Bob Chapek Just Had the Most Important Earnings Call of His Life

If you own stock in The Walt Disney Company, you’ve experienced a different kind of Mr. Toad’s Wild Ride lately.

Now, Disney CEO Bob Chapek has hosted a quarterly earnings report call and revealed information about the state of the parks.

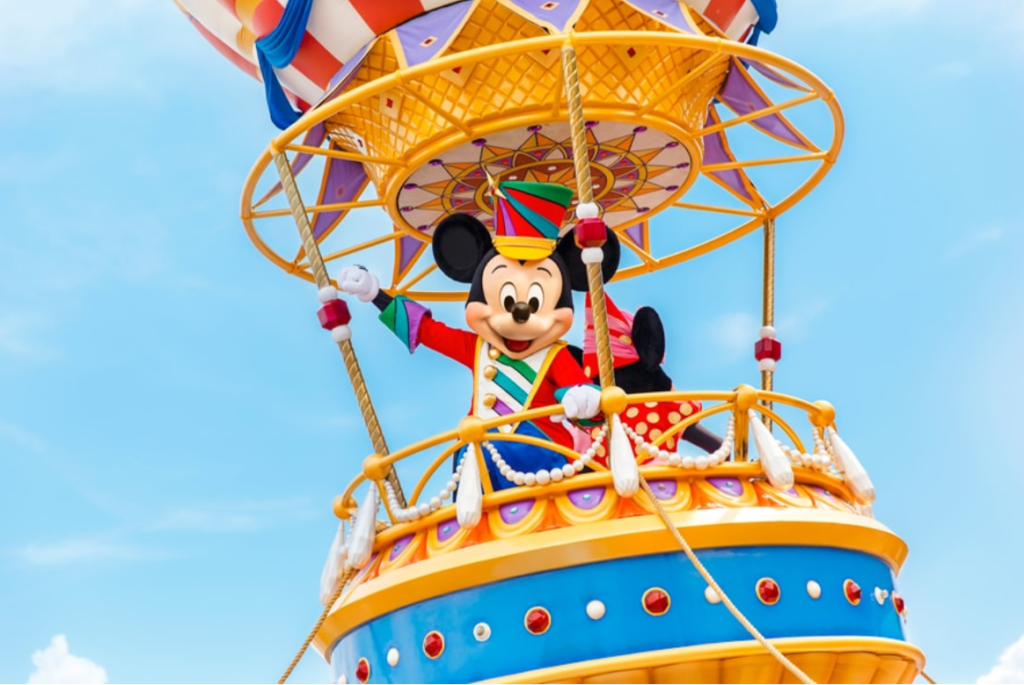

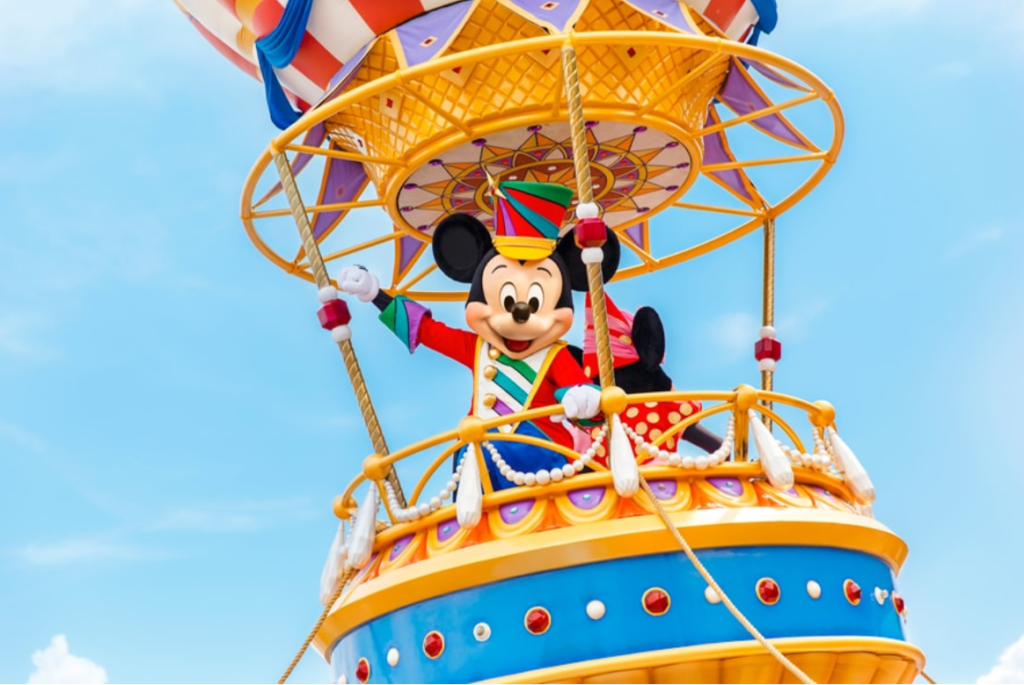

Credit: Disney

Let’s talk about what we just learned about Disney’s upcoming plans.

Let’s Talk Theme Parks!

How are Disney’s theme parks doing? I’m just gonna leave this right here…

“As I said, our domestic parks were a standout.

They continue to fire on all cylinders, powered by strong demand, coupled with customized and personalized guest experience enhancements that grew per capita spending by more than 40% versus 2019.

Response to next-generation storytelling like Star Wars: Galactic Starcruiser has been phenomenal.

In fact, guest ratings for this immersive experience, which opened on March 1st, are incredibly high and in line with our best-in-class offerings.

Demand is strong, and we expect 100% utilization through the end of Q3.”

So, I honestly don’t even need to add much here. That’s Chapek leading with the best possible headline.

