Everything We Just Learned About the Future of Disney

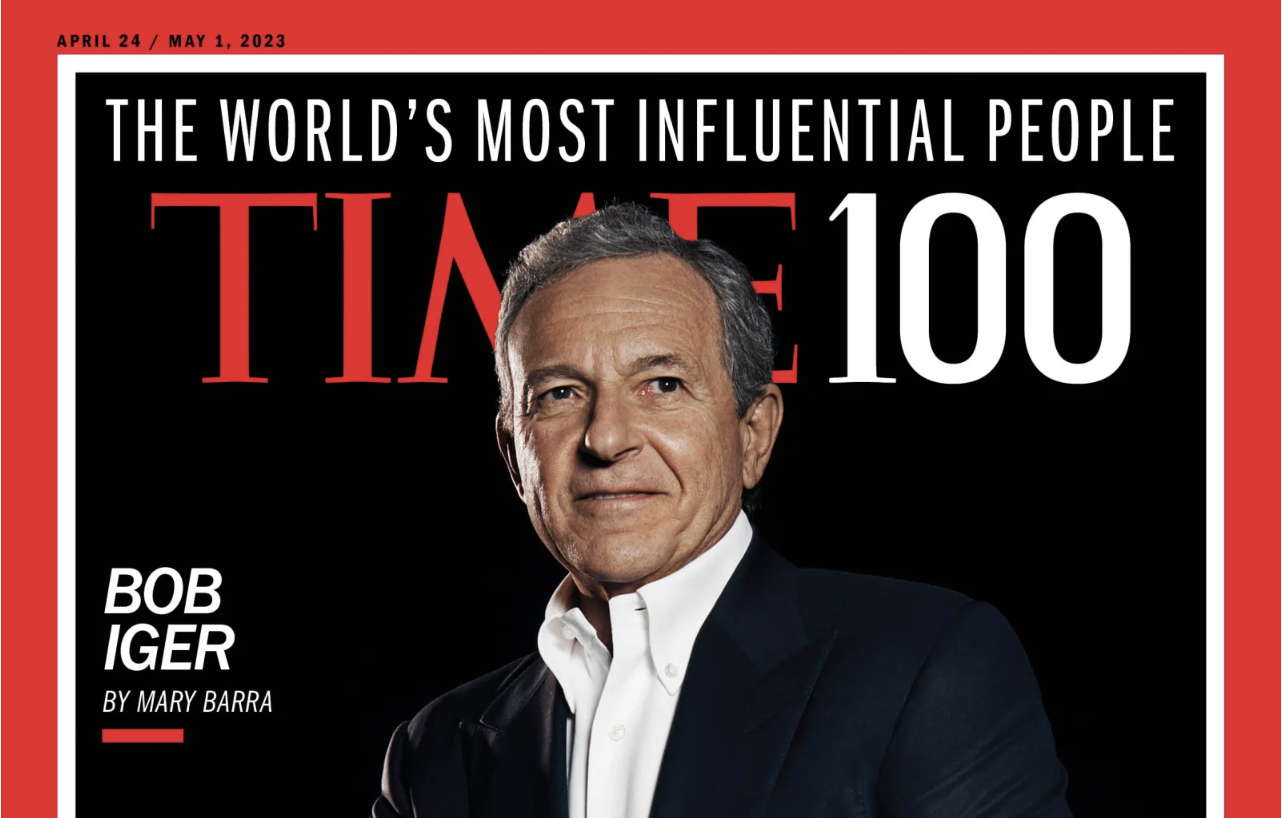

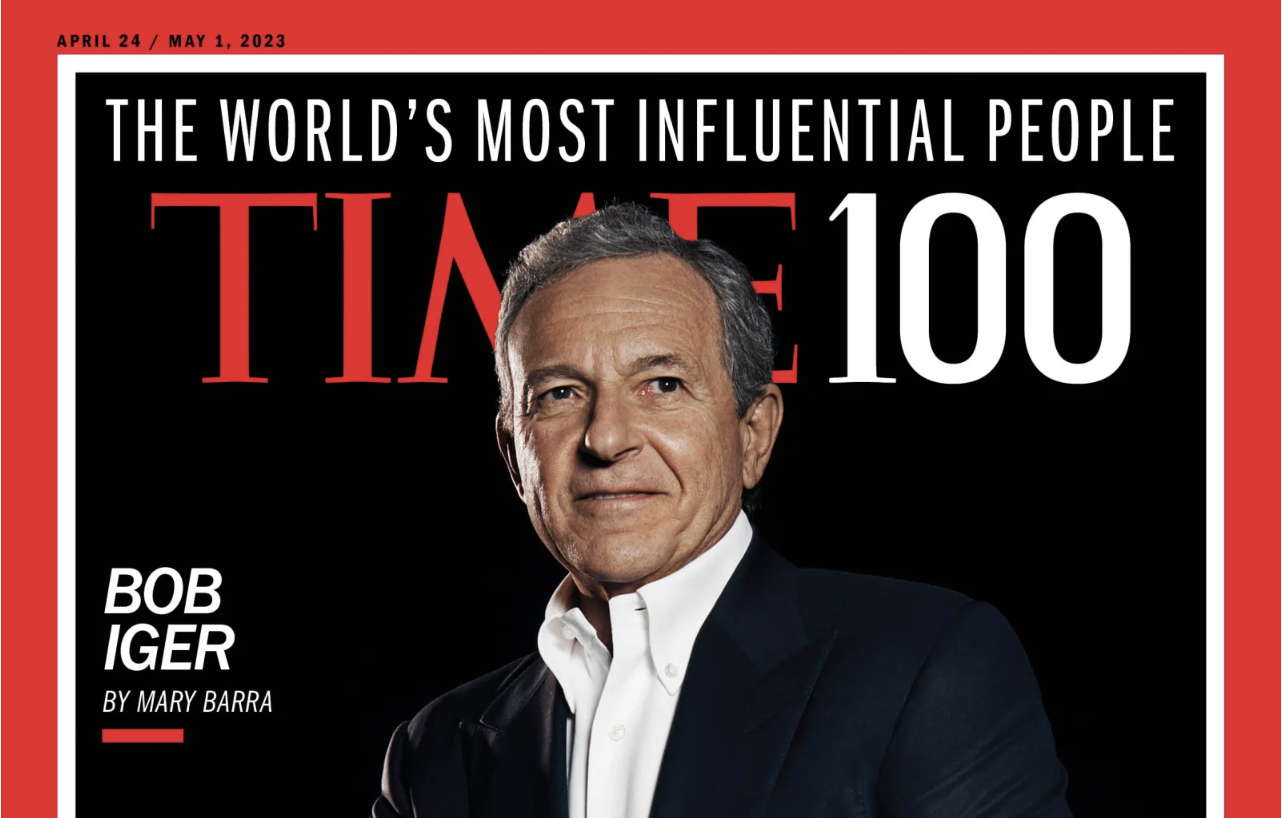

An embattled Bob Iger joined a conference call on August 9th to discuss the future of The Walt Disney Company.

When Iger returned as Disney CEO last November, fans envisioned a conquering hero who would immediately undo Bob Chapek’s mistakes.

