Disney Tries to Secure Its Fortress

Are you tired of the palace intrigue at The Walt Disney Company?

I can assure you that Disney’s leadership is. That’s why Disney has taken an extraordinary step this week.

Image: Disney

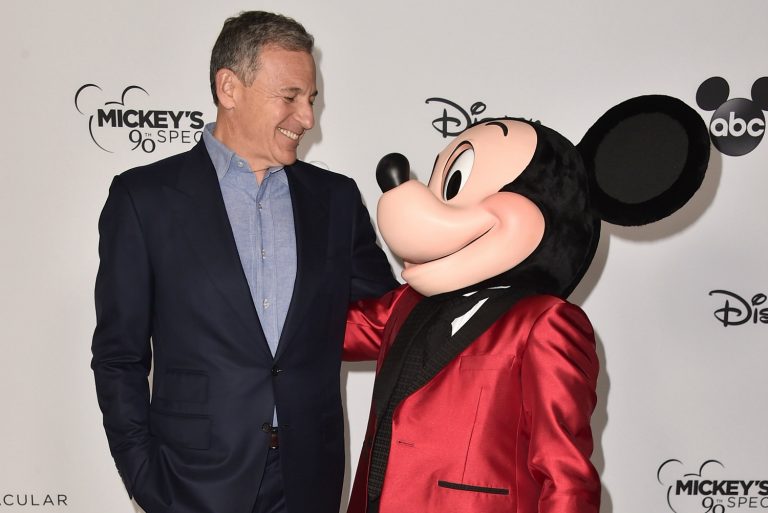

As MickeyBlog’s Melissa Roden reported, the company has introduced a new Chairpman of the Board.

This move occurred barely two months after Disney fired its old CEO, Bob Chapek, and replaced him with Bob Iger.

Photo: Disney

We’re all wondering the same thing right now. What in the world is happening at Disney???

The answer is that Disney wants to secure its fortress and end the instability once and for all. Here’s what just happened and why.

Photo: The Walt Disney Company

Susan Arnold Exits the Disney Board

Let’s start with the headline story. Susan Arnold, the first woman ever to act as Chairman of the Board at Disney, has completed her 15-year tenure.

Disney’s press release and media comments have stressed that Arnold honored the Board’s rules.

Image Credit: Disney

Still, Wall Street understands that Disney could have altered the rules if leadership had wanted Arnold to remain.

Possibly, she wanted out. Conversely, Disney’s remaining Board may have viewed her as damaged goods in the wake of the Bob Chapek fiasco.

Photo: Charles Krupa/AP

You may recall that Arnold sided with Chapek multiple times during the past two years.

Most significantly, she resisted the Board’s idea to replace Chapek with Nike Executive Chairman Mark Parker in June.

Photo: Disney

Arnold gave Chapek an ill-fated three-year extension instead. And we all know how that worked out.

Arnold believed that the Board should support its CEO as often as possible. Meanwhile, Disney’s upper management screamed to the Board that he was failing.

So, the timing here appears suspect…in multiple ways. Did Bob Iger plan this tactic all along?

Iger knew how long Arnold had sat on Disney’s Board when he announced her as his replacement on December 1st, 2021.

Photo: Chip Somodevilla/Getty Images

Thirty days later, Iger left the company, knowing that Disney’s Chairman faced a term limit at the start of 2023.

In other words, he selected someone who would get barely a year on the job before needing their successor.

Photo: Alberto E. Rodriguez / Getty Images

Never cross Bob Iger, my friends.

Meet the New Chairperson of the Board

If we count Iger — and I think we should — Disney has just announced its third Chairman of the Board since December 1st, 2021, a period of 14 months.

Jewel Samad/Agence France-Presse, via Afp Via Getty Images

Nothing screams stability like three CEOs and three Chairmen of the Board in three calendar years!

Sure, the same person held three of those six positions, but even three changes at the top would be a lot in the corporate world.

Photo Credit: @jaytasmic/Twitter

To a larger point, why would Iger intentionally select someone he knew wouldn’t be there through the end of 2023? What’s the rationale for that?

The “Chapek was the fall guy” theory gains more support with this news.

