Is Disney History Repeating Itself?

Is Disney repeating itself in 2024?

A recent Wall Street Journal article has tried to make that argument.

According to the publication, Disney CEO Bob Iger’s return has mirrored the last days of Michael Eisner.

What are the similarities, and is the comparison valid? Let’s evaluate whether Disney history is repeating itself.

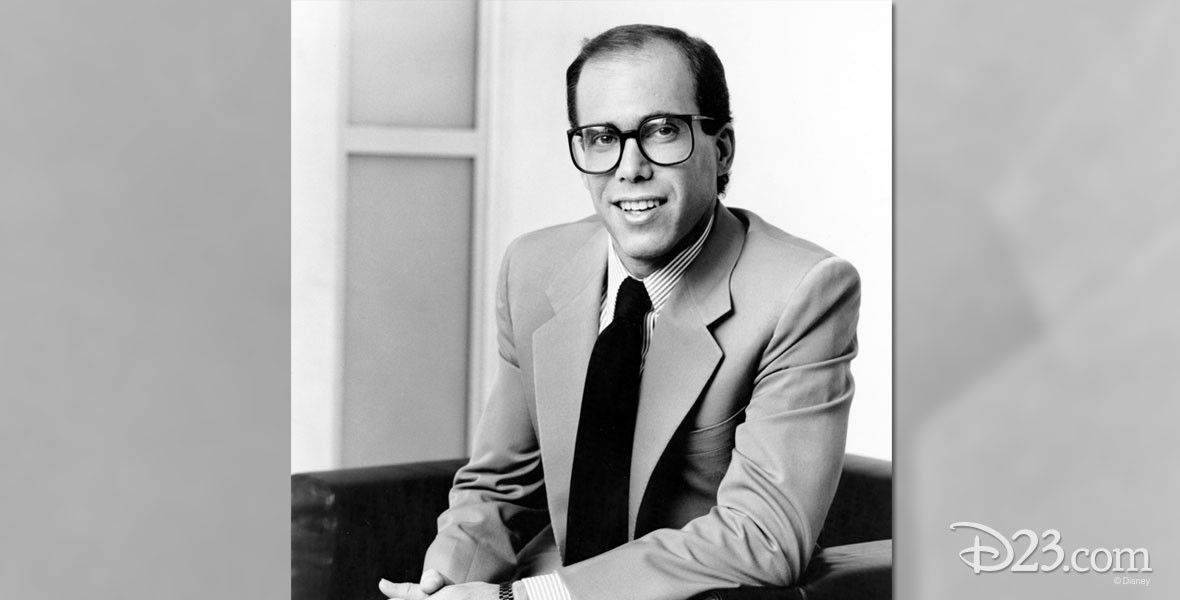

What Happened to Michael Eisner?

(AP Photo/Nick Ut)

