Theme Parks Have Become a Two-Player Game

Theme parks have become a two-player game. We need to face the facts about this reality.

In the face of the existential threat that was a global pandemic, competitors faltered while two entities stood tall.

The Walt Disney Company and Comcast/NBCUniversal have become the Coke and Pepsi of theme park experiences.

Credit: Disney

Simultaneously, competitors have faltered and may never recover.

Let’s talk about how Disney and Universal have left the competition in the dust.

The Haves

Photo: Getty

During Disney’s fiscal first quarter 2024 earnings call, Bob Iger ever-so-casually mentioned something astonishing.

“Every one of our parks was profitable in Q1, giving us an incredibly solid foundation to build upon as we invest significantly to turbocharge growth in this business.”

As a reminder, Disney owns, operates, and/or licenses theme parks in four countries across three continents.

Theoretically, the entire point of diversifying theme parks in multiple countries is to protect yourself against an economic crisis.

Sure, one or two countries could suffer tourism slumps, but the other parks should pick up the slack.

Universal Studios Japan

That same principle applies to Comcast’s NBCUniversal as well.

You’ll find Universal Studios theme parks in China, Japan, and Singapore. Another will open in England in a few years.

Both companies have created global theme park empires of various scales.

Photo: Universal

Given the dramatic difference in market share, Disney is unquestionably the Coke to Universal’s Pepsi, the McDonald’s vs. the Burger King.

Still, most other businesses wish they were Pepsi, and Universal has the expansion plans to prove its excellence.

Photo: Universal Studios

Universal Studios recently announced a new park coming to Frisco, Texas, and a licensed Halloween Horror Nights experience in Las Vegas, Nevada.

Similarly, on UniversalParksBlog, I’ve reached the point where I could just cut-and-paste the following statement.

Universal

“Comcast reported record earnings in its theme parks division last quarter.” It’s borderline automatic at the moment.

Roughly four years ago, I opined several times about whether Universal Studios and Disney would ever be the same after the pandemic.

Photo: Visitingsingapore.com

Both businesses have come out the other side stronger, better, and motivated to expand, striking while the iron is hot.

For this reason, you would naturally assume that the entire theme park industry is doing well, but that’s not the case.

The Have Nots Part I

Photo: Universal

I’ll start with the confession that I have a personal bias toward Cedar Point. It’s my favorite non-Disney theme park.

While I hope Universal Epic Universe persuades me otherwise, I slightly prefer Cedar Point to Universal Orlando Resort.

For this reason, I’ve always looked favorably on Cedar Fair Entertainment Company, the corporate owners of Cedar Point.

Cedar Fair

This entity has acquired many other beloved theme parks over the years, including the culturally significant Knotts Berry Farm.

Also, Cedar Fair owns Carowinds, which suffered a debacle last summer.

The park’s most famous roller coaster, Fury 325, developed a crack in its foundation.

Carowinds

Shockingly, a guest noticed before any park employee did. The park garnered the wrong kind of international headlines.

This outcome wasn’t a surprise, though. I’d mentioned multiple times during the pandemic that maintenance was likely to slip through the cracks.

Carowinds

Theme parks had no choice but to lay off many employees. Then, the parks operated at less than full staffing for years afterward.

Still, Cedar Fair’s Carowinds drew the short straw, and its stock lost ten percent after the negative press.

In late October 2023, Cedar Fair’s stock still hadn’t recovered and hovered in the range of $34.

