The Disney-Reliance Merger in India Could Face Regulatory Scrutiny

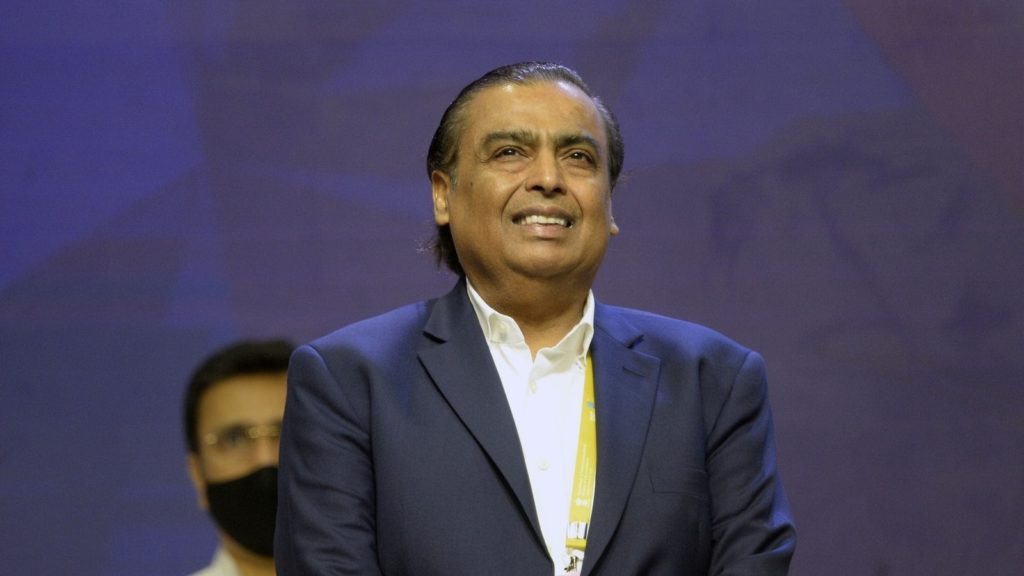

A proposed merger between The Walt Disney Company’s India business and Mukesh Ambani’s Reliance Media is poised to create an entertainment behemoth in India.

Combining the two media conglomerates would create a new business with two major streaming services and 120 channels. Because of the union’s size, lawyers believe the merger could draw antitrust scrutiny, and assets would likely need to be shed.

Photo: Disney

If a deal is reached, it would be the second merger of entertainment giants in recent years. Previously, Sony announced plans to merge its India business with Zee Entertainment.

The Sony-Zee Merger Could Hurt Disney

The Sony-Zee merger plan recently passed a review by the Competition Commission of India (CCI) last year and could close in the coming weeks. The two companies agreed to divest three of Zee’s Hindi TV channels to gain regulatory acceptance.

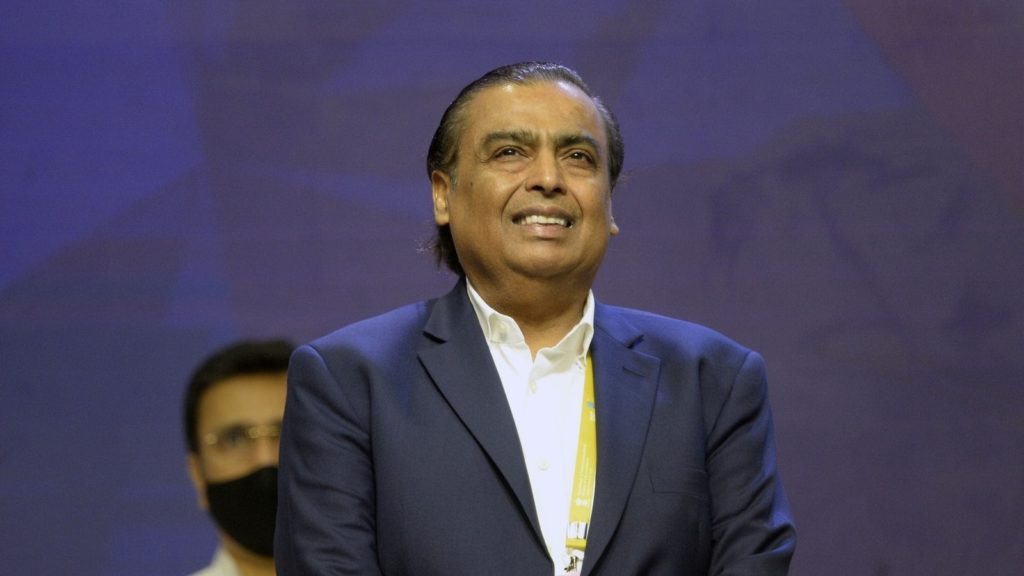

FILE PHOTO: Mukesh Ambani, chairman of Reliance Industries Limited, poses for photographers before addressing the annual shareholders meeting in Mumbai, India, June 12, 2015. REUTERS/Shailesh Andrade

The Sony-Zee merger could impair the chances that the Disney merger is approved.

While Netflix and Amazon also compete in India’s entertainment sphere, there could be fear that creating another massive company could generate a duopoly that would wield power over advertisers, users, and creators.

Photo: Reliance Industries Ltd

“This deal may get closer scrutiny because of the increased concentration of market power post the Zee-Sony merger. That makes their path to CCI approval more challenging,” said Avimukt Dar, founding partner at India’s IndusLaw.

Disney-Reliance Would Dominate Streaming and Cricket

Disney Hotstar continues to be India’s biggest streaming app, with 28 million users. The service also owns the rights to International Cricket Council matches in India until 2027.

Meanwhile, Reliance owns the rights to the IPL cricket league.

Photo: Forbes

The CCI will likely worry about the combined business’s control over India’s streaming business and cricket content.

Photo: BBC

The CCI would be worried that the “combined entity, due to its strong market presence in streaming, can command their own rates and advertisers will be left without bargaining power,” said Vaibhav Choukse, head of competition law at Indian law firm JSA.

Would The New Entity Own Too Many Channels?

The other issue the CCI could raise would be the number of channels the new company would own. The merged Disney-Reliance company would have a 30% to 40% combined market share. In local language Marathi channels, Disney would have a 65% to 75% market share. In Bengali language entertainment channels, they would command a 50% market share.

The Walt Disney Company

“If the market shares of the parties exceed 40-50% in any market, CCI is likely to conduct a detailed investigation,” said Choukse.

To address the CCI’s concerns, the merged entity could shed some channels or make commitments to avoid raising ad rates.

Photo: Hindustan Times

While the merged Disney-Reliance will likely have a path to passing the CCI review, a closed agreement is still a long way away.