Disney Just Had a Weird 36 Hours. What Just Happened?

The Walt Disney Company’s stock just fell to a 33-month low…AFTER it declared record annual revenue.

Meanwhile, Disney announced a delayed park closure due to Hurricane Nicole but chose not to close the parks Thursday. Instead, they’ll employ a delayed opening, weather allowing.

Disney has just experienced an impossible 36 hours. What happened, and what’s coming next?

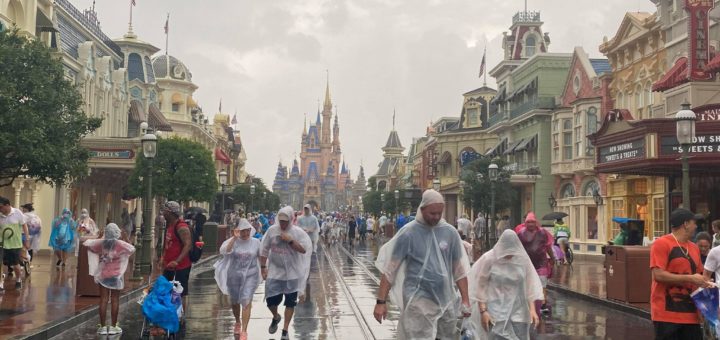

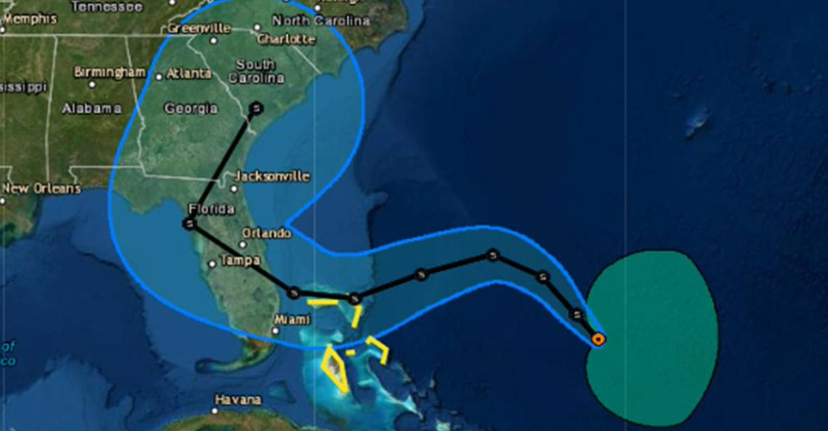

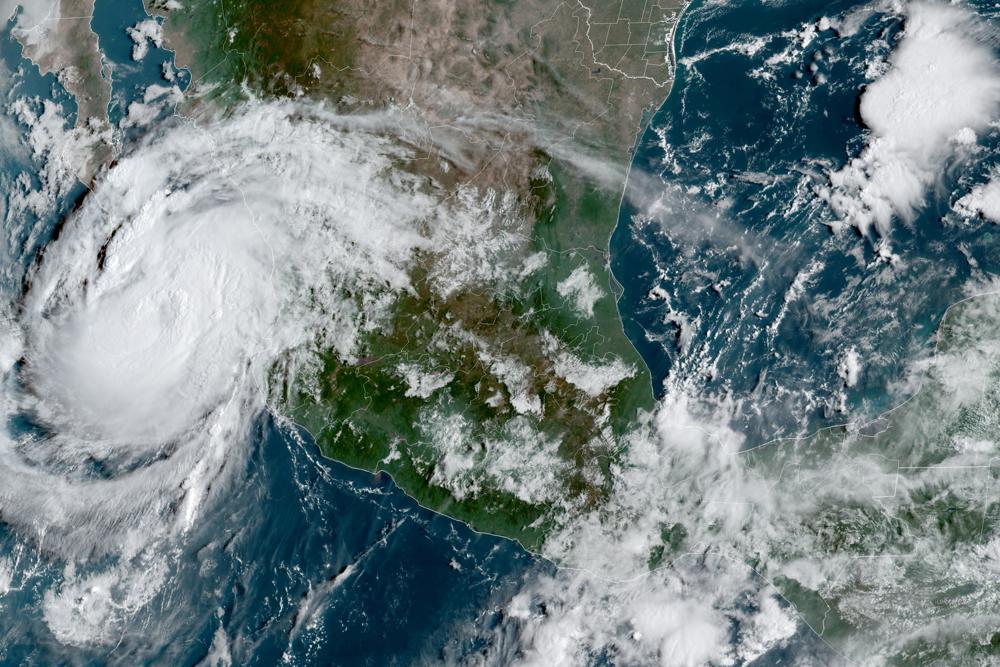

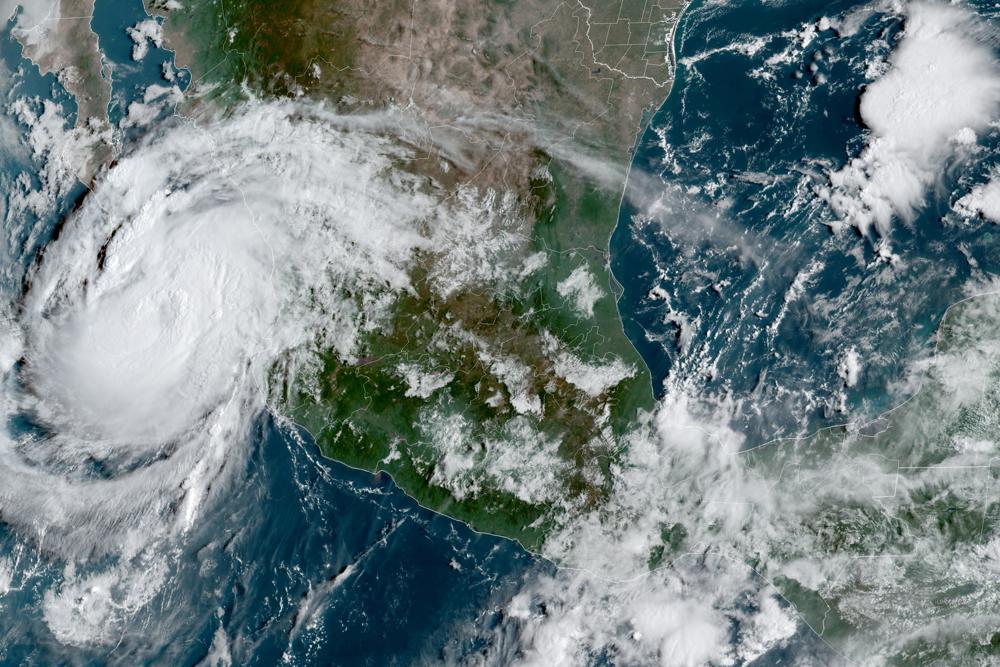

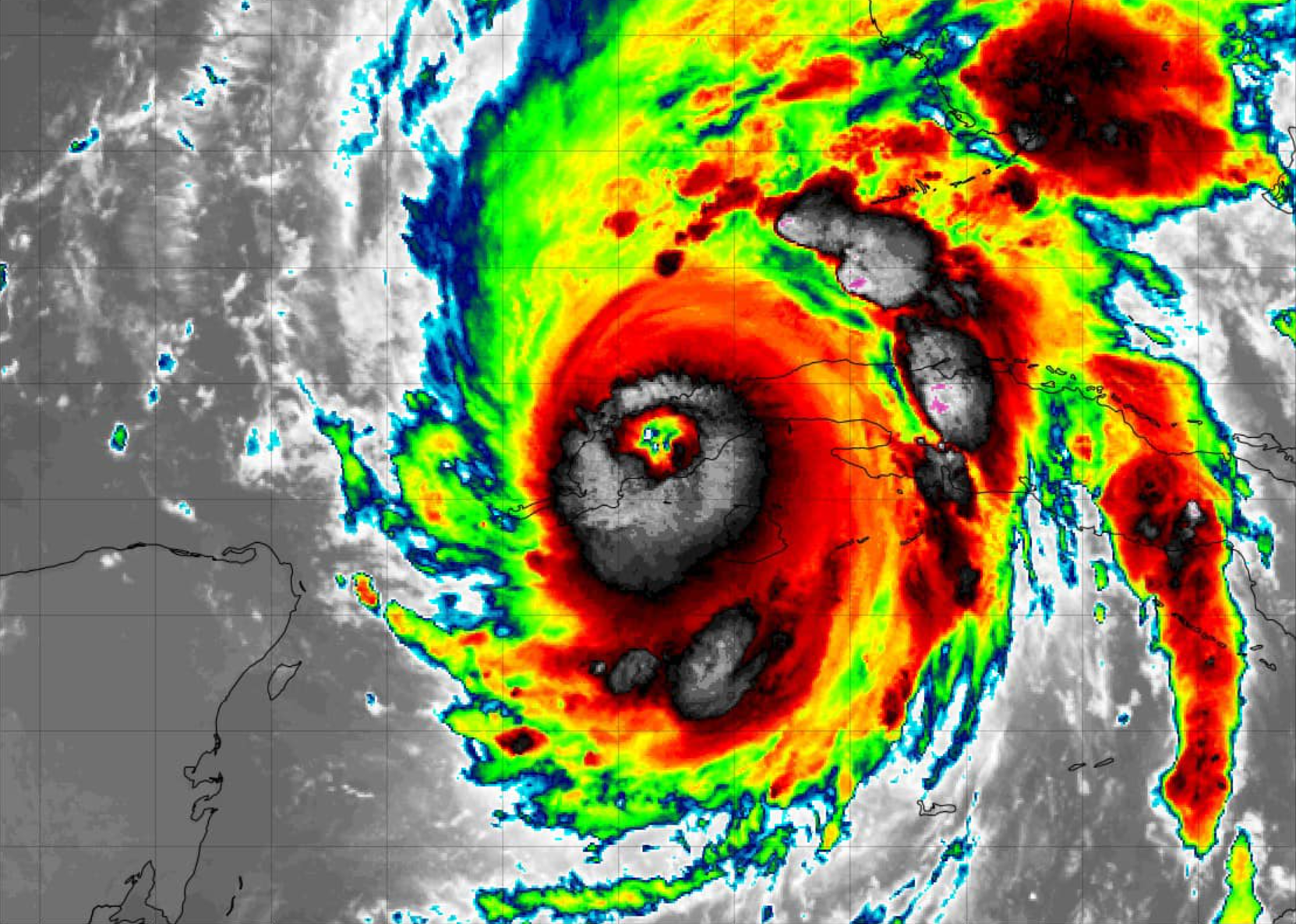

Hurricane Season

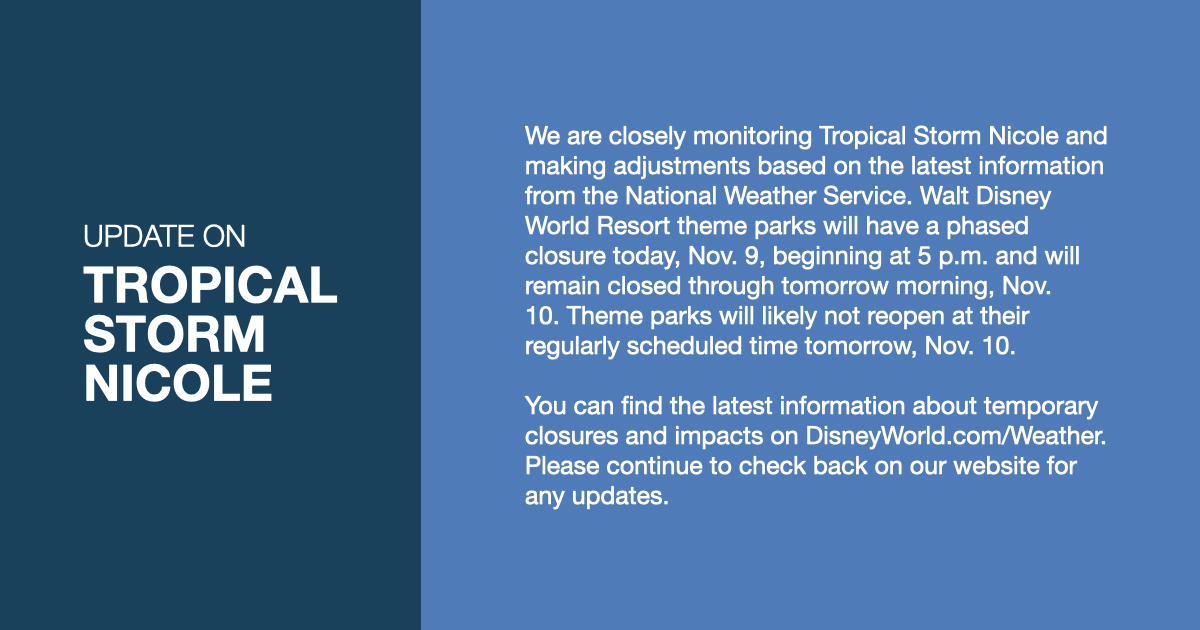

