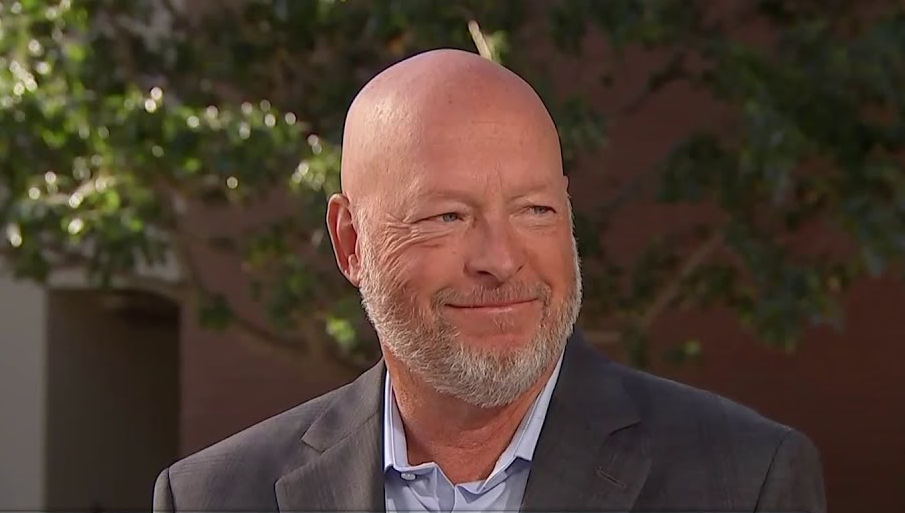

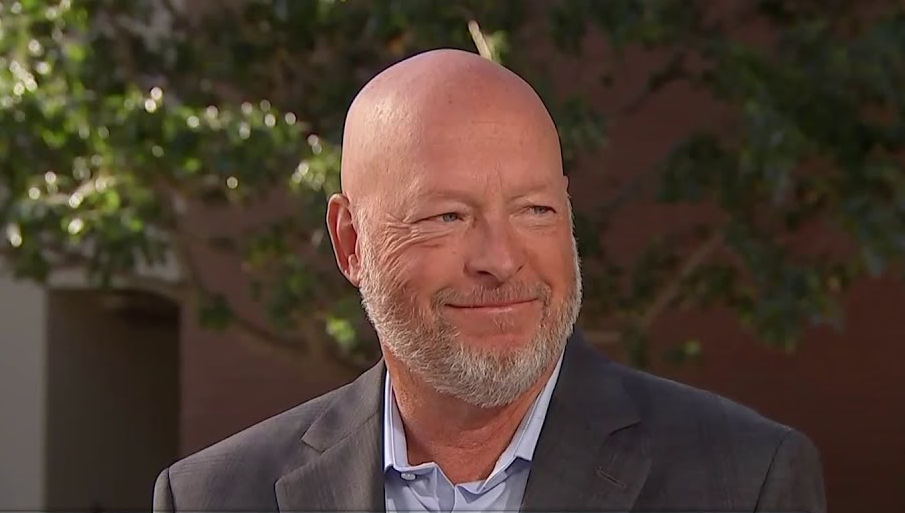

Disney Stock Closes At $85.58 – Near a Five-Year Low

The Walt Disney Company shocked the entertainment industry and Wall Street on November 20, 2022, when they abruptly fired their CEO, Bob Chapek.

While Disney fans pointed to Chapek’s changes to the Disney parks or his response to Florida’s Parental Rights in Education Act, cold hard numbers proved to be his undoing.

Photo: CNBC

The Disastrous Earnings Call

Nine days before his departure, Chapek presided over the company’s Q4 earnings call. Despite reporting “record sales and its best revenue growth in 25 years,” Wall Street was not impressed.

In the end, Disney was bleeding money. The company failed to meet Wall Street’s expectations for revenue. Additionally, Disney revealed that its streaming services had lost nearly $1.5 billion.

Photo: Marc Piasecki/Getty Images

Following the earnings call, CNBC’s Jim Cramer called for Chapek’s job. Meanwhile, other Wall Street analysts called the CEO delusional. More importantly, Disney stock fell to a multi-year low of $88.50.

Nine days later, Bob Chapek was out, and Bob Iger returned.

Photo: Chip Somodevilla/Getty Images

Iger’s Return

Iger’s resumption of his CEO duties was met with widespread praise from Disney fans and the media alike, despite the fact that many of the strategies that got Disney into trouble in the first place (like their $71.3 billion purchase of Fox) came under Iger’s watch.

Nevertheless, with his million-dollar smile and propensity to say the right thing, it was easy to paint Iger as Richard the Lionheart returning home to save Disney from their own Prince John in Bob Chapek.

Image: Disney

Fast-forward nine months, though, and the walls are beginning to close in on Iger.

Nine Months Later

Following a rare PR mishap that saw the Disney CEO call the WGA and SGA-AFTRA strikes “disturbing” and the strikers “unrealistic,” the media has begun to turn on Iger.

As is often the case, Iger’s biggest problem comes down to numbers. Five months after announcing that the company would be laying off 7,000 employees, Disney has yet to reap any financial benefit from the layoffs and accompanying corporate restructure.

Photo: Disney

With movies failing to live up to expectations at the box office and Hollywood ground to a halt from labor disputes, it is an uncertain time for Disney, and Iger seems to be losing control.

A Disastrous Week

In the last week, reports emerged that Disney was looking for strategic partners in India to help alleviate the company’s streaming woes. Then came reports that Disney may look for a similar solution to its ESPN problem. This news was followed by Iger conceding that linear television stations “may not be core” to Disney, leading to speculation that the company could look to sell its networks.

Photo: CNBC

Nine months after Bob Chapek was fired for failing to live up to Wall Street’s expectations, stock in The Walt Disney Company closed at $85.58 a share, nearly three dollars lower than the number that got the former CEO ousted.

Despite the company’s current woes, the Disney board seems committed to Iger’s vision of the future. Just last week, the CEO announced that he would be extending his contract for another two years. Without a natural successor in place, it is unlikely that the board would move to replace Iger. With that being said, one thing is clear- the honeymoon is over. While there is still time for Iger to end his storied Disney career on a good note, you have to wonder if the 72-year-old CEO misses retirement.

Photo: PRNewsFoto/The Walt Disney Co.

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below and one of the agents from MickeyTravels, a Diamond level Authorized Disney Vacation Planner, will be in touch soon! Also, thanks for reading!