Photo: Matt Stroshane/Courtesy Disney Parks

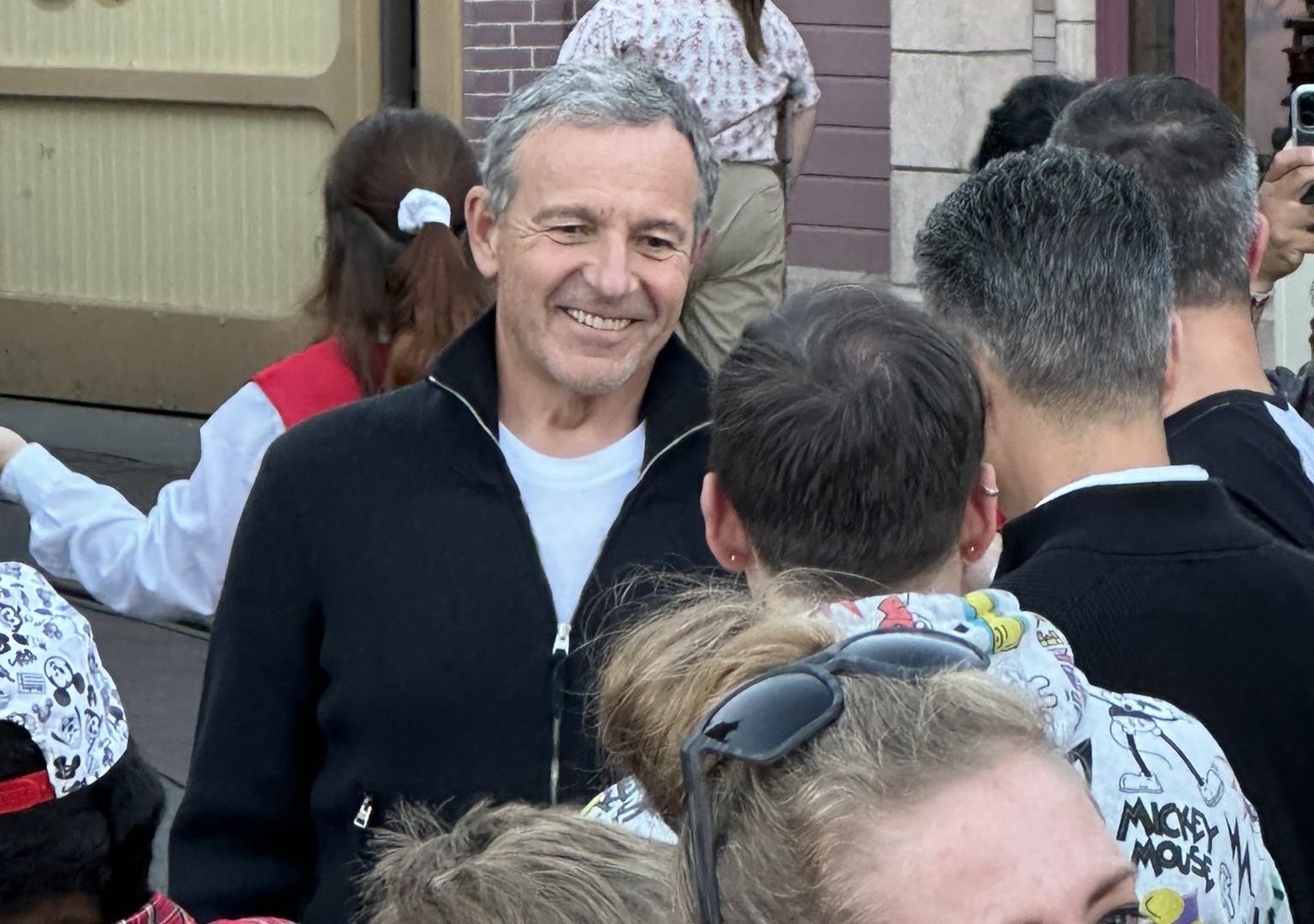

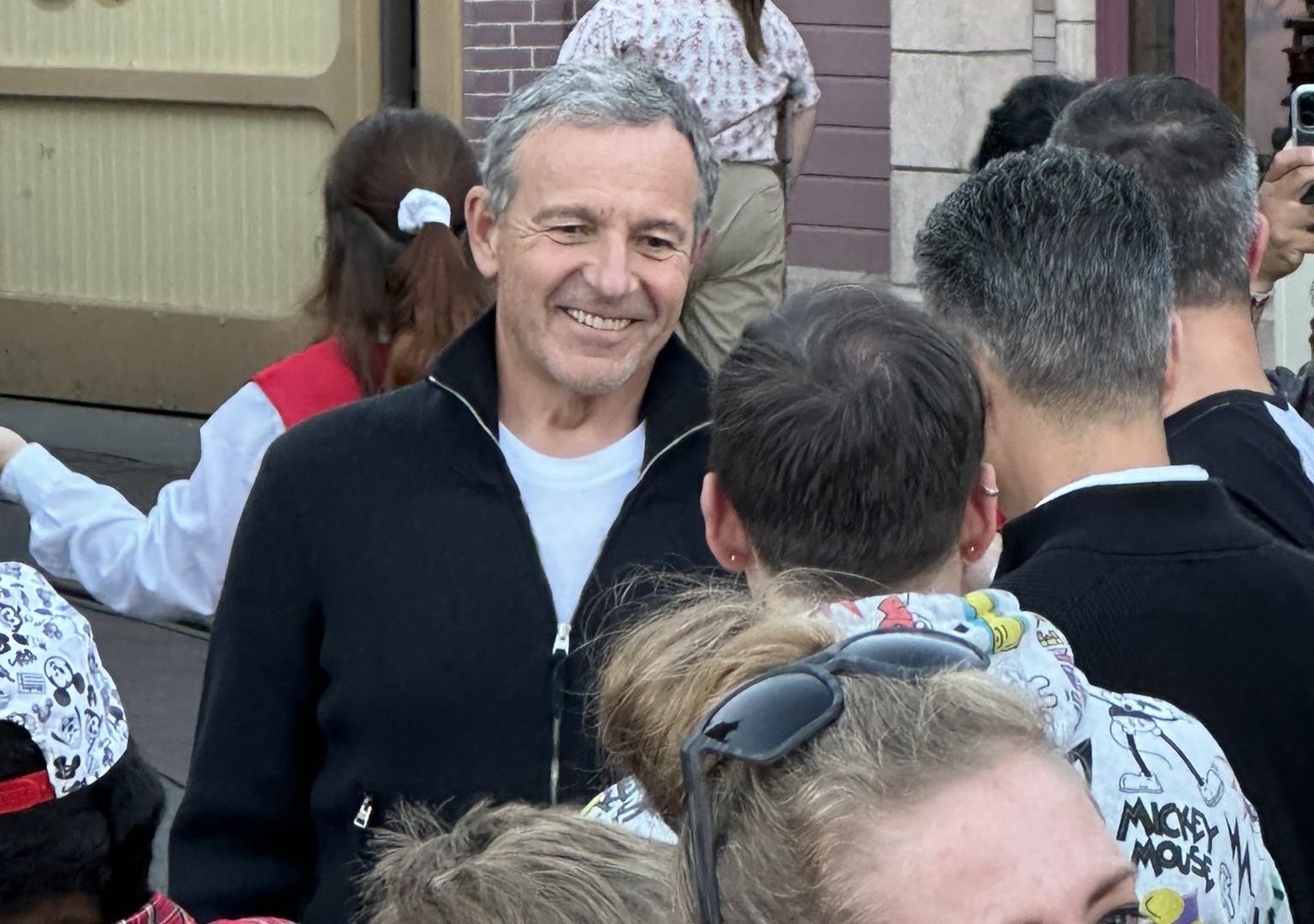

Nike Executive Chairperson Mark Parker has just accepted the title of Chairman of the Board at Disney.

You could make an argument that Parker now stands as the most powerful executive on Wall Street.

Parker holds Chairman titles at two of the top 30 corporations in the world.

#BREAKING: $DIS climbing in #Overtime after news that Nelson Peltz is seeking a seat on the company's board. Disney also announcing $NKE's Mark Parker will replace Susan Arnold as Chairman. @davidfaber reports: pic.twitter.com/LMbT3haQXk

— CNBCOvertime (@CNBCOvertime) January 11, 2023

More importantly, Disney has switched out Arnold’s baggage for a clean slate with Parker.

The former Nike CEO served in that role from 2006-2020. Those years nearly match Iger’s 2005-2020 run as Disney CEO.

CREDIT: REX SHUTTERSTOCK

In short, they’re contemporaries of similar age (Parker is 67, Iger is 71) and credentials.