The Have Nots Part II

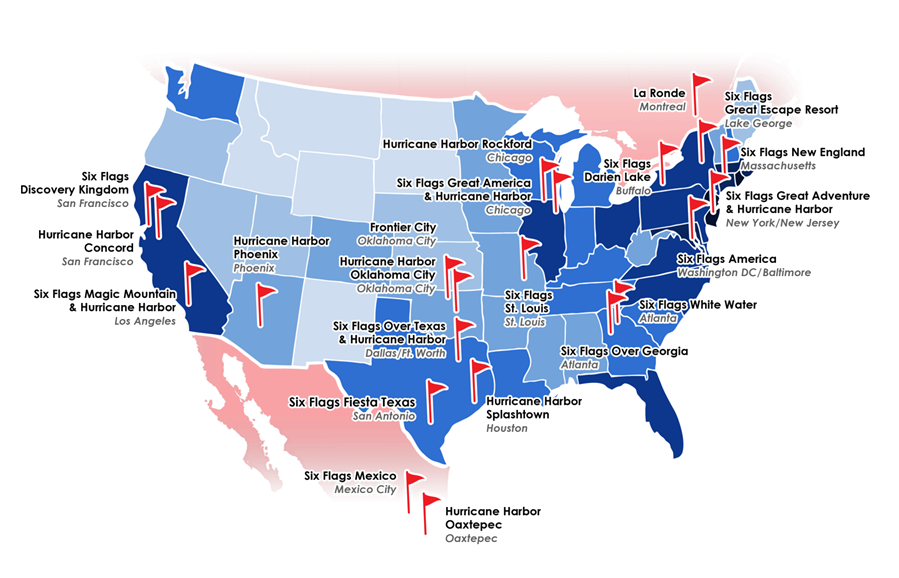

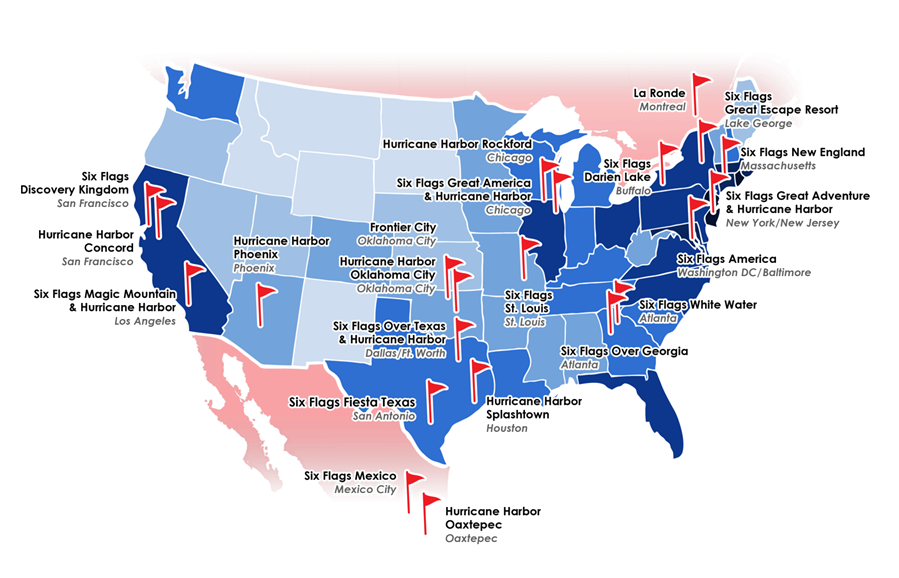

Six Flags

Remarkably, that total was the envy of a peer, Six Flags Entertainment Corporation.

While Universal and Disney parks market themselves as destination tourism vacations, Six Flags and Cedar Fair take the opposite approach.

These two entities have either built or purchased countless theme parks, thereby satisfying a local itch.

Six Flags

When you cannot find the time or money to visit Southern California or Central Florida, you go to Six Flags instead.

That’s the theory anyway. In truth, Six Flags has utterly failed to distinguish itself during the 21st century.

The pandemic’s timing proved especially brutal to this company, as it lost 67 percent of its market value virtually overnight.

Photo: WHO

While the stock price recovered within the year, Six Flags’ continued lack of innovation made its recovery a bubble of sorts.

After another disappointing summer in 2023, Six Flags cratered again, with its stock price falling to $17.

In isolation, neither company’s performance is acceptable. As a duo, they’re representative of a top-heavy oligopoly.

Photo: Disney/Universal

In case you don’t know, an oligopoly is an industry consisting of a few businesses that claim most of the market share.

As Disney and Universal have grown, they’ve almost accidentally crushed the competition.

Lesser theme park competitors are struggling to survive while Disney and Universal thrive.

An Attempt to Survive

Cedar Fair

Not coincidentally, Six Flags and Cedar Fair realized that their current tactics weren’t working.

In early November, the companies agreed to merge in an $8 billion transaction.

The deal isn’t certain to become final, as it has triggered antitrust concerns.

Six Flags

Department of Justice officials have asked for additional details about the proposal.

However, the mere attempt reflects the challenges that smaller competitors face in the theme park industry.

We’re talking about two companies that control 27 theme parks, 15 water parks, and nine resorts.

Six Flags

Cedar Fair and Six Flags have decided they cannot survive in the current marketplace unless they join forces.

There’s simply not enough oxygen in the room for everyone.

In calendar 2019, Universal and Disney earned more than 200 million park visits as opposed to 60 million for Six Flags/Cedar Fair.

Six Flags

The only other American entity in the top ten in market share was SeaWorld Parks & Entertainment with 22.6 million.

This seems like a good time to mention that Disney alone claimed 157.3 million park visits.

These were the pre-pandemic stats! The gap has expanded in its aftermath.

Credit: Disney

There Is No Player Three

Now, Disney and Universal absolutely dominate the industry so completely that Bob Iger doesn’t even blink about record profits.

Neither does Brian Roberts, the CEO of Comcast. They expect these results because they’ve gotten them quarter after quarter.

Conversely, Six Flags and Cedar Fair view their potential merger as the only path forward to survive an existential crisis.

Theme parks have become a two-player game.

The companies currently sitting in third place have realized they’re neither Pepsi nor Coke.

The Walt Disney Company

So, when you read about how Disney could/should respond to Universal – and I’ll publish one of these soon-ish – that’s not the point.

The real question is whether the also-rans in the marketplace can survive in a world where the quality of Disney/Universal outweighs the quantity of 42 theme/water parks.

MickeyBlog Logo

Thanks for visiting MickeyBlog.com! Want to go to Disney? For a FREE quote on your next Disney vacation, please fill out the form below, and one of the agents from MickeyTravels, a Diamond Level Authorized Disney Vacation Planner, will be in touch soon!

Feature Photo: visitorlando.com