Let’s Hear Disney’s Side of the Story

Stating the obvious, Disney had a strange Tuesday.

At the start of the day on May 7th, The Walt Disney Company released its quarterly earnings report.

Investing.com

Wall Street responded by selling the stock in droves, lowering the price by $11 in a single day.

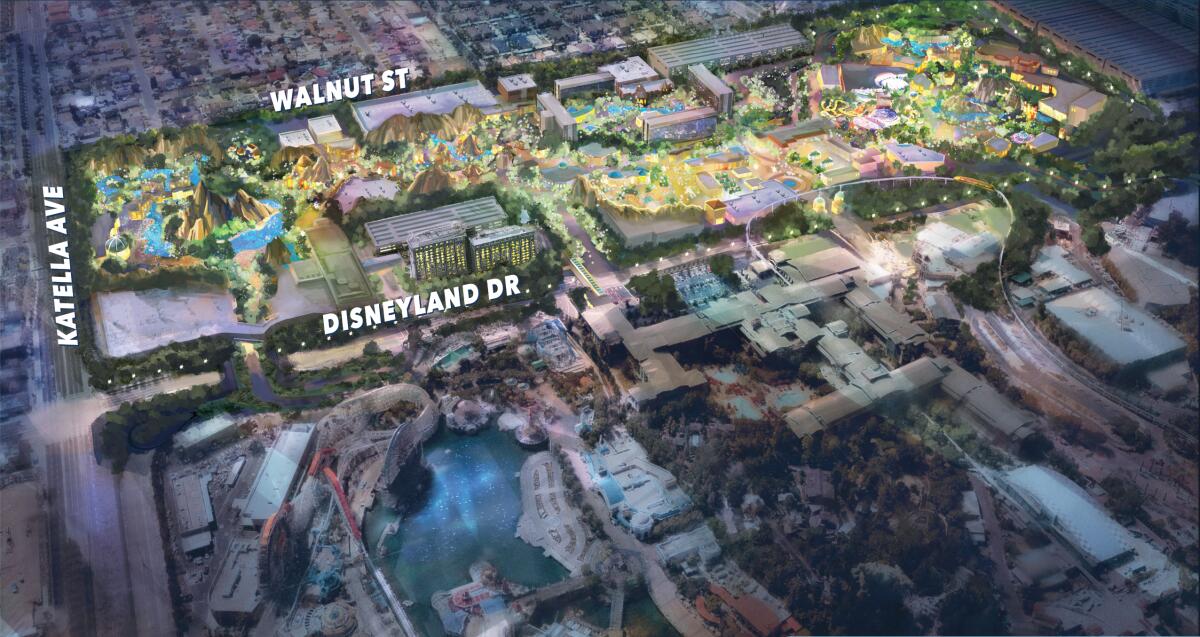

On the evening of May 7th, the Anaheim City Council voted in favor of DisneylandForward.

Photo: Disneylandforward

While nobody will remember this particular day’s stock performance in a year or two, fans will feel DisneylandForward’s impact for decades to come.

But we’ll save the DisneylandForward discussion for a different day.

For the moment, I’m more interested in what just happened on the business side, as that’s what pays for the parks.

We know that Wall Street isn’t happy, but let’s hear Disney’s side of the story about how the company is doing.

Disney’s Numbers Look Good

Photo: Disney

Sometimes, I’ll read a critical evaluation of Disney, and I’ll legitimately laugh out loud. Like, I’ll guffaw.

A recent example occurred after Disney reported that it was increasing its positive projections for the rest of fiscal 2024.

Photo: Shutterstock

Disney expects its earnings per share to increase 25 percent over the next six months.

I swear to you that an analyst argued that Disney had disappointed because projections had called for a 25.3 percent increase.

Photo: Dreamstime

Stuff like this is why I can’t take these people seriously. We’re talking about pennies in difference, folks. Pennies.

More importantly, Disney’s earnings per share have gone up more than 30 percent since last year.

Photo: Disney

In Disney’s Entertainment core, operating income increased by “over 70 percent from prior year.”

