

Photo: Vecteezy

Now, Disney has laid out the road map for an upcoming negotiation with Charter and other cable companies.

Iger showed what Disney is willing to do to keep the cable industry alive for another couple of years.

Photo: Getty Images

That’s only one of the ways Disney earned money from this deal, though.

Charter agreed to pay Disney for Disney+, which provides the streaming service with millions of new customers.

(Charley Gallay / Getty Images for Disney)

Disney never needs to worry about the bills getting paid, either. Charter foots the bill.

Recent reports have suggested that Disney won’t reach its stated subscriber goals for the end of fiscal 2024, which is a little over a year from now.

Photo: Disney

Disney just boosted those subscriber numbers in one fell swoop.

Since Comcast is even larger than Charter, a similar arrangement will more than double the number of new subscribers.

Photo: Disney

Somehow, that’s not all, either. Disney is onboarding these customers — i.e., Charter’s customers – to the basic Disney+ ad-tier.

That’s Disney’s most lucrative service in terms of average revenue per user because of the ads.

Walt Disney Company

Disney sells that advertising as a second revenue method in addition to the monthly subscriber fee.

That’s the secret sauce that has driven Disney’s linear networks for a generation now.

Getty/Disney

Cable companies pay Disney the carriage fees, while advertisers pay Disney to air commercials on its networks.

Charter just blithely agreed to the same deal, thereby throwing extra money in Disney’s bank account.

Disney had 3.3 million ad-based customers before this deal. Charter will provide them with 10 million, thereby tripling the service’s customer base.

Even More Benefits

Photo: Disney

This deal is also forward-thinking for Disney.

I mentioned that Charter gained the future rights to ESPN. It’ll become a full-fledged over-the-top streaming service in 2025.

Photo: ESPN

Yes, ESPN+ already exists, but it’s a hybrid with Disney’s cable channel offering.

A project called Flagship will turn ESPN into a digital entity in two years, according to internal Disney documentation.

Photo:GETTY IMAGES FOR ESPN

Charter acquired the ability to pay Disney for that service, just as it has with Disney+.

That’s good for Charter, whose primary business these days is broadband internet anyway.

Photo: wirefly.com

Eventually, Charter knows that customers will grow wise and consume media via streaming almost exclusively. It’s a good deal for them.

However, Disney makes out like a bandit here. Its primary concern with Flagship as a concept is that it’ll lack customers at the start.

Photo:Rappler

Disney just guaranteed itself ten million of them from Charter! ESPN+ only has 25.2 million subscribers right now.

Flagship will launch more effectively than ESPN+ thanks to this deal with Charter.

That statement is doubly true if Comcast agrees to something similar.

Even More Benefits

Photo: Washington Post

Oh, and Disney even squeezed in some revenue another way.

During the Charter squabble, Disney reminded cable subscribers that they could sign up for Hulu + Live TV instead.

Source: Disney

Immediately afterward, this streaming service, a cable television replacement, experienced a 60 percent boost in new customers.

Disney quickly capitalized again by offering a $49.99 deal for the service.

Photo: DVC

That offer would last for three months, the length of the college football season.

However, the NFL season lasts for four months, and Disney hopes to use that extra month to persuade customers to stay on the service.

Credit: Disney

This seems like a good time to mention that thanks to the magic of advertising revenue, Disney earns more per subscriber for Hulu + Live TV than customers pay for the service.

I’m totally serious. It’s one of my favorite statistics.

Photo: THIERRY CHESNOT/GETTY IMAGES

Hulu + Live TV currently costs $69.99 for the ad-free service. Disney earns $91.80 per customer.

The deal that Bob Iger just accomplished borders on witchcraft.

(Photo by Kimberly White/Getty Images for Vanity Fair)

I don’t know if he learned hypnosis during his retirement or what, but this deal is so comically pro-Disney that I’m in awe of it.

Disney should be grateful that Charter threw a tantrum here.

Photo: MickeyBlog

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!

Photo: Disney CEO Bob Iger (Getty Images)