Bob Iger Gets Ready To Face Down Wall Street

On August 9, Disney CEO Bob Iger will once again have to answer to investors as Disney reports its third-quarter earnings.

Fresh off a new contract that will see him retain the helm of the company through late 2026, Iger will likely not face the same kind of internal pressure that his predecessor Bob Chapek was faced with. Nevertheless, investors and observers alike will look to Iger to give answers to some of the biggest questions facing a company which already gone through plenty of changes.

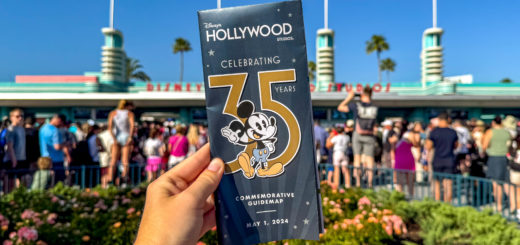

Photo: The Walt Disney Company

Following Iger’s November 2022 return, the CEO announced that the company would be slashing 7,000 jobs in order to save nearly $5.5 billion.

While the decision might have made sense from a business perspective, according to one Disney employee who lost their job, the company’s morale has taken a hit.

Photo: Disney

“When you see the things that got cut and what you imagine the rationale must have been, it seemed ill-thought-through,” they said.

Streaming, Streaming, Streaming

The biggest problem facing Disney and Iger is the profitability of steaming.

Disney’s flagship streaming service Disney+ has been tasked with reaching profitability by next year.

Photo: DIsney+

To that end, Wall Street is looking for Disney+ to announce similar results to last quarter, where subscriptions declined but so did the division’s losses.

According to Insider Intelligence principal analyst Paul Verna, whether or not the company’s timeline for streaming profitability is still on target is “a big question.”

Photo:amplitude.com

“If Disney doesn’t either revise or confirm that target, obviously investors are going to ask more and more heated questions the closer that time gets,” Verna said.

Reaching Profitability

While the ongoing WGA and SAG-AFTRA strikes have given Disney an excuse to stop spending in the short term, not producing new content is obviously not a long-term strategy.

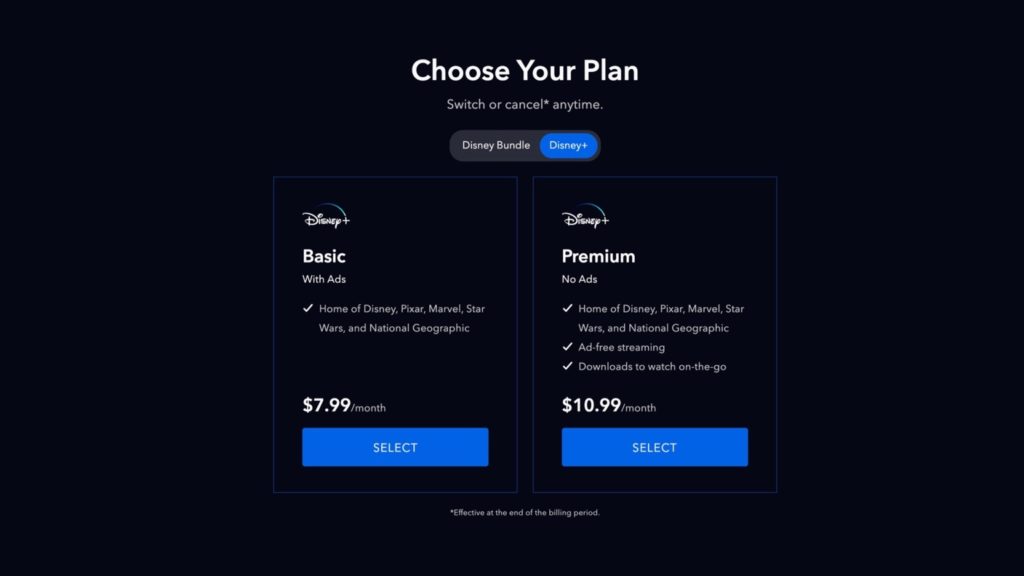

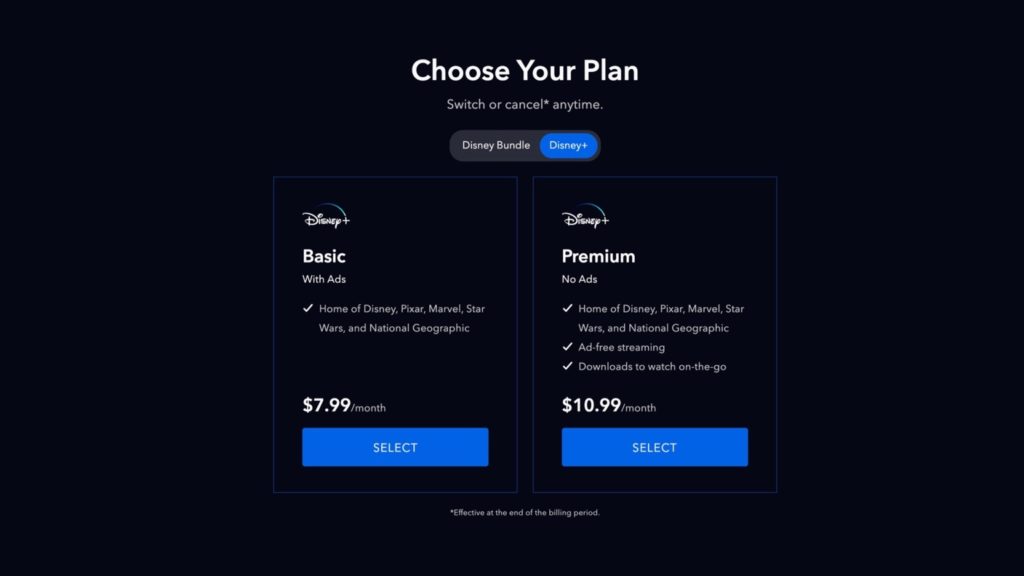

In order to make Disney+ more profitable, Disney could instead raise its subscription prices. Currently, the service’s lowest tier costs less than some of its peers, including Netflix.

Photo: Disney+

The other option would be to incorporate more advertising to bring in more revenue. Both of these paths are likely on the table.

Hulu and ESPN

Meanwhile, Disney is still facing questions about the future of Hulu. Following February’s announcement that Hulu would eventually be integrated into Disney+ to create a “one-app experience”, Iger has been clear that Disney will buy the 33% stake of the streaming service that Comcast currently owns.

Photo: Hulu

How fast a deal can be completed remains to be seen, as does the fair market valuation of Comcast’s Hulu stake.

Last but not least, Iger faces the daunting task of transforming ESPN into a direct-to-consumer business. In order to help transition the network from cable to streaming, Disney is reportedly looking for strategic partners, including possibly professional sports leagues.

Photo: Yahoo Sports

With Kevin Mayer and Tom Staggs back in the fold as advisors, the future of ESPN remains Iger’s biggest headache.

Photo by Chip Somodevilla/Getty Images

One has to wonder if nine months into his return to Disney, Iger doesn’t regret trading his retired life for scrutiny of Wall Street.

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below and one of the agents from MickeyTravels, a Diamond level Authorized Disney Vacation Planner, will be in touch soon! Also, thanks for reading!