Swiftnomics Carry the Day

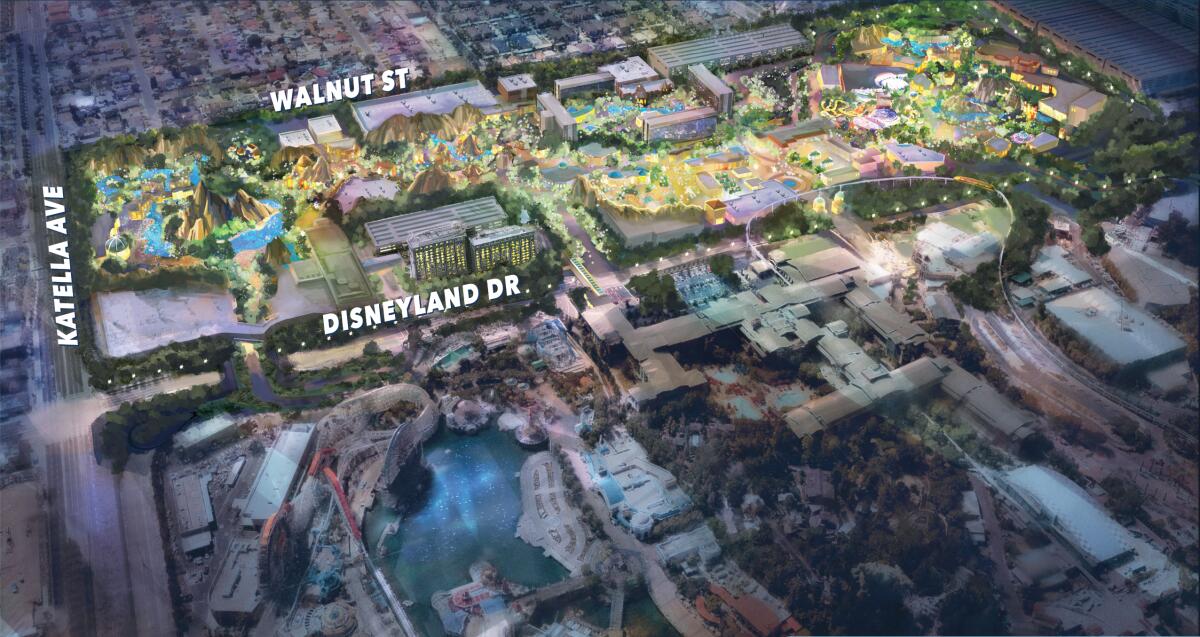

Disney credited most of its success in that segment to improvements in Direct-to-Consumer (DtC), which did enjoy incredible growth.

In fact, Disney notes that “Core Disney+ subscribers increased by 6.3 million in the quarter, reflecting nearly 8 million additions domestically.”

