Evaluating Disney’s Current Mess

This week has proven eventful for The Walt Disney Company.

In the aftermath of a fascinating earnings call, analysts remain uncertain of Disney’s short-term future.

Photo: DIsney+

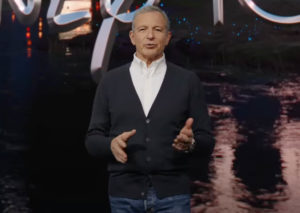

Specifically, five worries bubble to the surface in many Disney discussions. Let’s examine each one and decide how concerned CEO Bob Iger should be.

Disney’s Debt

Photo: skillastics.com

Here’s a problem that has fluctuated in stress level for the past several years.

Initially, during Iger’s first tenure as Disney CEO, he agreed to purchase most Fox media assets for $52.4 billion.

Photo: Disney

Notably, the original agreement was an all-stock deal, which meant Disney wouldn’t add to its debt. Instead, it’d simply swallow the parts of Fox it wanted.

Ultimately, Disney spent $71.3 billion on Fox because a second bidder, Comcast, offered more.

Disney eventually raised its bid to secure the Fox assets.

Photo: Getty

According to Disney’s own release, it acquired $19.2 billion in debt to finalize the transaction.

As Investopedia tracked at the time, Disney gradually increased its debt from $14.8 billion in early 2014 to $53 billion in October 2019.

Photo: Vecteezy

Nobody took serious issue with this, even though many analysts noted that Disney had reached a ten-year high with its leverage ratio.

Compared to other similar companies, Disney’s debt wasn’t problematic at all.

Photo: WHO

Then, something changed. The pandemic created near-historic inflation levels, which the government has attempted to control via interest rate hikes.

So, while Disney’s debt decreased from $52 billion in 2022 to $48.5 billion earlier this year, its financial position is tenuous.

Disney isn’t liquid in the way it would like, especially for the reason we’ll discuss next.

If/when the company needs to acquire more loans, it’ll pay higher interest rates with an A- credit rating.

Refinancing the current debt isn’t feasible right now, either. It’s a problem.

The Hulu Problem

Comcast

Speaking of problems, Disney agreed to something else when it bought the Fox assets.

Disney promised to pay Comcast for the company’s one-third ownership interest in Hulu.

Photo: THIERRY CHESNOT/GETTY IMAGES

At the time, Disney kicked the can down the road on the final payment. Both parties agreed to a settlement in 2024.

This move made sense to Disney because it would have time to pay down its other debts first.

Then, the pandemic happened and wiped out Disney’s financial reserves. You can’t save money when you’re not making money.

Now, Disney must pay Comcast a sum of roughly $10 billion, possibly more. And that payment comes due in a matter of months.

Photo: Washington Post

Given Disney’s current financial struggles, you can imagine how much of a concern this payment is.

That’s why higher loan rates are worrisome. Disney could pay more for the same loan that it would have gotten in 2019.

Issues like this exemplify how companies suddenly find themselves with debt-riddled balance sheets.

Declining Asset Value

Photo: Pexel.com

What’s a quick fix for high debt levels? Well, it’s no different for a company than it is for you.

Let’s say that you have too much credit card debt. You could sell a card or your Pokemon/sports card collection for some quick cash.

Photo:istock

Then, you’d use that money to pay down your debt. Corporations take the same approach with assets.

In fact, Bob Iger recently went on CNBC and openly begged investors to buy some of the company’s assets.

Photo: Chip Somodevilla/Getty Images

The problem is that Iger himself acknowledged that some of Disney’s holdings are distressed assets, ones the company wants to ditch quickly.

Iger feels this way because he views these ventures as “no-growth businesses,” meaning they’ve already peaked and are now in the downward spiral.

Photo: AFP

Circling back to the car analogy, it’d be like you making a social media post that you want to sell your car because the brakes are failing and the engine is sputtering.

Who would want to buy a car in that shape? Similarly, who would want to buy Disney’s linear television assets, knowing that cord-cutting has accelerated?

Photo:nbjobs.ca

In an extreme example, Disney has one asset that some calculations would value at $12-$18 billion.

I read a report yesterday that suggested its actual value has slipped under $1 billion.

Photo: Cars.com

If you think your car is worth $12,000-$18,000, and the best bid you get is for $1,000, how would you feel? Exactly.

For what it’s worth, I find that low-end evaluation light years beyond pessimistic, but stranger things have happened lately.

Still, somebody will want all these assets. They still have value.

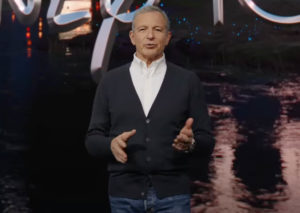

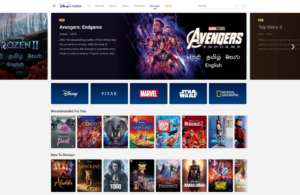

Disney’s Lack of Streaming Scale

Photo: TechCrunch

Here’s one that has popped up a lot lately.

When some analysts discuss Disney’s position in the streaming marketplace, they point out its shortcomings.

Photo:cnet.com

Specifically, a few critics suggest that Disney cannot compete with larger services, which is bizarre to me.

I say this because Disney is currently in a tight race with Netflix to claim the most subscribers in the world.

Photo: Netflix

To be fair, Netflix accomplishes this feat with only one product, while Disney offers three. The Disney Bundle consists of Disney+, Hulu, and ESPN+.

That’s not the intent for the comparison, though.

Instead, some hold the belief that one of Apple, Amazon, or Google will eventually throw money at the problem.

Image: The Wall Street Journal

When that happens, a smaller service like Disney cannot hope to compete in a bidding war. That statement is true.

In fact, we’ve witnessed this scenario play out twice recently. The first time involved IPL cricket streaming rights in India.

Photo: NFL

More recently, Google snagged NFL Sunday Ticket for its YouTube TV service.

Disney would have loved to win that bidding war, but it couldn’t match the deep pockets of Google.

So, while I think this worry is overstated, I understand the basis for it.

Sustained Succession Woes

Photo: Getty Images

I won’t relitigate this one, but let’s be honest here.

Many of Iger’s current problems stem from one core truth. His chickens have come home to roost.

Photo: Getty

Iger refused to groom a worthy successor during his final decade at Disney. In fact, he specifically stabbed one, Thomas O. Staggs, in the back.

Later, Iger’s presumed first choice for his successor, Kevin Mayer, failed to earn the favor of the board.

Photo: Disney

As a reminder, that’s a group of people Iger brought on board. He couldn’t (or wouldn’t?) persuade them to promote Mayer.

Instead, Disney went with Bob Chapek and, well, you know.

When Disney brought back Iger, he promised he would only remain for two years, prioritizing succession.

Photo: Wikipedia

Now, Iger has extended his contract through 2026. So, this wound will continue to fester at Disney for multiple years.

None of what we’re discussing here is particularly problematic in a vacuum. In totality, Disney’s position does appear precarious.

Photo: MickeyBlog

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!

Feature Photo: Scott Mlyn | CNBC