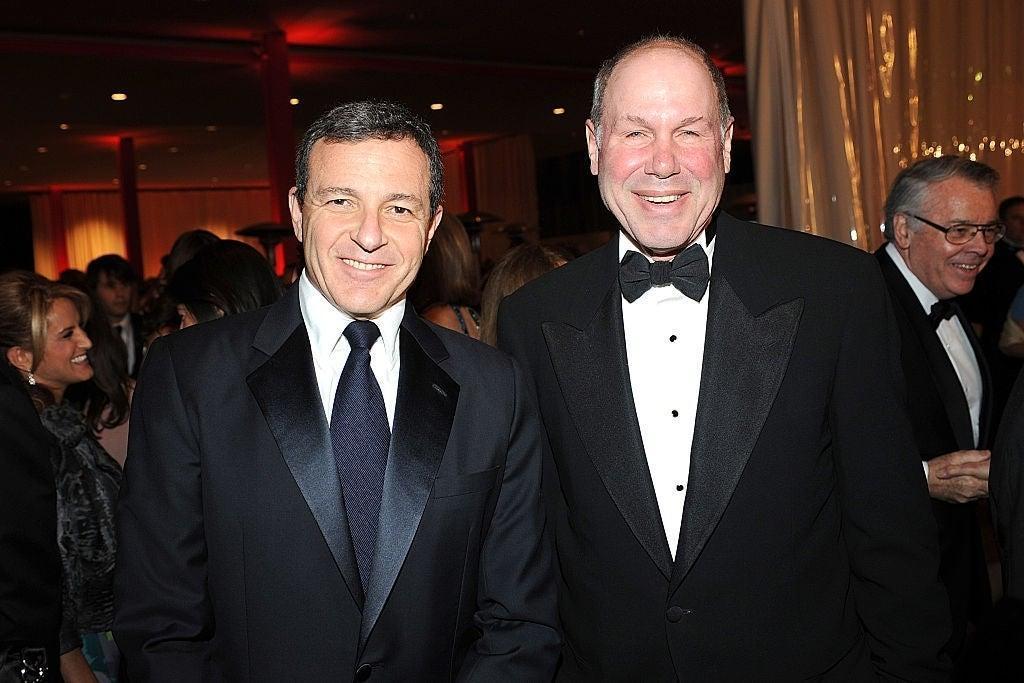

In 1984, a frustrated Michael Eisner realized he’d missed his window.

A few years before, Eisner had created Happy Days, one of the most popular television shows ever, while sitting at an airport.

Eisner’s former boss at ABC, Barry Diller had moved to Paramount. Diller appreciated Eisner’s talent and poached him.

At the time, both men presumed that Eisner would one day succeed Diller as the head of Paramount.

The move would have made sense as Eisner possessed the Midas Touch when it came to film development.

Eisner’s resume includes titles like Raiders of the Lost Ark, Grease, Saturday Night Fever, Beverly Hills Cop, and Footloose.

Image: Lucasfilm

Alas, Paramount chose someone else, unintentionally triggering a fascinating talent loss.

Eisner switched his loyalties to Disney, which needed a new CEO after Walt Disney’s son-in-law, Ron Miller, resigned.

Eisner quickly assembled a dream team, including Frank Wells as President/COO and Jeffrey Katzenberg as head of Disney’s film division.

Photo: D23

Not coincidentally, a decade of excellence ensued as Disney soared to newfound heights as a publicly traded company.

Unfortunately, the company made several missteps during the 1990s, while Frank Wells suffered a tragic death in a helicopter crash.

Katzenberg left after Eisner specifically chose not to promote him.

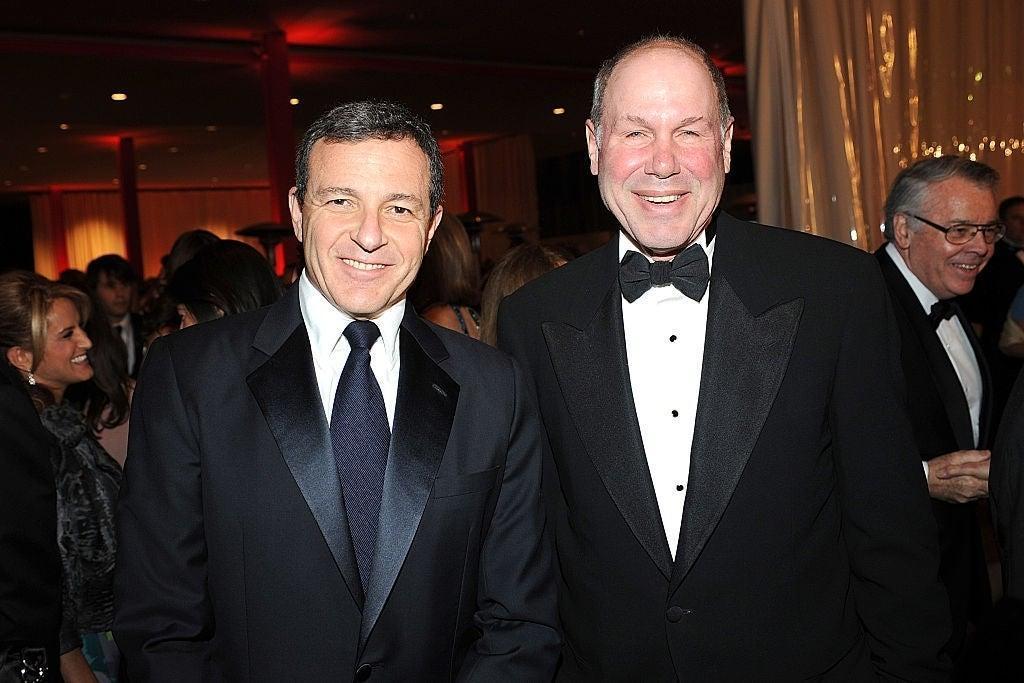

Disney Chairman and CEO Robert Iger with (L-R) Jeffrey Katzenberg and Rabbi Marvin Hier, founder and dean of the Simon Wiesenthal Center

Soon afterward, Katzenberg would form the company we now know as DreamWorks Animation.

