A Mixed Bag For Disney Stock

Two Sides To The DIS Story?

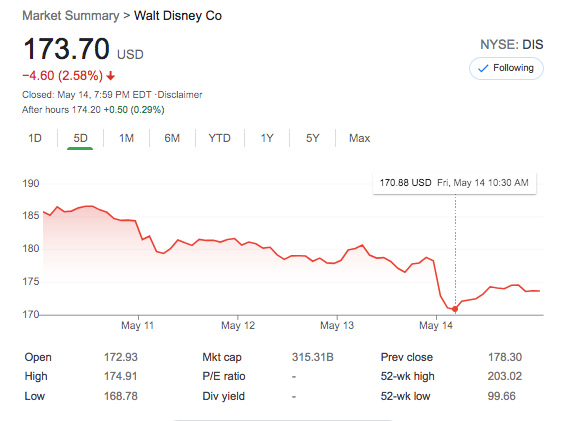

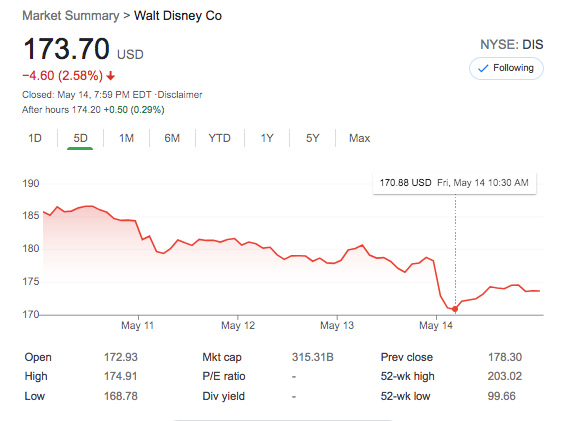

Disney’s Q2 report didn’t exactly set Wall Street ablaze on Friday.

In fact, the slowing of Disney+ momentum seemed to cool overall enthusiasm for DIS stock.

Disney stock lost $4.60 on Friday. Image: Google.

The Wall Street Journal’s Francesca Fontana reported Friday that “the streaming boom is running into more interference.”

The report highlighted:

- Disney’s streaming service added fewer users than expected.

- The end of lockdown presents issues presumably because fewer people are staying home.

Image: Disney Plus

Fontana added, “The end of lockdowns and mask mandates is good news for Disney’s lucrative parks division and studio releases, but presents new challenges for its 18-month-old streaming operation.”

Meanwhile, excitement builds around the reopening of movie theaters, too.

And realmoney.com’s Stephen Guilfoyle reminded readers there are two sides to every story.

Bob Chapek spoke to investors on Friday, May 14. Image: Disney.

I read what others are writing about the quarter that the Walt Disney Company (DIS) reported on Thursday evening, and I look at the numbers for myself and read what was said last night by management. Not exactly two different stories, but not exactly the same impression either. Disney had a good quarter. That’s my take.”

Photo: MickeyBlog.com

Guilfoyle, who owns and plans to buy more Disney stock, also suggested investors remind themselves of the significant holes in Disney’s bottom line throughout the pandemic – namely park attendance and cruise lines.

Reading between the lines, it’s clear that Guilfoyle believes there’s much to be enthusiastic about, even if Disney didn’t hit some very lofty performance goals.

Cinderella Castle. Image: Disney.

“Disney Parks, Experiences, and Products contributed just $3.173 billion (-53% y/y) to the whole,” he wrote. “As for Parks & Experiences, revenue of $1.735 billion came from the domestic side, -58%, while $262 million in sales were produced internationally, -45%. Consumer Products actually experienced sales growth of 13% to $1.176 billion.”

I own 12 shares of Disney stock. If I were more liquid, I would buy more. But for the moment, I’ll be standing pat, hoping to see the stock return to something nearer its all-time high.

(Richard Harbaugh/Disney Parks)

But what about you? Do you think Disney stock is a good bet? Or would you wait and see? Let us know in the comments below.

Feature Image: Disney

Bob Chapek, Walt Disney Company CEO, addresses Cast Members at a ceremony celebrating the reopening of Disneyland Resort in Anaheim, California, on Friday, April 30, 2021. Mr. Chapek stands in the same location in Town Square on Main Street, U.S.A. as Walt Disney himself when Disneyland was dedicated on July 17, 1955. (Christian Thompson/Disneyland Resort)