The average guest is spending over 40 percent more money per park visit than they were three years ago.

Image Credit: Disney

How has that affected attendance? Disney’s CFO, Christine McCarthy, added that demand at the parks has increased on some dates from 2019.

Remember that Disney still controls attendance via Park Passes. Nobody is saying that attendance has improved relative to 2019, but it’s in that range.

Simultaneously, guests are paying the equivalent of $1.40 today for what cost $1 in 2019.

You don’t need to be a math genius to know that the parks are crushing it.

Sure enough, Disney’s parks division earned nearly $6.7 billion for the quarter, with net income of $1.76 billion.

That type of revenue will justify park expansions sooner rather than later if it continues unabated.

Other Park-Related Notes

Some of that success stems from Star Wars: Galactic Starcruiser, the tiny but expensive Disney resort.

Critics had lambasted the so-called Star Wars Hotel before it opened. Many predicted a bomb that might not last the year.

Credit: Kent Phillips, photographer/Disney

Disney is having the last laugh, as it expects total sellouts at Galactic Starcruiser through June, the end of the third fiscal quarter.

The hotel will have claimed maximum occupancy for four whole months by that point.

(David Roark, photographer)

As a reminder, Disney is accomplishing this without the benefit of international travelers.

This group once comprised nearly one out of every five tourists at Disney’s North American parks.

Currently, the number of international guests is only a fraction of that. In other words, there’s still plenty of room for growth.

(Joshua Sudock/Disneyland Resort)

Overall, the only disappointing park news came from the international locations.

Disney executives believe they’ll incur a $350 million setback during the fiscal third quarter because of Shanghai Disneyland’s closure.

Photo: Todd Anderson, photographer

Hong Kong Disneyland reopened on April 21st, but it had already missed 20 percent of the fiscal third quarter by then.

So, international theme park revenue will be better a year from now than during the next quarter. Disney can’t do anything about this problem, though.

Photo: Hong Kong Disneyland

Finally, since I know some of you are wondering, the words “Reedy Creek” were never even mentioned.

Analysts do not believe that anything happening here is financially significant to Disney’s bottom line. At worst, it’s an inconvenience plus some recurring negative headlines.

Photo Credit: Facebook – Reedy Creek Fire and Rescue Department Emergency Medical Services

The Streaming News

Obviously, investors wanted to know more about Disney+, ESPN+, and Hulu+. They’re the anchors of Disney’s business right now, at least to Wall Street.

Disney provided plenty of insight about its businesses, starting with a unique note on its investor report.

Photo: Chesnot/Getty Images

The company explicitly mentioned that it lost $1 billion due to one business decision. That sounds alarming, right? Well, it isn’t.

This comment references Disney’s choice to end its licensing agreement with Netflix for Marvel content.

Photo: Chesnot/Getty Images

Disney’s CFO, Christine McCarthy, didn’t mention a timeline for the revenue. So, I cannot tell you if this was just for a quarter or a year or what.

Instead, what I can state is that Disney willingly sacrificed $1 billion to ensure that its entire Marvel content library is only available on Disney+.

Photo: Shuttershock

That’s the opportunity cost of doing business as a streaming service. Disney could readily turn many of its titles into a fortune by licensing them elsewhere.

Instead, the executive team has committed itself to exclusive Disney content on its streaming services.

Photo Credit: DisneyPlus.com

That comes at a high price…and in more ways than one. The CFO referenced that Disney will spend $32 billion on content in fiscal 2022.

Notably, that’s $1 billion less than the company had initially projected. Nobody offered insight as to why, but I perceive two possibilities.

Image Credit: Disney

The first is that Disney had to make up the $1 billion somewhere from the Netflix revenue shortfall.

Another is that some of Disney’s planned projects for the final quarter, which actually ends in October, have experienced modest delays.

Photo: Shuttershock

Presuming the latter is accurate, Disney won’t pay for that content until next year.

More about Streaming

Importantly, Disney doubled down on the idea of gaining at least 240 million subscribers by the end of 2024.

Photo: AndroidCentral.com

One investor balked at this notion, wondering whether Disney could feasibly maintain the required goal.

Currently, Disney+ claims 137.7 million subscribers. It’d need another 102.3 million in 30 months to reach that goal.

Image: Disney Plus

The recent Netflix woes have forced analysts to reconsider whether the streaming bubble has popped.

The executives on the call calmly pointed out that Disney+ will enter 51 (!) new markets this year.

For this reason, Disney fully expects sustained growth throughout the rest of 2022 as opposed to what Netflix just experienced.

Along these lines, at the end of 2020, Netflix claimed 203.7 million subscribers. Disney’s three streaming services combined for 120.6 million.

That’s a gap of 80.1 million 15 months ago. So as of right now, Netflix has gotten stuck in the mud at 221.6 million subscribers.

Meanwhile, Disney’s three services combine for 205 million, a difference of only 16.6 million. Disney is gonna catch Netflix, y’all…and soon!

Still, at least one investor worried about the price of doing business. This individual asked about a new metric.

Photo Credit: AP Photo/Richard Drew, File

Until recently, Wall Street only cared about subscriber growth. Now, there’s a second factor, the cost per new subscriber.

With Disney, this conversation involves the high cost of live sports broadcasts. The investor wonders whether the rising expense could outweigh the price.

(Photo by Peter DaSilva / ESPN Images)

Disney’s executives universally dismissed this idea, but it’s not going away anytime soon. The NBA’s ratings this postseason have been dynamic.

That league will earn a record-shattering contract during its next negotiation.

Photo: Noah Graham | Getty Images

Meanwhile, Google (!) just entered the bidding for licensing IPL cricket, one of Disney’s crown jewels.

People want what Disney has, and that’s causing bidding wars.

Feature Image: Disney