HOW Much Money Did Disney Just Lose???

Since the pandemic began, Disney executives have dreaded this day. On August 4th, The Walt Disney Company held its earnings report.

I should probably put earnings in quotes because the company made less this quarter than it has in a long time.

The explanation is, of course, Coronavirus. The outbreak has impacted Disney in many ways.

Today, we learned the full details of the financial impact, as Disney published its fiscal third-quarter earnings report.

How much money did Disney just lose? Read on to learn what just happened to $2 billion of the company’s money.

The Basics

During a regular quarter, Disney’s earnings usually increase by a respectable amount. Even during a slow quarter, the company maintains the status quo.

Sadly, the past quarter in no way resembled regular for Disney.

In fact, the following sources of revenue were rendered useless:

- Adventures by Disney

- All Disney theatrical releases

- Disney Cruise Line

- Disney Springs

- Disney Stores

- Disney Vacation Club Sales

- Disneyland Paris

- Disneyland Resort hotels

- Disneyland Resort theme parks

- Downtown Disney

- Hong Kong Disneyland

- Shanghai Disneyland

- Tokyo Disney Resort licensing revenue

- Non-theme park hotels

- Walt Disney World hotels

- Walt Disney World theme parks

Since mid-March, Disney has effectively been a kid trying to run a lemonade stand even though they have no lemonade.

As I mentioned in a previous article, Disney is far from the only company suffering during COVID-19.

Universal Studios just reported a 94 percent drop in attendance.

The Oriental Land Company, the owner of Tokyo Disney Resort, lost 95 percent of its revenue.

SeaWorld has indicated that its revenue fell from $406 million last year to $18 million (!) for the most recent quarter.

These revenue drops represent catastrophic financial circumstances for the entire theme park industry.

However, Disney remains a different breed compared to Universal and SeaWorld. Can the company avoid the fate of its peers and its friends in Tokyo?

Short answer: Sort of but not really.

About the Parks

Let’s start with the horror numbers. If you don’t go blind from reading them, the rest won’t seem so bad.

Disney’s theme parks fell slightly from earnings of $6.575 billion during the third quarter of 2020.

By slightly, I mean that revenue dropped to $983 billion. Yeah, that’s an 85 percent plummet from last year.

I realize that big numbers can be challenging to conceptualize. So, let me explain the situation like this.

Imagine that you thought you were getting a check for $65.75 and planned to use the money to take the sexiest person you know out to dinner.

When the check arrives, the amount is only $9.83. Now, you’re eating at Burger King…alone. And nobody’s messaging you on Bumble this year.

If we go bigger with the analogy, you’re expecting $6,575 and are thinking about buying a boat. Instead, you get $983, and you’re getting a TV instead.

Now, the TV is great; nobody’s talking smack about the TV. But you wanted the boat.