Seemingly overnight, Eisner lost his two most trusted co-workers.

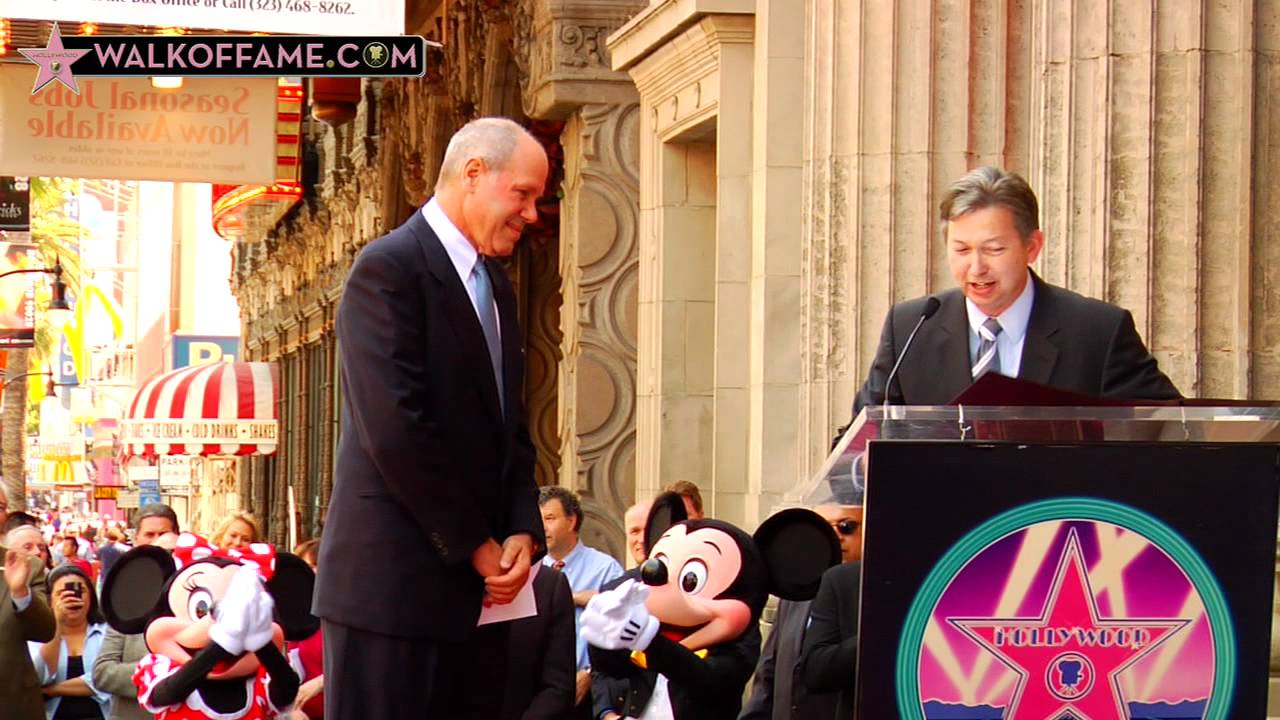

Photo: Hollywood Walk of Fame

Not coincidentally, Disney entered a period of steep decline. That’s when the wheels came off, and Eisner left.

In his wake, Disney replaced him with Bob Iger, indicating that there’s an argument to be made about Disney coming full circle.

What Are the Similarities between Eisner and Iger?

Photo: OC Register

If you subscribe, you can read the Wall Street Journal article here.

The story points to several surface similarities toward the end of Eisner’s tenure and what is currently happening with Iger.

Specifically, the article notes that Disney spent $5.2 billion on Fox Family in 2001, which represented “one-eighth of (Disney’s) total market value.”

In 2019, Disney acquired most of the Fox assets for $71.3 billion, which signified more than 25 percent of Disney’s market cap at the time.

The argument is that Disney has bet big on Fox products twice and suffered financially in each instance.

I’d emphasize that Disney has more than made back its money on the cable channel now known as Freeform.

The carriage fees and ad revenue over the past 22 years have turned this into a tidy transaction.

Similarly, criticisms of Disney’s Fox acquisition are premature and short-sighted, something I’ve discussed in detail.

Finally, I would wryly note that it’s good business for a WSJ writer to praise the business transactions of Rupert Murdoch, the Chairman Emeritus.

