Bob Iger Will Decide Disney’s Future Based on These Topics

You shouldn’t envy Bob Iger right now. Sure, the executive has returned to his dream job as CEO of The Walt Disney Company.

Now, Iger must clean up Bob Chapek’s mess, though. And Disney faces plenty of uncertainty in 2023.

Photo: CBR.com

I’m not exaggerating when I say that Iger will decide the future of Disney based on how he addresses these five quandaries.

None of them comes with a clear-cut answer, either.

(Photo by Randy Shropshire/Getty Images for Vox Media)

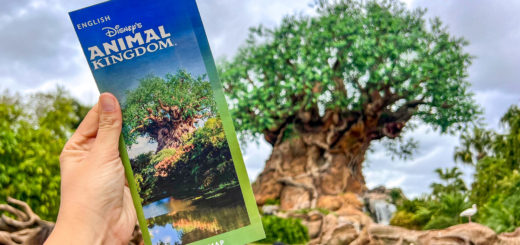

How to Fix Theme Park Pricing and Expansion

Most of these decisions won’t involve the theme parks, at least not directly.

Obviously, Disney possesses a finite amount of money, though. When the company spends on one core business, it cannot use those same resources on another.

Photo:visitorlando.com

Disney theme parks have felt the brunt of this problem throughout the pandemic. Park officials stubbornly refused to announce new projects during that timeframe.

In fact, Disney has confirmed only two new attractions since 2019, and one of those, Tiana’s Bayou Adventure, repurposes Splash Mountain.

Photo: Disney

The other, the King Thanos attraction at Disney California Adventure, won’t arrive for several years.

Disney committed too much to other industries, causing a strange problem at the parks.

Everything from food to admission tickets to Disney Genie+ has increased in price. In fact, Disney Genie+ didn’t even exist until 15 months ago.

Photo: Disney

When guests pay more for products, they expect more, too. Thankfully, Disney has opened multiple E-ticket attractions during this same timeframe.

However, the final projects will open in 2023. Virtually nothing else is in the pipeline.

Iger remains sensitive to the appearance that Disney has raised prices too much recently. So, how will he address this concern?

Will the CEO lower some costs, promise zero increases for a time, or expedite attraction creation? And is it too much to hope that he does all three?

Photo: Vecteezy

How Much Is Too Much Disney+

For the body of two years, Disney officials indicated that they’d spend upwards of $30 billion on content in 2022.

Executives declared a total of $33 billion in November 2021. Nobody batted an eye at this, as Wall Street deemed it the price of doing business at the time for Disney’s 2022 lineup.

Photo: Getty

Well, times change. In the case of Disney+, Wall Street expressed outrage that the company lost so much money on its streaming service in a quarter.

Ultimately, that was the straw that broke Bob Chapek’s back as CEO.

Photo: History.com

Seemingly overnight, Wall Street switched its priorities from gaining subscribers at all costs to controlling costs.

For Bob Iger, that’s a worrisome change in perception. Disney had already pot-committed most of its spending budget for calendar 2023.

Photo:Source: Ivan Marc / Shutterstock.com

The company makes most of those films and television series in either 2022 or early 2023.

Even worse, one of Disney’s strongest revenue streams, linear television, is currently in its death spiral as revenue declines at a shocking rate.

Photo:NYpost.com

So, Wall Street wants Disney to spend less when that request isn’t even possible.

Iger must solve this odd dilemma by weighing potential cost expenditures, the money Disney hasn’t spent yet.

Some streaming service providers have developed a theory that only a small number of titles drive all viewer totals.

In the case of HBO Max, that’d indicate Game of Thrones, The Big Bang Theory, Friends, and so forth.

On Disney+, no single piece of content falls under that heading. The service offers a substantially more diversified portfolio…which may work against it.

Bank of America analyst Jessica Reif Erlich has suggested Iger’s top priority should be the structure of the content division.

As you’re about to see, that’s easier said than done.

Photo:cnet.com

How Should Disney Approach Theatrical?

Some analysts swear that Disney has ruined its theatrical division. Some go so far as to say that it’s a permanent rift.

I always dismiss such criticisms as fundamentally misunderstanding how long permanence is.

Photo: Playbuzz.com

Still, in the short term, Disney has undeniably created some brand confusion.

Several high-profile Pixar titles and other films like the live-action Mulan have skipped straight to Disney+.