On Wednesday afternoon, Tropical Storm Nicole behaved as predicted. Regrettably, this weather event turned into a Category 1 hurricane.

Photo: GREGG NEWTON/AFP/Getty Images

Meteorologists had forecasted this scenario, but we all wanted them to be wrong.

Now, the storm resides 100 miles from making landfall in West Palm Beach, Florida.

Nicole’s current wind speeds of 75 miles per hour all but ensure it’ll be a hurricane when it reaches mainland Florida.

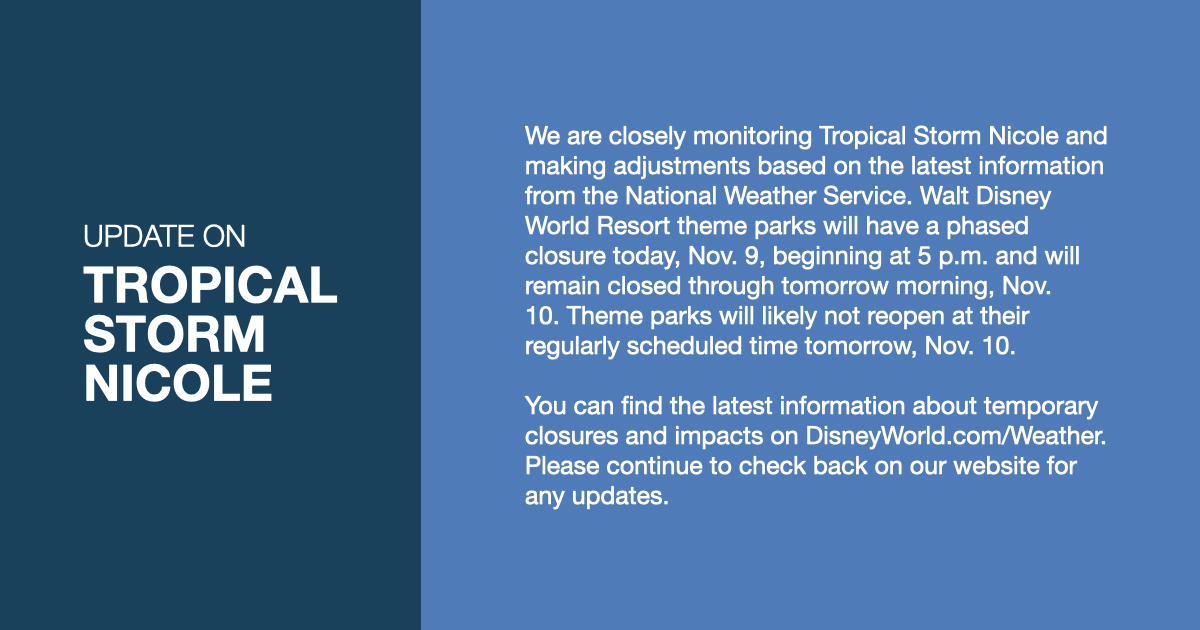

For this reason, Disney closed shop early on Wednesday. The parks employed a unique phased approach, with Disney’s Animal Kingdom closing first at 5 p.m. EST.