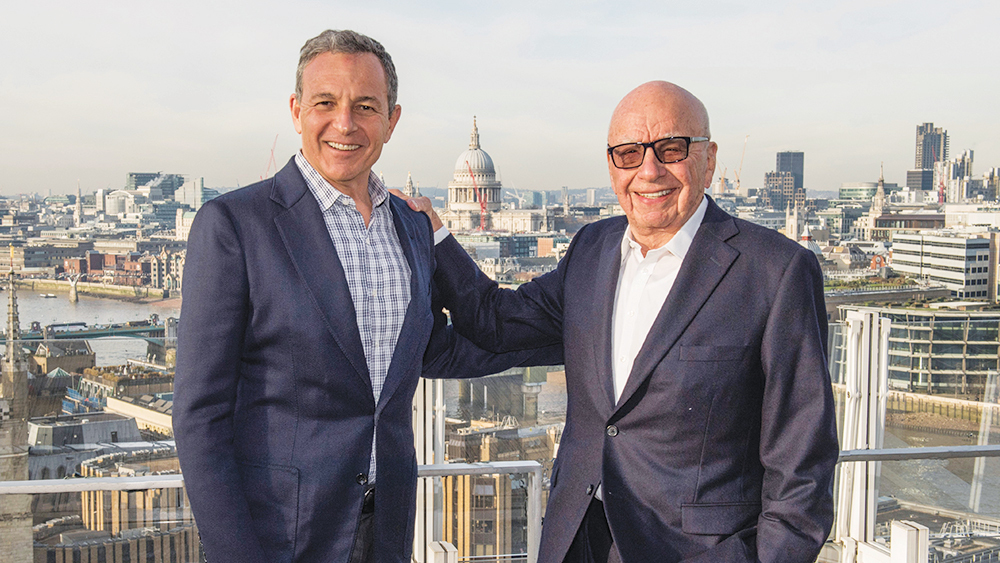

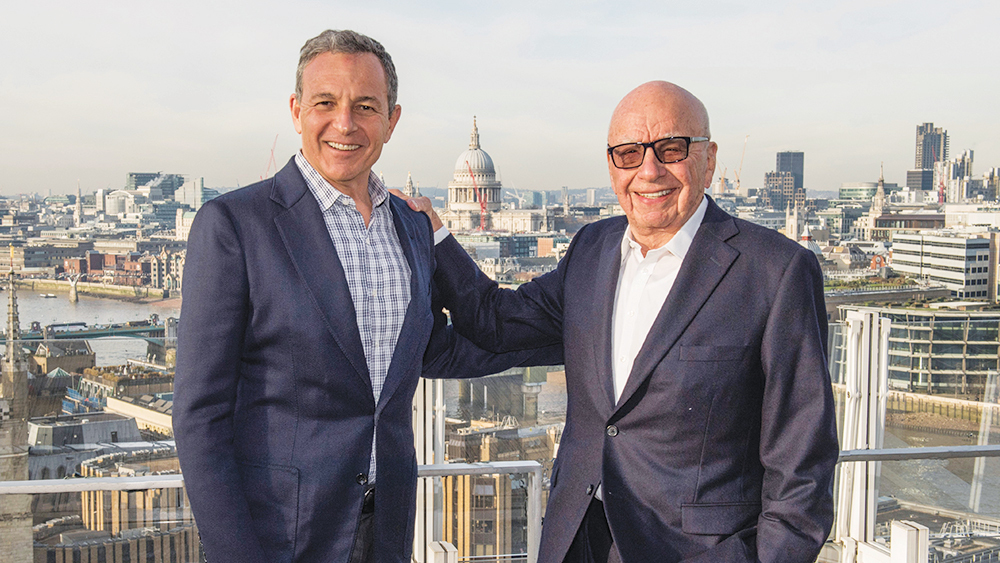

Robert Iger and Rupert Murdoch

credit: Disney

But the point remains that questions arose in the short term about the wisdom of the Fox Family purchase.

Now, Iger faces the same critiques for spending $71.3 billion on Fox, which was $17 billion more than the initial agreement.

Photo: Variety

Remember that Comcast entered a bidding war and forced Disney to pay one-third more than anticipated.

Disney is currently saddled with higher debt due to the combination of this purchase and the brutal timing of the pandemic the following year.

The Forced Film Comparison

Photo: Disney plus

This article only advances three or four surface similarities between the two situations.