Parker Wins One Vote but Another Looms

As I mentioned, the Board seemed willing to make Parker the CEO last June. Obviously, he controls a lot of votes and carries tremendous influence.

Photo: CNBC

Arnold lacked the Board’s confidence after she placed her thumb on the scale in favor of Chapek, a decision she regretted soon afterward.

So, the Chairman exchange serves Disney well as it moves forward. That’s not to say that Parker comes without baggage, though.

Photo Credit: AP Photo/Richard Drew, File

Disney’s new Chairman stepped down as Nike CEO almost as suddenly as Iger did in 2020. Parker announced he was leaving in the aftermath of a doping scandal.

The revelation obviously never bothered Disney’s Board.

Mike Pont//Getty Images

Parker had already sat on the Board for five years by this point, and they negotiated his CEO position during year seven. He ostensibly could serve as Chairman for more than seven years!

Six Is the Magic Number

To Disney leadership, Parker carries something even more important than prestige or track record. He controls votes on Disney’s Board.

Why is that significant? Well, Disney finds itself in another proxy fight.

You may recall what happened last September. Activist investor Dan Loeb of Third Point earned his desired outcome.

Photo: CNBC.com/Getty

The hedge fund specialist acquired enough Disney stock that Chapek chose to play ball. He added Carolyn Everson to Disney’s Board as a concession.

In exchange, Loeb dropped his request that Disney divest itself of ESPN. The move came across as a power play by Chapek at the time.

Photo:Thirdpoint.com

I’m fairly confident I misread that play and apologize for that. To Disney’s Board, Everson meant one more vote that wasn’t controllable.

To a 12-person board of directors, the most essential number is seven. With Arnold retiring, the Board drops to 11 members, making six votes the magic number.

Photo: CNBC

That’s the number of votes you need to hold the power. Everson’s arrival upset the delicate balance. And the math could grow even worse.

The $800 Million Purchase That Threatened Everything

As you know, Disney stock recently plummeted. Another group, Trian Fund Management, used this opportunity to purchase $800 million of Disney stock.

That’s like getting a $500 Disney gift card for $250. Everyone knows it’s worth way more, but if you pay $250, you win. Trian won.