Later, Disney’s Hollywood Studios closed at 6 p.m. EST followed by Magic Kingdom and EPCOT at 7 p.m. EST.

Also, there were some chaotic decisions involving Disney dining experiences that factored into the conversation.

Places that host meals that take longer stopped accepting guests at earlier times than the rest of the park’s restaurants. It was a mess, y’all.

Disney also shut down bus transportation at 8 p.m. EST, which is something cast members appreciated. It ensured they could return home safely before Nicole arrived.

Notably, Disney announced a delayed opening for Thursday rather than closing the parks, though.

That decision works in sharp contrast to how Disney approached Hurricane Ian.

Obviously, the weather events are dramatically different in scale. Ian’s wind speed more than doubled what meteorologists predict for Nicole.

Still, that’s only half the conversation. In a weird quirk of timing, Disney also detailed its fiscal fourth-quarter earnings for 2022.

During that call, an executive revealed that Hurricane Ian cost Disney $65 million. Understandably, that knowledge factors into today’s decision.

Photo: Travel and Leisure

Park officials would rather not close Walt Disney World on Thursday unless it’s necessary. The expense of doing so is literally tens of millions of dollars.

Disney must consider this aspect because…

Disney’s Stock Disaster

I’ve never understood Wall Street, and I never will…and I’m saying that as someone who has been an invited guest on CNBC.

The whole process is madness. I’m confident I’ll use the events of the past 36 hours to support this belief in future years.

(AP Photo/Matt Dunham, file)

I say this because Disney reported its best annual revenue in company history yesterday. And the stock absolutely collapsed. At one point, it had fallen 18 percent.

Wall Street analysts and short sellers capitalized on two parts of Disney’s report. One involves linear television, which has been Disney’s bread and butter for many years.

Photo Credit: AP Photo/Richard Drew, File

Everyone knows that linear television revenue is eroding. However, the pandemic has quickened the pace.