One of them strikes me as forced. It’s that Disney cinema was in a downturn as Eisner’s grip on the company faded.

Specifically, the reporter mentions the struggles of Home on the Range, admittedly one of Disney’s weakest offerings, and a second film.

That other title makes my eye twitch. The report disparages The Emperor’s New Groove, one of my favorites.

While the film absolutely wasn’t a strong box office performer, it has since found newfound life on home video.

Eventually, the project proved so successful that Disney released a direct-to-video sequel, Kronk’s New Groove.

Later, a Disney Channel series, The Emperor’s New School, ran for two seasons.

So, I’d describe it as a hit. In fact, I just suggested this a couple of days ago.

Anyway, the report finds another way to remind people that Disney didn’t dominate the box office last year.

Image: Disney

How bad was the damage? Disney finished second at the box office among studios.

This seems like a good time to mention that the studio that won, NBCUniversal, released seven more films than Disney.

The margin of difference between first and second place was $80 million or 1.6 percent.

Source: digitalspy.com

The fact that it’s gotten blown so far out of proportion speaks volumes about Disney’s box office dominance over the past decade.

Simply stated, the Disney of today has NOTHING in common with Eisner’s situation in 2003.

Amusingly, Disney released a Haunted Mansion in 2003 and 2023. Maybe that’s the problem.

The Activist Investor Comparison

Photo: REUTERS/Mike Blake

The other comparison between Eisner and Iger represents the reason the article exists.

The WSJ provides favorable coverage to Nelson Peltz and Isaac Perlmutter.

As a reminder, Perlmutter provided on-record quotes for the WSJ last year after his Disney firing.

Photo:Cosmicbooknews.com

That’s a borderline unprecedented action for the notoriously publicity-shy billionaire.

Peltz has used the WSJ to amplify his arguments against Disney over the past year, sometimes to his own detriment.

A recent Reuters article underscores how Peltz’s Trian Investment Fund underperformed by half in 2023.

Photo: The Walt Disney Company

Peltz blames Iger, but investors blame Peltz for obsessing on a single company, the one that fired his friend, Perlmutter.

Still, there is a direct comparison to previous Disney history.

After everything took a turn for Eisner, he sealed his fate when he feuded with Roy E. Disney, Walt Disney’s nephew.

Photo: D23

Eisner hastened Disney’s departure from the company, causing the latter individual to start an activist investor campaign.

Disney worried that his father and uncle’s company had become soulless and corporate.

Photo: wikipedia

So, Roy E. Disney started the Save Disney campaign, which proved successful when Stanley Gold, a former member of Disney’s Board, turned against Eisner.

Not coincidentally, Peltz started his own website, Restore the Magic, in early 2023 in hopes of history repeating itself.