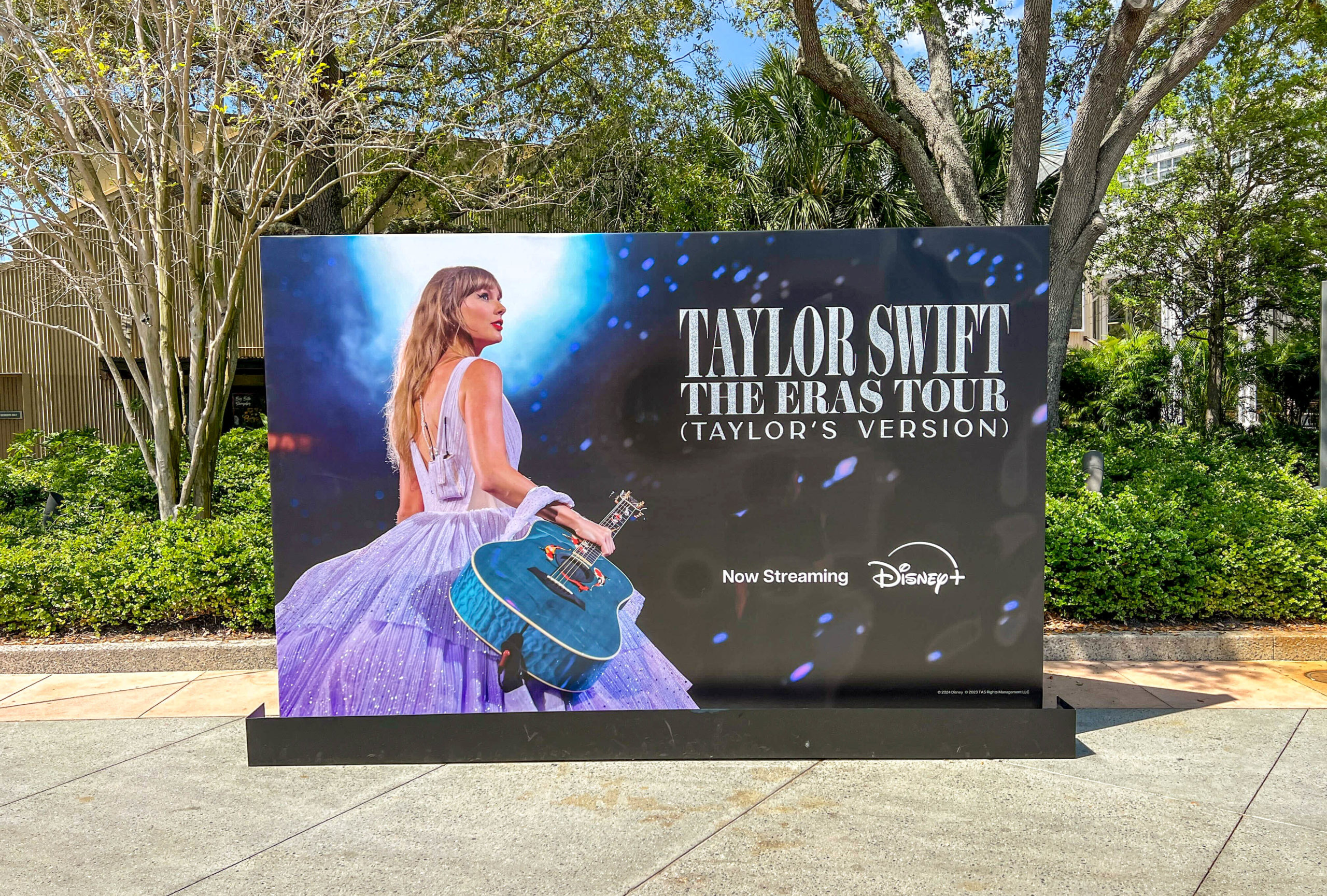

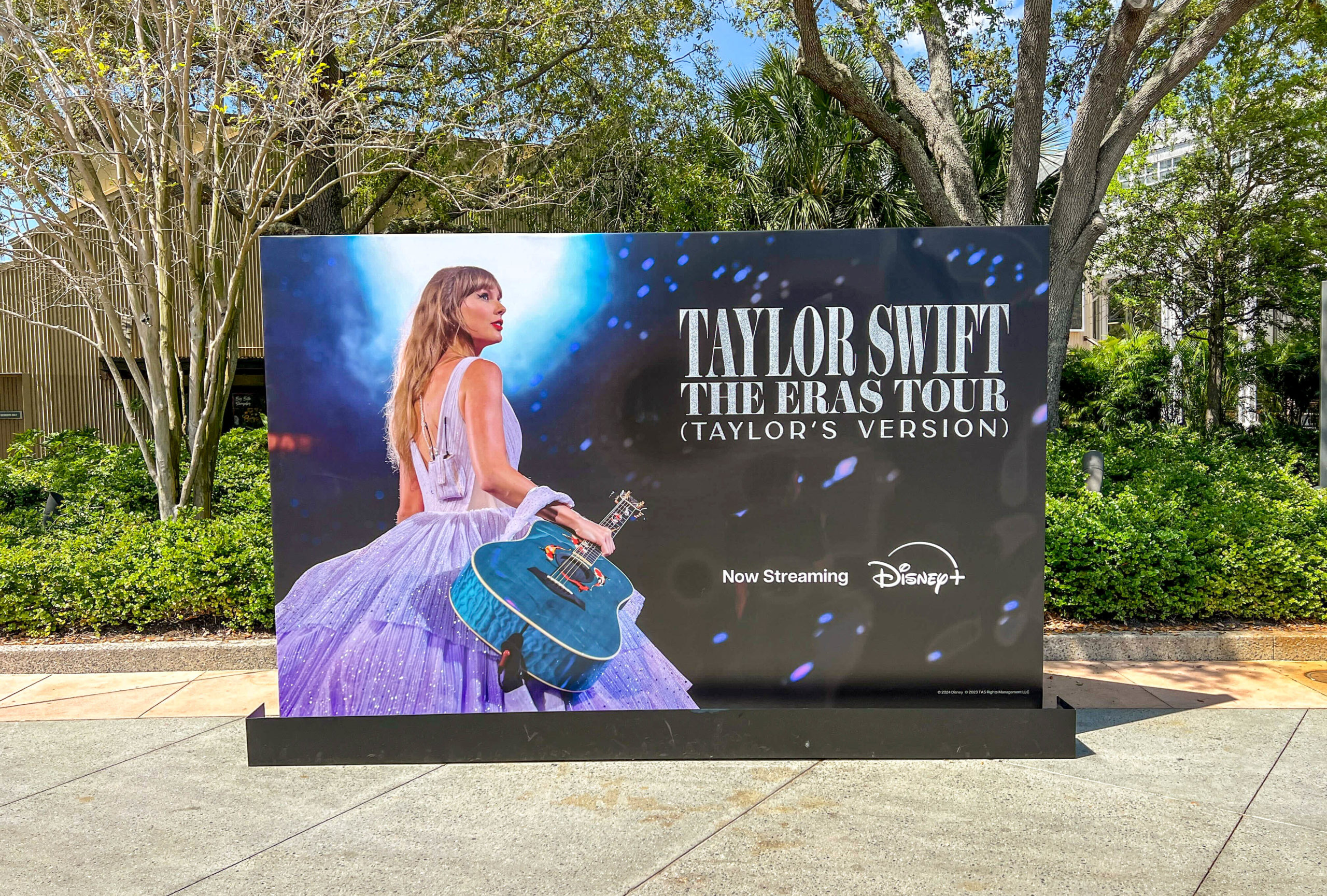

Photo: Taylor Swift

Some people are calling this subscriber surge Swiftnomics due to the presence of Taylor Swift: The Eras Tour on Disney+.

Executives had noticed during the previous earnings call that Swift would help Disney add 5.5-6 million subscribers for the quarter.

Photo: Taylor Swift

That total proved low, which is just…wow. Based on this data, The Eras Tour will probably pay for itself in a matter of weeks, if it hasn’t already.

About Charter and Caitlin Clark

Photo:cnet.com

The Charter deal also helped Disney, as these customers pay less — think of it as a wholesale rate – but are loyal.

Generally, the Charter cable customers who receive Disney+ view the add-on as a free incentive and value it.

Photo: Disney+

So, that’s the other part of Disney’s subscriber increases during the quarter.

The flip side is that the average revenue per user (ARPU) decreased from $8.15 to $8 due to the wholesale customers.

Photo: simplemost.com

Disney will happily make this trade-off in exchange for hedging against churn.

That’s an industry term that signals the percentage of people who cancel a subscription in a given timeframe.

Photo: THIERRY CHESNOT/GETTY IMAGES

You want a low churn number, and something that helps with that is when people feel like you’re getting tremendous value.

Disney+ and Hulu already perform well with purge, but the new Comcast customers definitely won’t cancel.

Taylor Swift

The next trick is to persuade Taylor Swift fans to stay for several months.