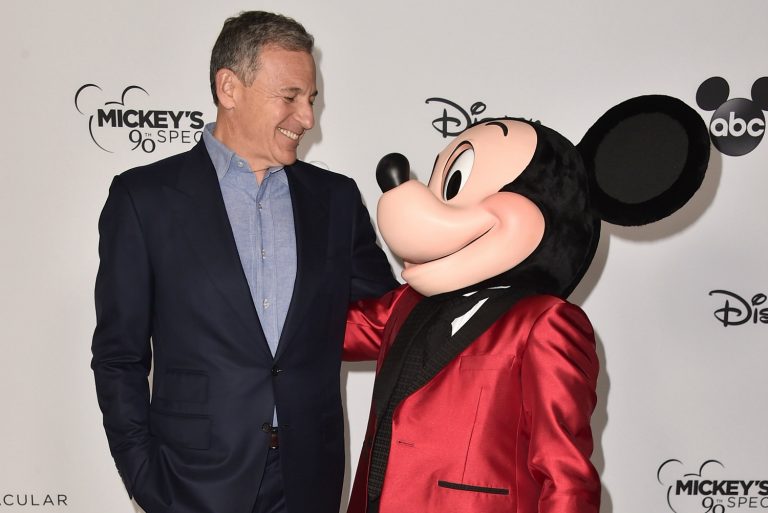

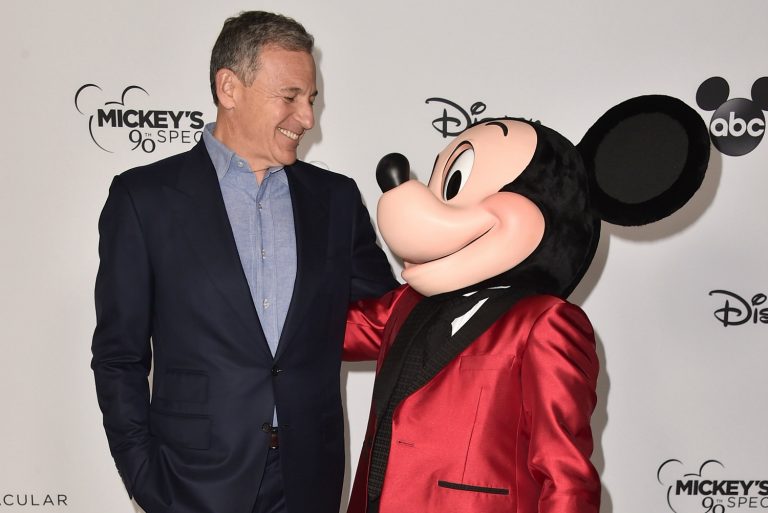

Former CEO Bob Iger anticipated this scenario and deftly switched to streaming. Chapek has since fully committed to Disney as a digital company.

Photo: Alberto E. Rodriguez / Getty Images

Those decisions come at a high price. Disney must expend capital to pay for all its streaming offerings.

Specifically, Disney has performed write-downs for its Direct-to-Consumer business. The company willingly accepted losses to maximize its streaming libraries.

Photo: Newsweek

Here are two recent examples. Disney ceded more than $1 billion to reclaim the rights to the former Marvel shows on Netflix like Daredevil and Luke Cage.

Meanwhile, Disney secured the sports rights to Formula-1 races for $255 million through 2025. That money has to come from somewhere.

Photo: formula1.com

The company has explicitly stated this for the past three years. Disney warned that its streaming services wouldn’t turn a profit until fiscal 2024.

However, analysts hadn’t paid attention to the timeline for whatever reason.

Source: “Once Upon A Disney Wish”

During yesterday’s earnings call, Chapek and his CFO, Christine McCarthy, explicitly stated that Disney will increase revenue by high single digits next year.

In other words, Disney should grow by about eight percent for fiscal 2023, which sounds spectacular, right?

Photo: AP Photo/Jae C. Hong

Disney’s Wall Street Problem

Wall Street doesn’t feel that way. Investors are slavishly devoted to the short term, caring little about steady growth over time.

Instead, they’re rats jumping off the ship because they had expected Disney to increase revenue by as much as 35 percent next year.

Photo: The Walt Disney Company

I’ll use real-world numbers to display the discrepancy. For fiscal 2022, Disney earned $83.745 billion in total revenue.

At eight percent growth, the company would claim $90.445 billion in fiscal 2023. As a reminder, Disney had never passed $70 billion until this year.

Photo: Disney Fanatic

A single-year take of $90 billion should sound really, really good to an investor. Wall Street people are strange and unreasonable, though.

Analysts like MoffettNathanson (an organization I normally like) had estimated 35 percent growth. That would be a total of $113.056 billion.

So, that’s a discrepancy of $23 billion between Disney and Wall Street. Once investors did the math on that, they got spooked and abandoned Disney.

The whole thing is as insane as it is absurd. But unfortunately, there are consequences to this sort of chasm between expectations and reality.

Image: The Walt Disney Company

Crazy old man Jim Cramer already called for Chapek’s head. Meanwhile, Disney executives are looking around in confusion.

Disney’s c-suite was as transparent as possible about the high cost of its conversion into a digital company.

Image Credit: Disney

Somehow, not enough people took them at their word until yesterday. The sudden awareness led to a short, emphatic plummet in the stock price.

I find this behavior curious due to the external factors in play. Other companies keep using terms like “headwinds” about 2023. They’re worried about the economy.

Disney just said the opposite. It expects steady growth in 2023. And the stock collapsed. This has been such a weird week…and the hurricane’s not even here yet.