Source: Pixar.fandom.com

Coincidentally or not, Disney’s 2022 theatrical animated releases, Lightyear and Strange World, failed at the box office.

Disney still won the box office crown for the seventh consecutive year and beat second place by more than $1 billion. But the point stands.

Photo: DIsney+

Some perceive Disney as losing its grip in theatrical. Fixing that problem comes with significant opportunity costs as well.

Let’s presume that Disney reinforces its theatrical releases in 2023 and beyond. It’ll come at the expense of Disney+.

Photo:cnet.com

Streaming service subscribers won’t have a chance to watch these films until they’ve left theaters, thereby reducing the appeal of Disney+.

We’re already witnessing this with Black Panther: Wakanda Forever, which debuted in theaters on November 11th. It won’t stream on Disney+ until February 1st.

Photo: ESPN

That’s a nearly three-month delay before most Disney fans watch the film. In short, Iger cannot solve both dilemmas, Disney+ and theatrical, as the strategies conflict.

Sell or Buy Hulu+

You may not care about this topic, but it impacts Disney theme park fans a LOT.

Photo: THIERRY CHESNOT/GETTY IMAGES

Disney currently owns two-thirds of Hulu but possesses full operational control. That’s due to a unique agreement with Comcast, the owner of NBCUniversal.

However, Comcast agreed to those terms in anticipation of a resolution in 2024.

At that time, either Disney will buy Comcast’s one-third of Hulu, or Comcast will buy Disney’s two-thirds of Hulu. Yeah, it’s weird.

The parties agreed that one-third of Hulu would be worth approximately $10 billion by then, if not more.

Photo: Walt Disney Company

Comcast has recently hinted that it wants to purchase Hulu rather than sell its interest. Therein lies the rub for Iger.

The CEO either signs a $10+ billion check to a company he hates – look up the specifics of the Sky and Fox acquisitions if you doubt this – or he cedes Hulu.

Photo: Twentieth Century Fox

Selling the streaming service would likely net Disney as much as $25 billion, $20 billion at a minimum. You can build a LOT of rides with $20 billion.

In fact, that much money would go a long way in securing Disney’s finances indefinitely. It would come at the expense of Hulu, though.

Image Credit: Disney

Would you rather have Hulu as part of the Disney Bundle, or would you rather Disney bank a check for $20+ billion?

Those are the options, and neither one is optimal.

Sell or Keep ESPN and ESPN+

Remarkably, Iger faces a similar decision with ESPN. Several respected Wall Street analysts have suggested that Disney divest itself of ESPN and ESPN+.

The thinking here is that Disney has committed massive amounts of money for live sports broadcasts.

Source: Steve Dykes-USA TODAY Sports

Several contracts have at least five more years on them. So, Disney will be paying huge money for sports over the next few years.

That financial outlay would disappear immediately if Disney sold or spun off ESPN and ESPN+.

Photo: Disney

In the former scenario, someone else, most likely a gambling-centric organization, would pay Disney billions of dollars for ESPN.

Yes, Disney would gain another massive capital influx with this strategy. That’s on top of the company’s eliminating the financial expenses of live sports.

Photo: Wikimedia

The new organization would accept those upcoming financial commitments.

Meanwhile, Disney would escape an ancillary but growing concern. Have you watched the channel/streaming service lately? There is a LOT of gambling discussion.

Photo: Pexel.com

When you think Disney, do you think of gambling? Well, ESPN accepts sponsorships from several betting entities.

Those relationships will only grow stronger as app-based and gamified betting grows in popularity.

Photo: The Hollywood Reporter/ILLUSTRATION BY DREW BARDANA

A recent report suggests that online gambling will be a $122.8 billion industry in five years!

As the worldwide leader in sports, ESPN is essential to that growth. For this reason, a split from Disney is growing more likely.

Photo: ESPN+

ESPN stands as one of the crown jewels of Iger’s Disney empire, though. He has lived off that revenue for nearly 20 years. Can he walk away from ESPN now?

I don’t envy Bob Iger in making any of these decisions. He’s gonna get second-guessed into oblivion no matter which way he goes on any of them.

Image Credit: ESPN

Honestly, they’re all coin-flip decisions with pros and cons, too. So, there are a lot of ways this can go wrong for him.

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below and one of the agents from MickeyTravels, a Diamond level Authorized Disney Vacation Planner, will be in touch soon!

Feature Photo: D23