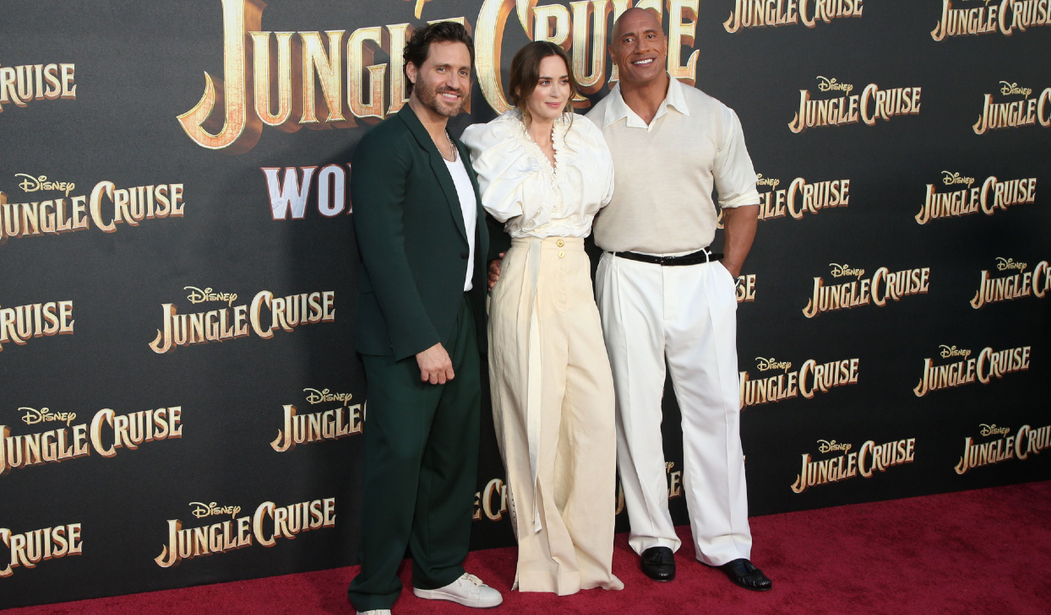

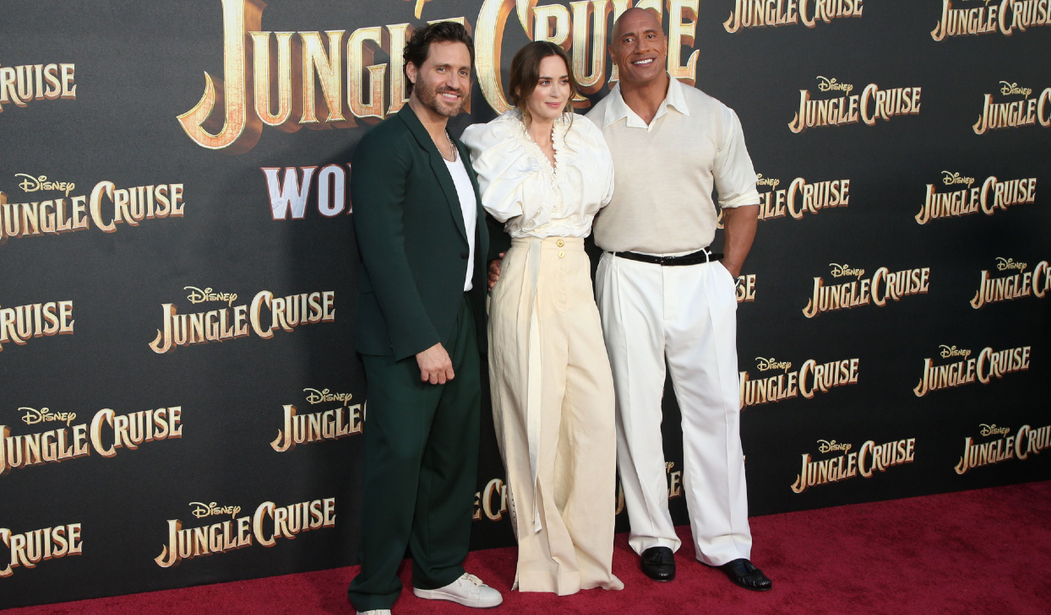

Photo: Marc Piasecki/Getty Images

Sadly, life is messier than that. I mean, it’s not like Chapek set out to fail, either.

Sometimes, fate works against you, something Iger is finding out now.

The Walt Disney Company

The beleaguered CEO and his acting CFO, Kevin Lansberry, spent the body of the call assuring investors that Disney is in good shape.

For c-suite executives like Iger and Lansberry, such guarantees are part of their job. But are they telling the truth?

(Mariah Wild, Photographer)

Here’s everything we just learned about the future of Disney.

Iger Thinks He’s Got the Money Part Fixed

Photo: TIME

While I would have strongly encouraged Iger to start with a mea culpa to everyone in the film industry, he went a different way.

As happened last month, Iger pointed his comments toward Wall Street, leading with comments about the recent layoffs.

Iger proudly proclaimed that Disney is “on track to exceed our initial goal of $5.5 billion in savings.”

Image: Disney

How did Disney gain most of that extra income? It performed three rounds of layoffs and cut a lot of its content budget.

Have you listened in disbelief as someone bragged about doing something idiotic and getting away with it? That’s the non-corporate equivalent.

Still, what Wall Street hears is positive reinforcement on buying Disney stock (DIS).

Not coincidentally, the stock’s post-close movement yesterday proved unusual.

DIS closed at $87.49. Once Disney released its financial documents, investors saw that the company had missed its earnings estimate. They either sold or short-sold the stock.

When Iger spoke, his reassurances worked their magic. The price soared in after-hours trading from a low $85.90 (down $1.60) to $91.98 (up $4.49).

Photo: Natacha Rafalski on Instagram

The price rose so quickly that I idly wondered whether some investment group snagged a few hundred million in stock. If so, we’ll probably learn that later.

Afterward, the stock settled back to its range of $89.50 or so and hovered at $90 in early Thursday trading.

Basically, Iger talked up the stock price by $2.50. That’s why he’s so highly regarded.

Photo: Hulu

While discussing his company’s improving balance sheet, Iger bragged about Disney’s streaming.

According to the CEO, “We’ve improved our DTC operating income by roughly $1 billion in just three quarters.”

Image Credit: Disney

In later comments, Iger and his team emphasized that streaming should become profitable by the end of fiscal 2024, which is 15 months from now.

That’s what Wall Street wanted to hear.

Disney’s Core Businesses

Photo: Hollywood Reporter

While I understand why he did it, Iger took an unusual approach during his opening comments.

The CEO defined his company’s three “value creators” over the next five years.

Those businesses are movies, streaming services, and theme parks.

Image: The Walt Disney Company

This statement provided subtle reinforcement that Disney has completely abandoned its pandemic streaming strategy.