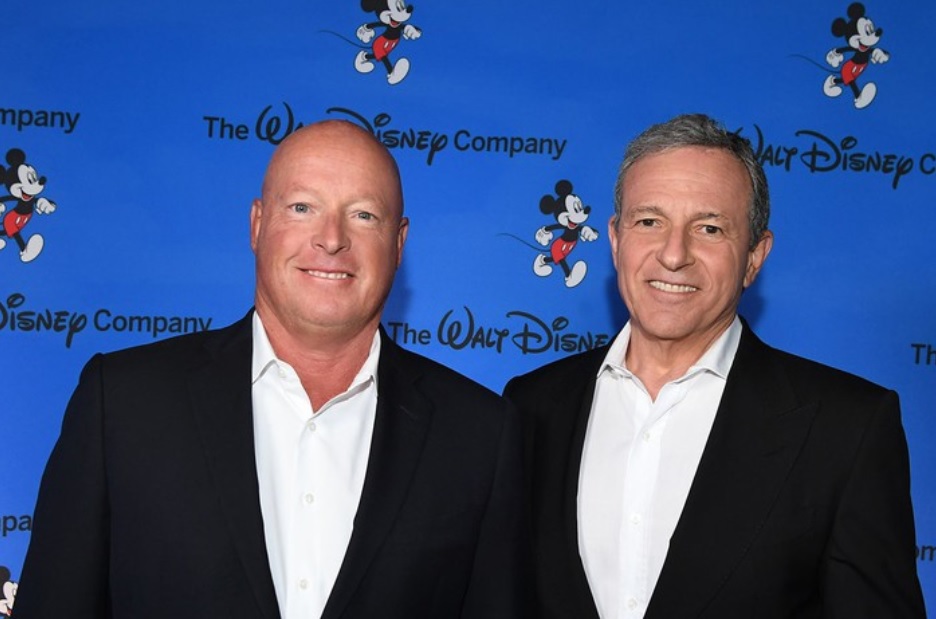

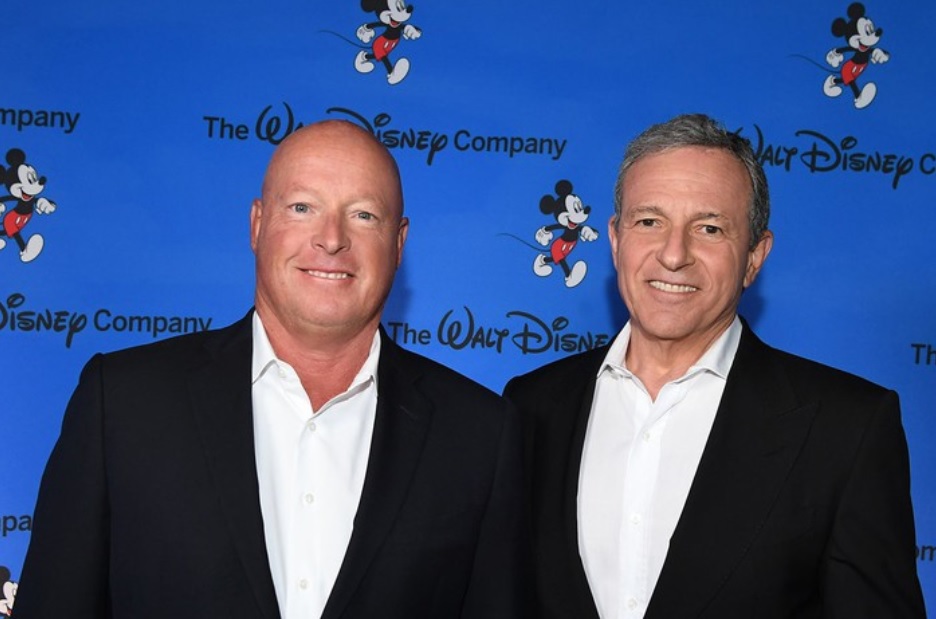

Disney’s executive team, led by CEO Bob Chapek and former CEO Bob Iger, had expected billions. Instead, they got millions.

Photo: Disney

How much does this matter? Well, we won’t know the full impact for several years.

For now, all we can do is focus on the numbers.

Last year during this quarter, Disney’s Parks, Experiences and Products division had operating income of $1.719 billion.

For 2020, the same division lost $1.96 billion. Yes, that $2 billion estimate from Reuters proved accurate, as Disney’s core business, theme parks, lost that much.

However, the number appears even scarier compared to last year. That’s a change of $3.679 billion. Disney’s out $3.7 billion from just 12 months ago!

More about the Parks

Disney’s earnings report explains the revenue loss in practical terms:

“Lower operating results for the quarter were due to decreases at both the domestic and international parks and experiences businesses and to a lesser extent, at our merchandise licensing and retail businesses.”

I credit the author for not using the easy excuse, which is, “WE DIDN’T MAKE MONEY BECAUSE WE WERE CLOSED!”

Anyway, the other reason is a bit more subtle:

“The decrease at licensing and retail also reflected the impact of COVID-19, which resulted in decreases in licensing earned revenue and lower minimum guarantee shortfall recognition, the closure of our Disney Stores for most of the quarter and the write-down of store assets.”

Analysts don’t appreciate Disney’s vertically integrated business model enough.

The movies cause people to visit the parks. While they’re at the parks, they see merchandise from the films and want to buy that. It’s brilliant.

The one flaw that nobody had considered is how the strategy collapses when there are no movie theaters or theme parks open. Everything goes sideways.

The entire situation qualifies as grim. However, Disney stock went up after hours for reasons I’ll explain in detail in a companion article.

What’s important here is that Disney still earned nearly $1 billion in the face of impossible odds.

Disney estimates that COVID-19 cost the company $3.5 billion, which means it would have been profitable if not for the outbreak.

Photo Credit: news.iheart.com/

So, the numbers are somehow nightmarish but also present a misleading picture of Disney’s status.

Other Disney Silos

By now, you know that Disney features four core businesses. The Parks division provides the anchor, as it’s the breadwinner.

Still, Disney’s other three divisions do well, too…when there’s not a pandemic.

For example, the Studio Entertainment division spent last summer relishing the blockbuster status of Avengers: Endgame.

Photo: Marvel.com

During the fiscal third quarter last year, Disney gained $3.836 billion. Over the past three months, the company managed less than half that at $1.738 billion.

Believe it or not, that’s the rest of the bad news for Disney. Its other two divisions performed similarly year-over-year.

Direct-to-Consumer & International, the Disney+ silo, earned $3.969 billion this year, up from $3.875 billion last year.

I should mention that the division’s operating income decreased from -$562 million to -$706 million.

Getting Disney+ up and running in international locales comes with startup expenses.

So, even some of the wins for Disney this quarter are actually losses.

The fourth division, Media Networks, fell from $6.713 billion to $6.562 billion.

Humorously, this part of Disney has troubled analysts the most, as they have done much handwringing about the gradual erosion of cable television.

Well, those complaints appear ridiculous, as Media Networks totaled more than half of Disney’s earnings for the quarter.

In the process, this industry proved itself pandemic proof. Even during the start of a recession at a time with no live sports of note, Disney cable channels performed solidly.

Overall, Disney managed $11.779 billion for the quarter, which is waaaaay down from 2019’s $20.262 billion.

However, we have just learned what rock bottom is for The Walt Disney Company.

Image Credit: Disney

There’s no way other than a societal shutdown for the company to earn less.

In short, this quarter was horrific but also better than many feared.