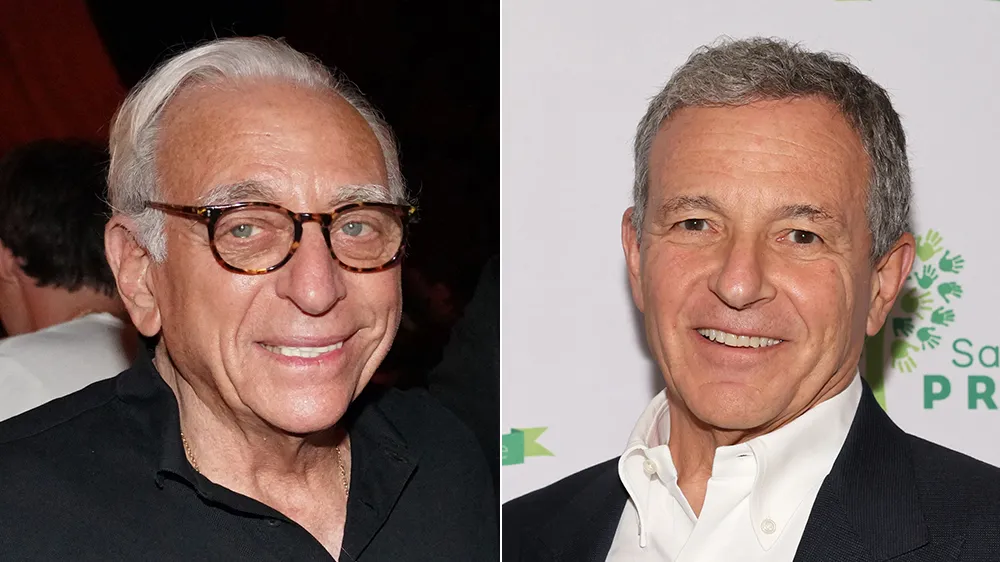

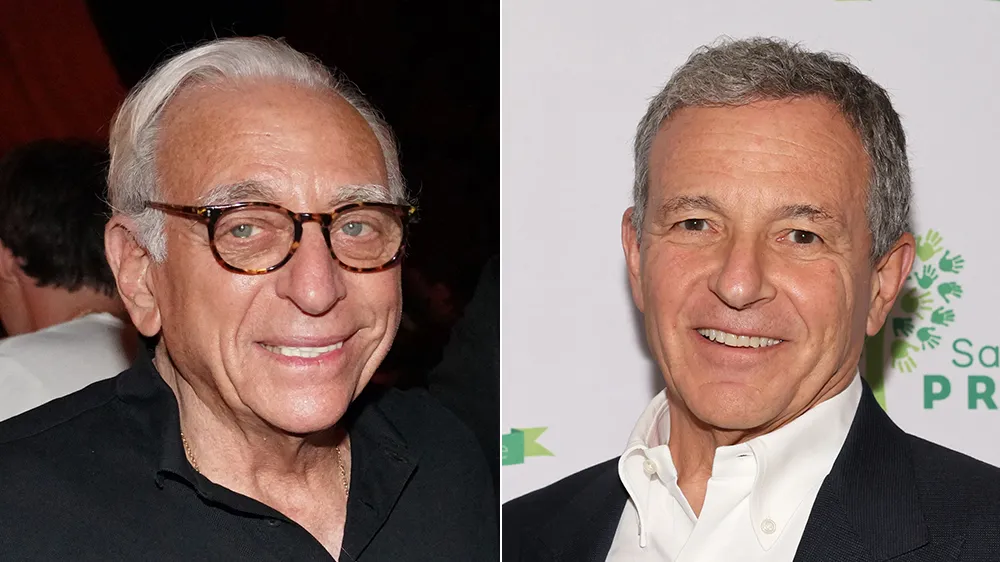

Romain Maurice/Getty Images for Carbone Beach | Dia Dipasupil/Getty Images

Alas, that campaign failed completely as Iger outmaneuvered Peltz then and again in November.

Peltz hasn’t given up and gone away, but analysts describe it as “an even longer shot now.”

The most optimistic evaluations are that while losing, Peltz is “serving a useful purpose.”

The people saying this WISH Disney was more soulless and corporate, which means it’s not just different than 2004.

We’re discussing the polar opposite scenario wherein Iger is protecting Disney’s legacy, which is upsetting Wall Street.

Other Takeaways from This Report

While I obviously disagree with the core concept and don’t believe Disney history is repeating itself, the article does reveal something intriguing.

Reportedly, “Disney was in previously unreported talks to acquire videogame maker Activision Blizzard” in 2003 and 2004.

Image: Activision Blizzard

That’s…a surprise. Disney has enjoyed a long, productive working arrangement with Activision Blizzard over the years.

So, the report makes sense and makes me think a bit more highly of Eisner with the benefit of hindsight.

After all, Microsoft just purchased Activision Blizzard for $68.7 billion.

In 2003, Activision Blizzard’s market cap was $1.62 billion.

I’m not saying the company would have performed as well under Disney since Blizzard didn’t come until later, but Eisner definitely identified an undervalued asset.

Image: Activision Blizzard

Perhaps, to a degree, that’s what Peltz and other Wall Street analysts are doing with Disney.

They recognize a sleeping giant and are attempting to kickstart the stock’s ascension.

Photo: Disney

That’s probably giving Peltz too much credit, though. He recently acknowledged that he’s most concerned with having a voice in Iger’s successor.

Eisner has stated that he had intended to select Iger anyway, but Disney’s Board effectively made the decision for him.

Photo: Hollywood Walk of Fame

Something similar could happen with Iger. In that scenario, Disney history would repeat itself.

To a larger point, Peltz has all but shouted from the rooftops that he intends to use WSJ as his platform for additional attacks.

Image rights: CNBC and Illustration by Elham Ataeiazar

The activist investor has a little more than two months to make his case and thereby follow Roy E. Disney’s lead in toppling a Disney CEO.

So, we’ll probably read a couple more of these stories on WSJ between now and Disney’s Annual Shareholder Meeting.

MickeyBlog Logo

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!