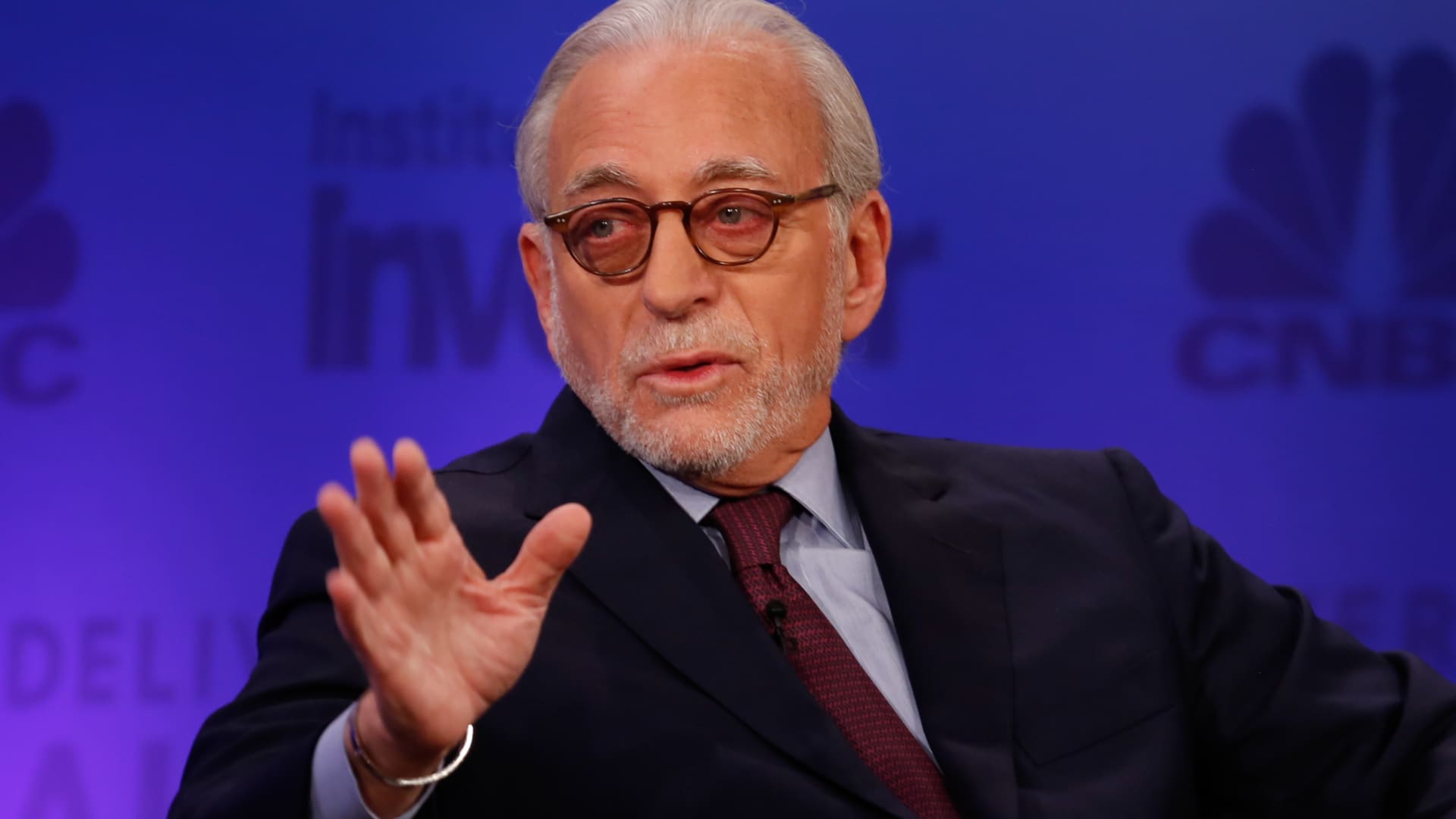

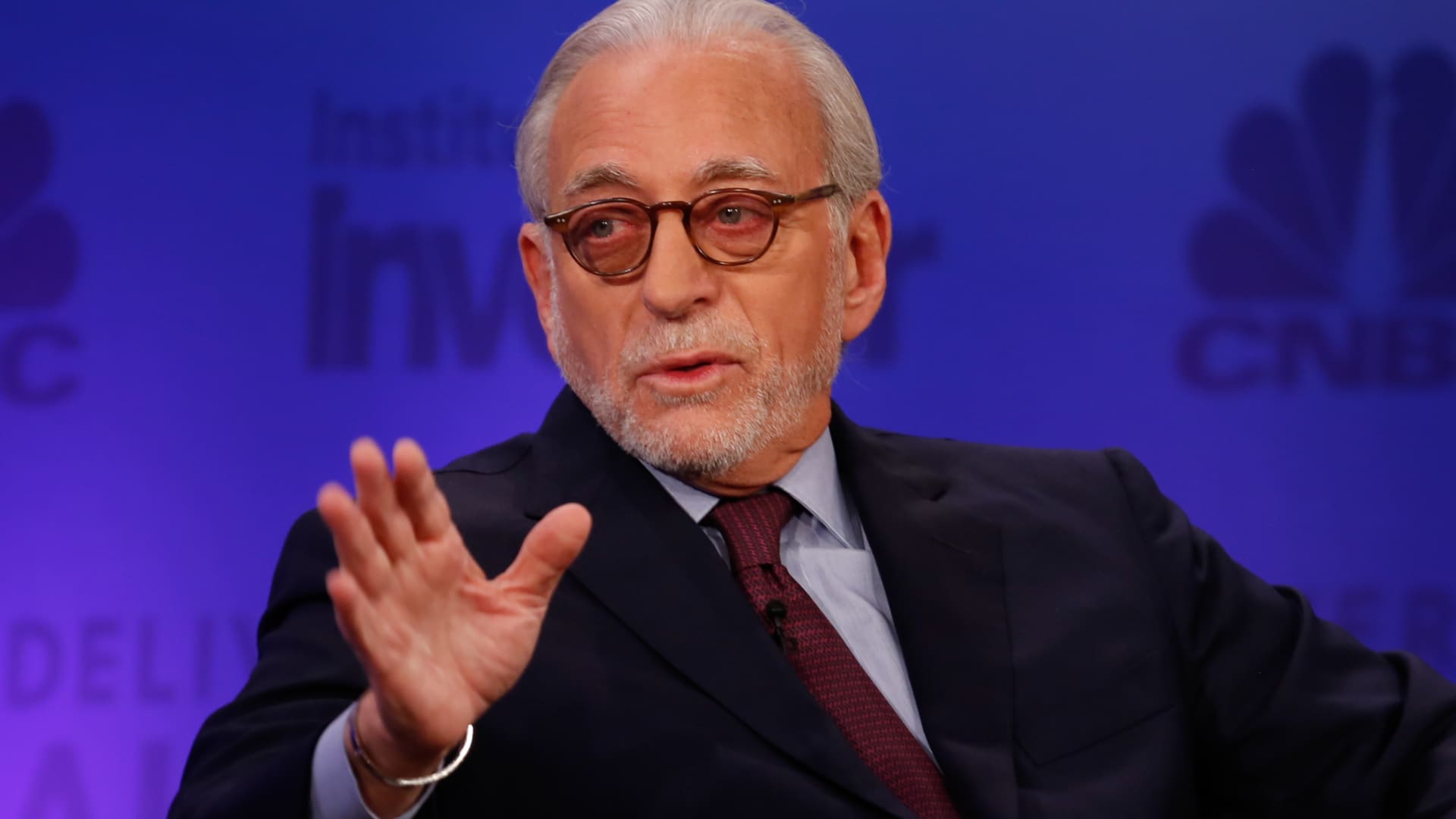

Now, Trian is flexing its stockholder ability as its leader, activist investor Nelson Peltz, wants a seat on the Board as well. Unlike Loeb, Peltz wants it to be him.

Disney just brought back Bob Iger as CEO. Now activist investor Nelson Peltz is demanding the company plan for his successor and is gearing up to wage a “proxy fight” for a board seat, reports @laurenthomas https://t.co/LGCrNM7qNk

— Amol Sharma (@asharma) January 12, 2023

Notably, Peltz rejected Disney’s idea of bringing back Iger as CEO. He lambasted that choice and is clearly no friend of Iger.

Not coincidentally, Disney has strongly denounced this proposal. The Board has asked stockholders to reject Peltz’s candidacy.

Creator: Mike Blake |Credit: REUTERS

If Peltz gains a seat on the Board, that introduces a second wild card on top of Everson. You need six votes to control Disney.

Two activist investors could persuade four more voters to side with them. At that point, all bets are off regarding the future of Disney.

Photo:InsideHook

The future can look pretty scary if we explore that path.

Peltz’s Plan

Peltz has demanded budget cuts and the other kind of nonsense David Zaslav has performed with Warner Bros. Discovery.

Many activist investors have a company’s best interests at heart. Peltz doesn’t fall into that bucket.

He’s a “money above all” sort, the greedy kind we want nowhere near Disney.

The Chairman of Wendy’s Company is 80 and has spoken with Disney several times recently.

Photo: CNBC

Disney’s Board has decided that there’s no negotiating with him. According to The Wall Street Journal, this was one of Arnold’s final acts on the job:

“Ms. Arnold phoned Mr. Peltz on Wednesday morning to offer him a role as a board observer and to ask him to sign a standstill agreement, which Mr. Peltz declined, according to the people with knowledge of the call.”

Photo: REUTERS/Mike Blake

That’s corporate speak for “Go kick rocks.” And it’s both parties saying that.

From Disney’s perspective, Trian’s investment has already earned $100 million, and Peltz should be happy about that.

Photo: skillastics.com

Meanwhile, Peltz feels Disney pays its executives too well and is too lavish with its expenditures. In other words, he’s a Bob Chapek type and is mad that Iger returned.

Peltz vs. Iger and Parker

I previously mentioned this existential divide Disney faces between Hollywood and Wall Street.

Photo: History.com

Iger’s a creative type, while Wall Street wants a penny pincher like Chapek.

To Iger’s credit, he has anticipated what happens next. By adding another proven corporate superstar, Parker, as Disney’s Chairman, Iger has formed a dream team.

Photo: Getty

As long as Iger and Parker work in tandem, Disney should stave off this interloper and create a stable future forged in smart investments and a viable succession plan.

Unfortunately, Disney has already invited one big bad wolf onto the Board, and now another is trying to blow the house down from the outside.

Photo: Disney+

So, Disney’s recent instability won’t change any until Disney’s annual shareholder meeting on March 9th.

Yes, I’m afraid we’ve got another two months of headlines about Disney chaos.

Feature Image: Richard Drew | Credit: AP