The Disney team didn’t mention this during the earnings call, but it also came up with a clever plan for that.

(Photo by Maddie Meyer/Getty Images)

Disney+ will air Caitlin Clark’s WNBA debut, a first for the service.

The audience demographics obviously aren’t one-to-one, but Clark has shown serious star power of her own. It’s a good fit.

(Photo by Matthew Holst/Getty Images)

Oh, and while we’re on the subject, Disney+ will add an ESPN+ tile later this year.

That’s part of a subtle strategy to embed all of Disney’s content in one app.

Photo: ESPN

A few years from now, an entire generation of consumers will know the “Disney channel” as the Disney+ app.

On that service, tiles will show consumers all their favorite Disney+, Hulu, and ESPN+ content.

That day is coming sooner than anybody realizes.

Shogun Is Dominant

As we’ve recently learned due to a Nielsen service correction, Hulu is more dominant than anyone had realized.

During the most recent week of Nielsen charts, Disney+ and Hulu content claimed 70 percent of the top ten.

Photo: IMDB

Still, there’s no disputing what Hulu’s biggest recent hit is. According to Iger, Shogun’s performance is exemplary.

“FX’s ‘Shogun’ has proven to be a global hit with success on both linear and streaming.

Image Credit: Disney

“It’s tracking as FX’s most-watched show ever on our streaming platforms.

“And (‘Shogun’) is driving the second-largest number of sign-ups to our streaming services since 2022, behind only ‘Black Panther: Wakanda Forever.’”

Photo: Hulu

That’s the exact reason why streaming services pay for new content. It’s an attempt to entice new subscribers while lowering churn.

Shogun’s strength is the talk of the industry to the point where even though the limited series has technically ended, people are wondering about potential spin-offs.

Photo: Newsweek

Also, while we’re on the subject of multi-platform hits, Disney’s recently evolved strategy is already paying dividends.

“In Q2, series that aired on linear networks accounted for 17 of the top 20 most-viewed series on our streaming platforms, with almost 3 billion hours of consumption.”

Photographer: Pavlo Gonchar/SOPA Images/LightRocket/Getty Images

That’s Disney’s way of bridging the gap between the Linear Networks and streaming eras of media consumption.

Disney has started taking a combining programming approach, and the modified tactics are paying dividends.

The Parks Remain Strong

Ultimately, what you and I care about the most are the parks. On this front, Disney is still performing amazingly well.

The Experiences division increased 13 percent in operating income from the same quarter a year ago.

Rise of the Resistance

Disney added the following context:

“Strong international Parks growth was driven by Hong Kong Disneyland Resort, while Walt Disney World and the Cruise business both contributed to domestic growth.

Photo: Richard Harbaugh/Disneyland Resort

“At Disneyland, despite growing attendance and per-capita spend, results declined year-over-year due to cost inflation, including from higher labor expenses.”

So, every park but Disneyland Resort performed admirably, as did Disney Cruise Line.

Photo: Disney

The only park that didn’t increase was Disneyland Resort, and while Iger didn’t explain why, there’s a good reason.

In January 2023, the Disney centennial celebration began, with Disneyland as its home base.

Photo: Disney

So, it’s a more challenging comparison year-over-year than the other Disney parks.

Disney’s CFO, Hugh Johnston, added: “Regarding the investment in the Parks, you know the financials of that business well.

Credit: Disney

“It’s a 25-plus margin business and has been for an extended period of time.

“It has terrifically high guest satisfaction scores, which create layers of advantage…

Photo: Disney

“We should be able to sustain high margins and high returns on investment. With a business with that profile, you invest in it.

“We know there are lots of opportunities to continue to grow attendance, both domestically and internationally.

Credit: Disney

“And the Cruise business, frankly, is one that has an enormous number of opportunities for us over time, and that is why we’re leaning more heavily into that business.”

Folks, that’s Disney’s leadership emphasizing that it has committed to massive theme park expansion.

The Walt Disney Company

I sure wish that Disney would start announcing some stuff, though…

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!