I’m referencing the controversial (but brilliant at the time) decision to release titles on Disney+ at a time when customers couldn’t go to theaters.

What we’ve since learned is that businesses like Paramount, Warner Bros. Discover, and Disney struggle with a streaming-exclusive model.

Photo: Paramount

Historically, release windows ensured that companies would earn revenue in multiple phases. First, they’d sell movie tickets.

Then, Disney would manufacture VHS tapes and later DVDs/Blu-Rays, which it sold for hefty profits.

Later, linear television networks would pay Disney to air its movies. Titles would start on premium changes before switching to cable and later network television.

Under the model I’m describing, Disney earned five forms of payment for the same product. You can count if you don’t believe me.

During the pandemic, Disney gained only Disney+ subscribers for its super-expensive films. That business model wasn’t working.

So, Iger has recommitted to the theatrical release window, which we already knew.

For example, a year ago, The Little Mermaid and Elemental would have been on Disney+ by now…and for several weeks.

Neither is available as I type this, although The Little Mermaid arrives in September.

Image: Disney

In other words, Disney tried something in an emergency situation. They’ve since decided the money isn’t there to continue the experiment.

So, you’ll be watching movies in the theater on opening weekend for the foreseeable future. This tactic will still feed streaming services, too.

What about the Parks?

Credit: Disney

Iger spent part of the earnings call explaining in detail what’s happening in the Parks, Experiences and Products division.

Park news has proven exceptional across the board.

In fact, Iger led with a mind-blowing fact about Disney Cruise Line.

Photo: Disney

For the current quarter, the one we’re in right now, DCL lists an occupancy rate of 98 percent.

Folks, DCL has already booked nearly every cabin on every cruise for this entire quarter.

Not coincidentally, Iger reminds investors that Disney is “nearly doubling” its worldwide cruise cabin capacity by the end of fiscal 2026.

Disney’s operating income in this segment increased from $356 million at this point last year to $2.186 billion this time.

That’s also nearly identical to the segment’s operating income during the last quarter, which was $2.166 billion.

I would have deemed anything over $1.8 billion a wild success. So, that’s a staggering total to me.

I had previously described that second quarter operating income as “astounding,” yet Disney somehow beat it.

How did Disney manage that feat? According to Iger, Disney’s Chinese theme parks have recovered much faster than projected.

Disney singled out Shanghai Disneyland for experiencing record revenue and operating income.

Photo: Disney

Meanwhile, Walt Disney World has surpassed 2019 (i.e., pre-COVID) revenue levels by 21 percent and operating income by 29 percent.

The CEO also suggested that Disney has tracked “positive indicators” for future bookings. So, the Florida Feud isn’t impacting Disney in the least.

Meanwhile, the Parks division is performing so well that Disney accelerated part of its financial hit for Star Wars: Galactic Starcruiser.

Disney took a $100 million charge to remove the former Star Wars Hotel from the books. So, it can also proceed with whatever comes next.

The Galactic Starcruiser project still holds a $150 million charge for the current quarter, though.

Other Disney News and Notes

We’ve got a few other topics of note to discuss.

I won’t bore you with the math here, but Iger sounds confident his streaming services have the revenue problem solved.

Personally, I fall into the “I’ll believe it when I see it” camp, but Iger confirmed strong ad sales for the new ad-based Disney+ tier.

Photo: Hulu

Disney+ will increase prices again on October 12th. The standard service will change from $10.99 to $13.99 per month.

The ad-free Hulu service will increase from $14.99 to $17.99 per month.

Image: Disney (The good ole days of Disney+ pricing)

Meanwhile, the ad tiers will remain the same price. That decision reflects Disney’s desire to add more subscribers to the ad-based versions of streaming.

This business practice circles back to what we discussed with theatrical releases. Disney gets two paychecks this way.

You pay Disney a monthly or annual subscription fee. Meanwhile, advertisers pay Disney to distribute their commercials to you, the viewer.

Photo: Washington Post

In combination with the layoffs and stricter cost control on production budgets, Disney believes it has found the missing ingredients for streaming profitability.

Speaking of “two paychecks” business models, the wheels are finally coming off the Linear Networks revenue machine.

Before the pandemic, Disney’s linear channels like ESPN, Disney Channel, FX, and ABC anchored the entire company.

Due to accelerated cord-cutting, the bloom is off the rose…but it’s still a rose.

Even after all the recent losses, this division’s operating income held firm at $1.889 billion, making it nearly as profitable as the Parks segment.

However, that total reflects a 23 percent drop in operating income in a year. And that’s Disney’s problem.

Credit: ESPN

The previously reliable Linear Networks division is slipping. Think of it as an aging superstar athlete whose MVP days are long behind them.

Disney needs its new core trio of businesses to replace that lost income.

Photo: MickeyBlog

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!